Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

USDCZK

The pair has yet again used the 200-day moving average, reversing right on top of the average after using the 50-day moving average above as a resistance. Should the pattern continue, it could hit the 50-day MA level again as resistance. Over in Prague, the European Commission has deemed that Czechia should return millions of crowns in EU subsidies after Prime Minister Andrej Babis did not adequately separate himself from holdings that received the funds, according to a local Czech news outlet. This finding has the chance to put another central European leader in lock-horns with the European Commission. It would also hurt Agrofert, which is a large conglomerate Babis built up for more than two decades and then put in trust funds in 2017. The arrangement wasn’t enough to avoid a potential conflict of interest, according to a report by the Commission that hasn’t been released, based on local news reports.

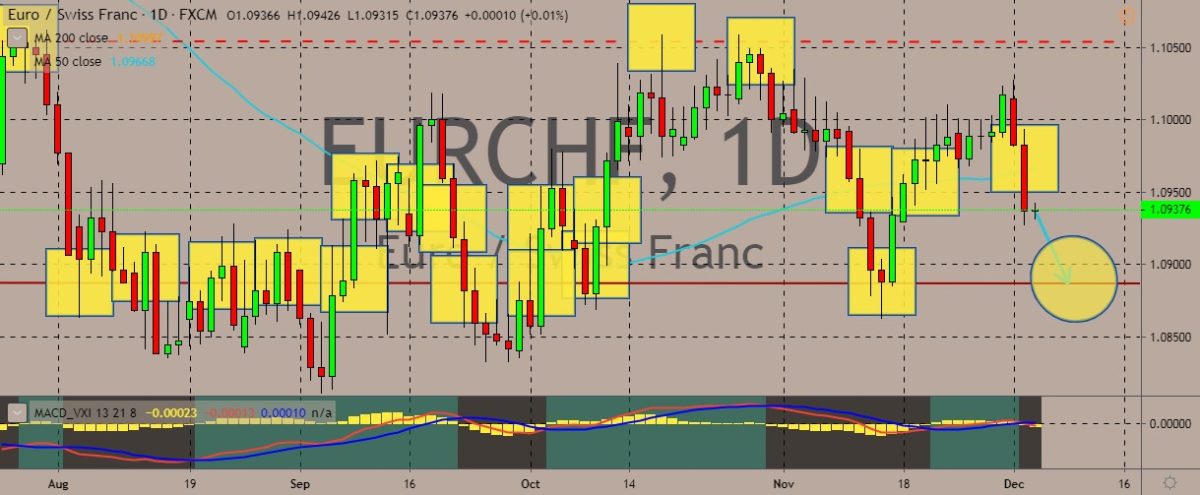

EURCHF

The pair has plummeted and lost most of its gains during the previous week, slipping below the 50-day moving average and fluctuating just below that area. With the 200-day moving average far above the current price, it possible the pair will suffer continuous bearishness from traders. Over in Switzerland, SVME manufacturing PMI rose to a level of 49.4 in October, which is higher than market expectations for an advance to a level of 45.0. During the previous month, the metric of PMI has recorded a reading of 44.6. also, retail sales have advanced 0.9% on a year-on-year basis in September. In the previous month, the retail sales registered a revised drop of 1.0%. conversely, the country’s consumer price index (CPI) slipped 0.3% on a yearly basis in October, coming after an increase of 0.1 in the month before. The trend for the pair is expected to be driven by the SECO consumer climate for the fourth quarter, to be released later in the day.

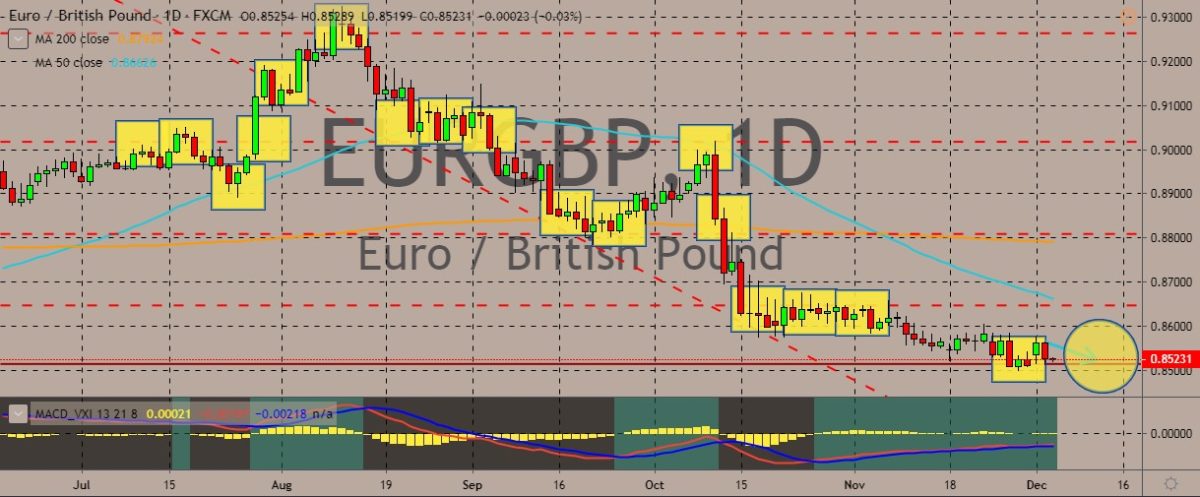

EURGBP

The euro remains weak against the British pound, with the pair trading near lows and doesn’t show any sign of perking up soon. The 200-day MA remains flat on the daily chart, while the 50-day MA continues to tread lower. With the subject of Brexit, a soft Brexit is still highly likely at this point despite the uncertainty surrounding the December 12 UK election, as reflected in the low Institutional Stability Risk and as suggested by GeoQuant. British Prime Minister Boris Johnson and his Conservative Party still holds a strong position in polls, and this gives him a large parliamentary majority in election simulations. Such is a likely outcome that could mean high chances of a soft Brexit in line with Johnson-EU agreement, which aims to establish a customs union backstop between Britain and Northern Ireland. On the flipside, the House of Common’s single-member district election rule could mean unexpected seat distribution.

EURJPY

The pair has recently hit a multi-month high but now treads in the red, hitting a solid resistance around the 121.000 level. Previously, it has used the 50-day moving average as a support line from which it bounced back up. Over in Japan, sources said that the government is preparing a stimulus package worth 13 trillion yen to support the fragile economic growth. This could come in dispute with government efforts to fix public finances. The spending would be marked in a supplementary budget for this fiscal year as well as an annual budget for the coming fiscal year, which starts April 1. The spending could strain the industrial sector’s heaviest public debt burden, which is more than double the size of Japan’s economy. Also, in spite of the headline size of the stimulus, the actual spending would be smaller in the present fiscal year. And economist are not really expecting much of a boost.

COMMENTS