Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

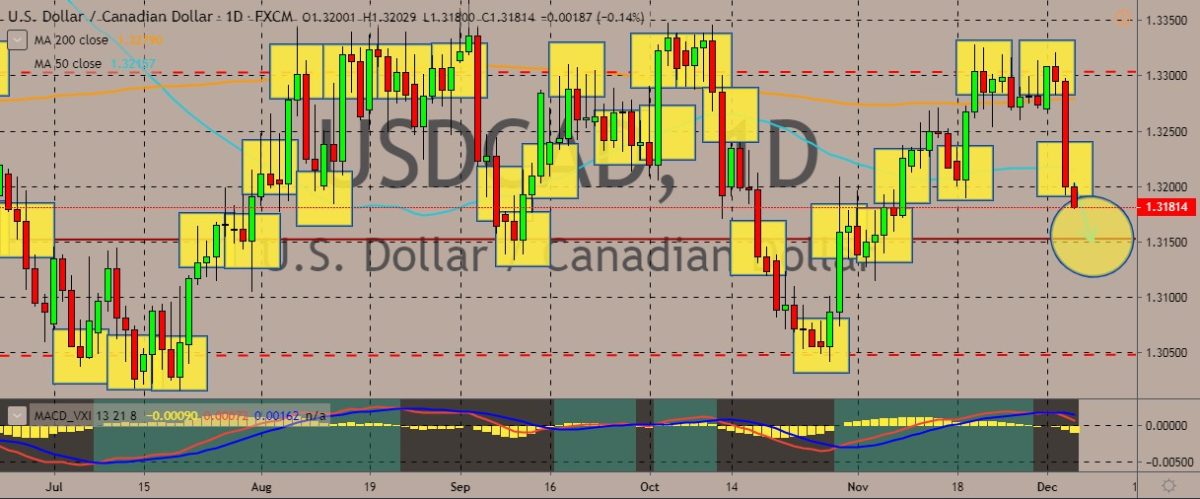

USDCAD

The pair has plummeted steeply in the previous sessions, and it still continues to trade in the red. It has broken below the 200-day and 50-day moving average and is on its way to touch monthly lows. The strengthening in the Canadian dollar is attributed to the decision of Bank of Canada, which opted to hold interest rates steady, pulling in bullish traders for the Aussie. In its final decision for 2019, the BoC cited signs of stabilizing global economy and the “resilience” of Canada’s consumers. It maintained the overnight rate at 1.75%, where it has stood since October of 2018. This means the bank is largely going against the trend of major central banks around the world cutting rates to combat the faltering growth and the uncertainty spurred by the US-China trade war. In addition, the central bank said the country’s inflation rate continues to be close to the 2% target, “consistent with an economy operating near capacity.”

