Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

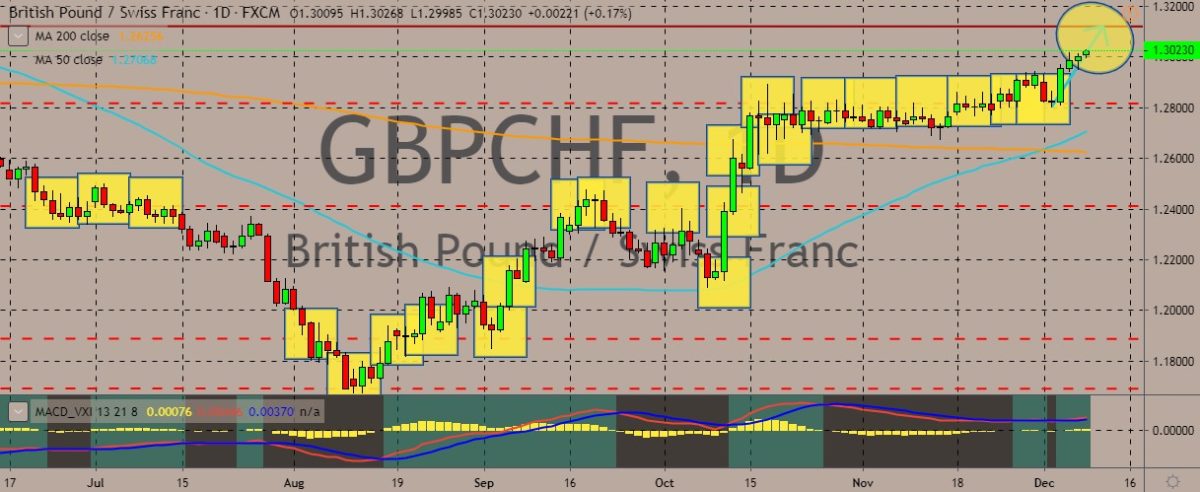

GBPCHF

After trading sideways for much of October and November, the pair is now trading upward. The uptrend also comes after the confirmation of the golden cross, in which the 50-day moving average crosses above its 200-day counterpart. Bullish technical traders are flocking the British pound, obviously going after the strength in the currency as the December UK general elections is just around the corner. As data from current polls shows, British Prime Minister Boris Johnson is likely to remain prime minister after next Thursday’s votes. Also, he will have a working majority in the UK Parliament, which could make him free to push through Brexit by the end of January 2020. According to some expert, Johnson’s lead is almost unbeatable. However, they also content that things could change if Johnson shoots himself in the foot. They also expect that further polls and surveys to be released soon will show the gap narrowing.

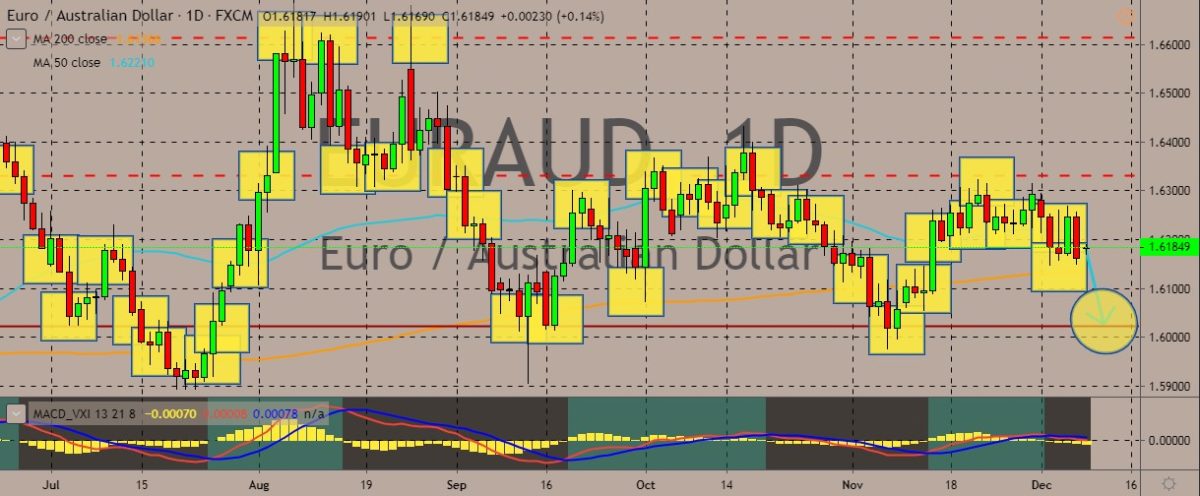

EURAUD

The pair is trading sideways within tight ranges, with the 50-day moving average at the higher range and the 200-day moving average at the lower range. Recently, the pair lost a most of its recent gains after the pair pulled back, with Australian dollar traders going bullish after the Reserve Bank of Australia decided to retain key rates steady. At the same time, the Australian dollar managed to gain some more boost after the official GDP data came in as expected, which is something that made traders feel less nervous. Still, there is a lack of front-tier domestic data, and this could mean that the Australian currency will still be subject to the adverse effects of international risks. Among these risks will still be the US-China trade talks. The forex markets will also focus on the Federal Reserve’s last policy decision for 2019, which will come out on Thursday. Fed policy makers are anticipated to leave key rates unchanged.

EURUSD

The pair is trading near the 50-day moving average on the lower part of its trading range, and it is expected to have a reversal soon. Still, there are lots of fundamental drivers to the expected to move the pair. Both the US dollar and the euro aren’t moving much in today’s trading session as traders await decisions from the central bank meetings in both currencies. The meetings will be held later this week. For the US Federal Reserve, Governor Jerome Powell in October said that both the policy and the economy were in a “good place,” right after the last rate cut in that month. This means that policy makers are seeing little reason to change policy. Over in the eurozone, Christine Lagarde will be holding her first meeting and news conference as the European Central Bank president, also on Thursday. Traders are not expecting the ECB to make any significant change to the monetary policy, although they will scrutinize Lagarde’s wordings in her speech.

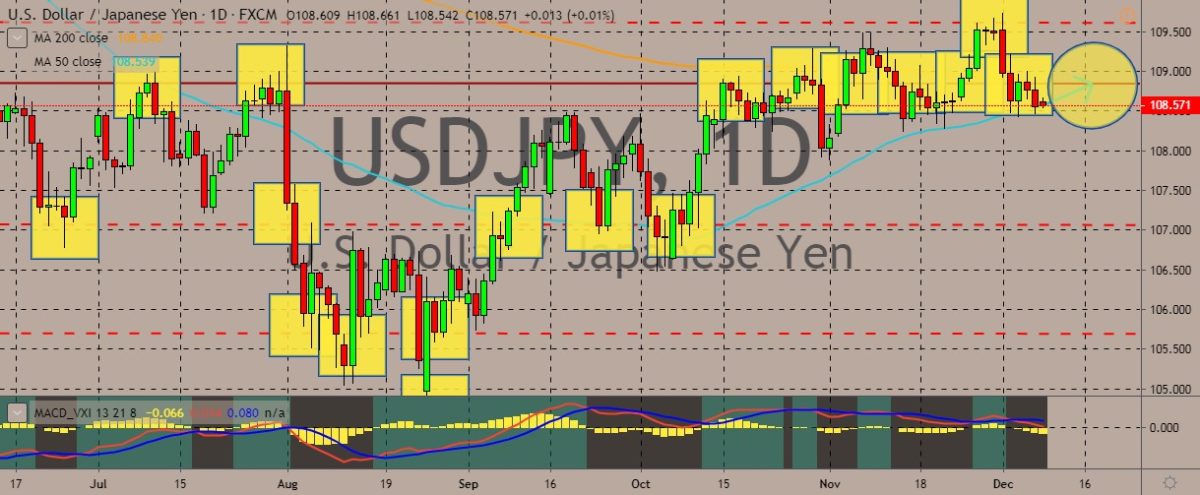

USDJPY

The pair is trading lower on the daily charts as sellers continue to weaken the dollar and boost the safe-haven Japanese yen, which is something not surprising as the Federal Reserve meeting approaches. Traders are likely preparing for the volatility to expected to occur during and after the meeting, although it is widely expected that the Fed will not be making any huge changes on the monetary policy. For fundamentals, the US last week received the latest jobs report, which showed that nonfarm payrolls surged by 266,000 in November. That figure is better than the expected 187,000. The unemployment rate moved down 3.5% from 3.6%, back to the 2019 low and matching the lowest jobless rate since 1969. According to reports, the end of the GM workers’ strike has had a huge effect to employment, boosting hiring in motor vehicles and parts by 41,300, which is part of an overall 54,000 gain in the manufacturing sector.

COMMENTS