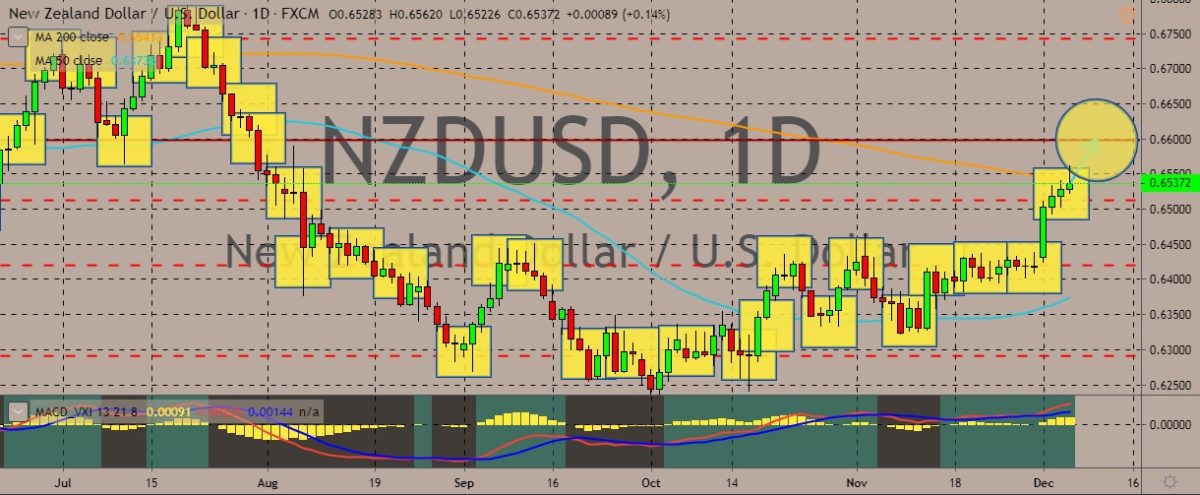

NZDUSD

The pair is going bullish on the daily chart, clocking in consecutive gains in the previous three sessions and reaching the 200-day MA after trading sideways for most of September to November. The bullishness in the New Zealand currency comes despite the Treasury’s comments that were largely negative on the subject of economic growth. According to the Treasury, te weaker-than-forecast investment and services exports are likely to see overall New Zealand GDP growth fall below the budget estimates. The kiwi, meanwhile, didn’t show any signs of faltering, likely because the Treasury also noted that improvement in the housing sector. Also, the PMIs are signaling some form of economic recovery. Traders may also be counting on the optimistic China data released recently to keep the NZD afloat. The Caixin PMI rose 51.8 in November, rising from October’s 51.7. This is also the fastest expansion in three years.

AUDJPY

The pair is trading in the red today after trading bullishly in the previous three sessions. It’s currently hovering just above the 50-day MA, reluctant to go higher and capped by the safe-haven appeal of Japanese yen. Still, the trend appears to be showing a rising wedge pattern. Similar to the Bank of Canada, the Reserve Bank of Australia left its key official interest rate at 0.75% in its final interest rate decision of the year. This decision comes after robust month for property markets and ahead of a Christmas spending period. Still, Governor Philip Lowe said that the Board is ready to ease monetary policy further should it be necessary to support sustainable growth in the economy. Also, he reiterated that it was reasonable to expect an extended period of low interest rate because of both “global and domestic factors.” The next focus for Australian dollar traders will be the government data which has missed forecasts.

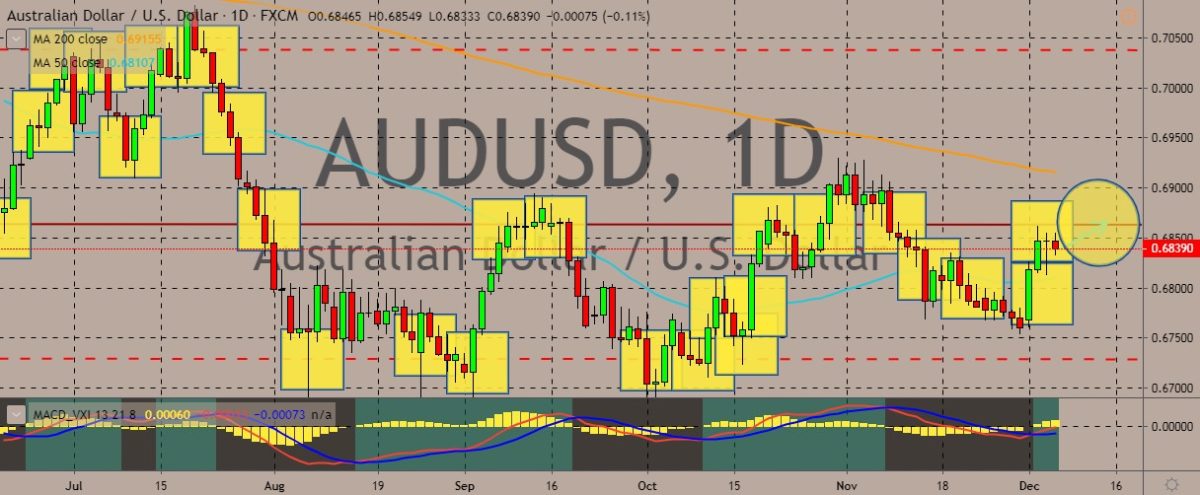

AUDUSD

The pair is trading in the red after the bullish moves that came right after the decision of the Reserve Bank of Australia to hold rates steady in its final interest rates decision for the year. Traders immediately switched gears after receiving the weaker-than-expected government data. The Aussie fell against major rivals after the release of the gross domestic product estimate rose 0.4% for the three months to September. This missed the markets’ expectations of a 0.5% rise. The yearly estimate, meanwhile, came in as expected at 1.7%. Further, the AIG Performance of Services Index sank to 53.7 in November from 54.2 in October. For the same month, the Commonwealth Bank Services PMI strengthened to 49.7. The next focus for Australian dollar traders will be the release of October Trade Balance later in the Asian session. For this gauge, the market is expecting a surplus of 6100M.

COMMENTS