Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

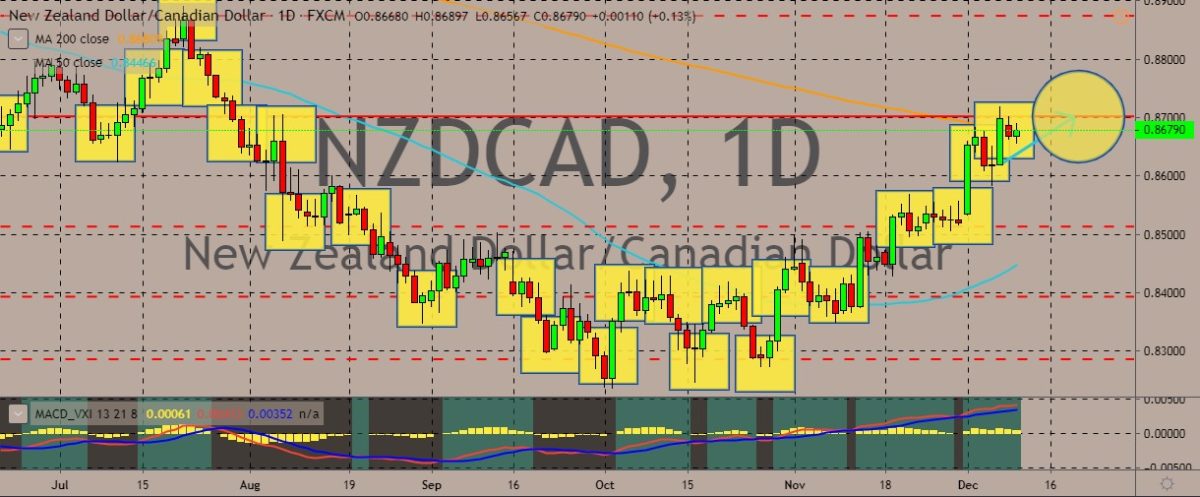

NZDCAD

The pair is trading in the green, with strong bull sentiment for the New Zealand dollar. Prices have reached levels near the 200-day moving average, which is also serving as a strong resistance line for the pair. However, the kiwi could gain more against the loonie because of recent economic data. The Canadian November labor market recorded its biggest monthly job loss and wildest unemployment upswing since the financial crisis, according to Statistics Canada. The Canadian economy lost 71,200 jobs in the previous month. Jobless rate increased to 5.9%, which is higher than the 5.5% recorded in October. Economists have expected an average gain of 10,000 jobs and unemployment rate at a steady pace of 5.5%. The data showed that job losses was widespread across industries and job titles. However, 2019 year-to-day tallies are still in the positive, adding 26,000 net new jobs between January and November. Wage also showed a growth of 4.5%.

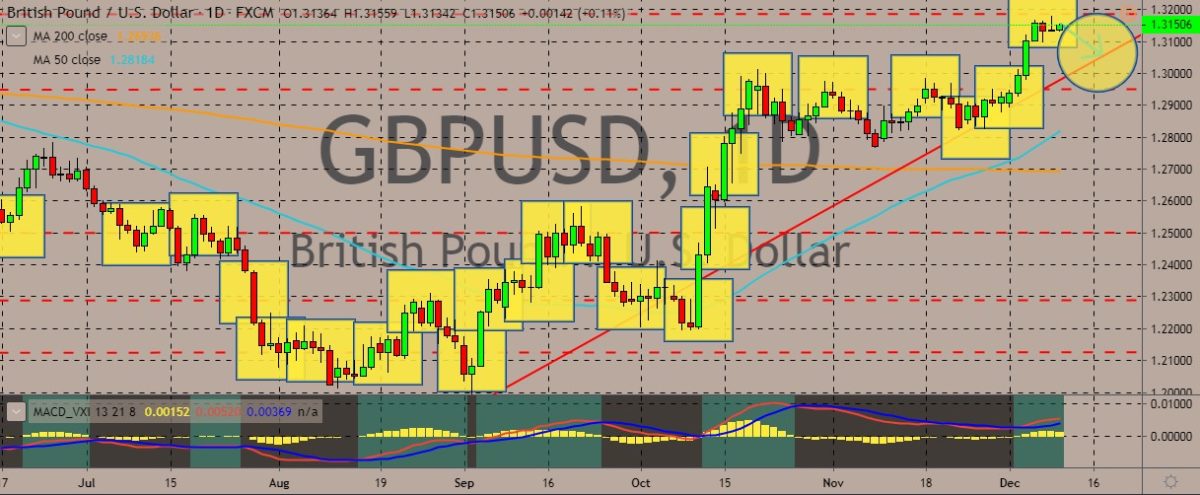

GBPUSD

The GBPUSD pair is still tracking as strong uptrend after the confirmation of the golden cross, with the British pound still soaring high on Brexit hopes and ahead of the UK’s December general elections. The pair is currently at a multi-month high. This Thursday, elections will occur. The polls, however, already have an impact on the royal currency. Surveys show that Boris Johnson’s Conservative Party has a 10-point lead over the Labour Party. This is a boon for investors, as the Conservatives are pro-business. Investors are also anxious to get Brexit finally done and wrapped up, and the Conservatives’ primary pledge is to accomplish Brexit as quickly as possible. If Boris Johnson takes the victory and gains a majority in the Parliament, getting his withdrawal deal ratified by the House of Commons will be easy and further trade negotiations with the EU can start. However, polls can be wrong and could show otherwise.

EURCAD

The EURCAD pair is still chopping sideways, and although the Canadian dollar was bummed by the dull jobs report, the euro wasn’t going all in for the upward, with traders preferring to wait and see what happens on the upcoming European Central Bank meeting. For fundamentals, investors’ sentiment and expectations for the eurozone’s economic future have turned positive, according to the Germany-based investor sentiment index, Sentix. This is the first time in eight months. Hopes are apparently rising that the worse for the economy has run its course despite the gloomy German industrial data last week. This comes ahead of European Central Bank president Christine Lagarde prepares for her first monetary policy decision and press conference this Thursday. Traders will be keeping close tabs on her wordings regarding her views of the state of the eurozone economy. traders are also expecting no change in the key rate from the ECB.

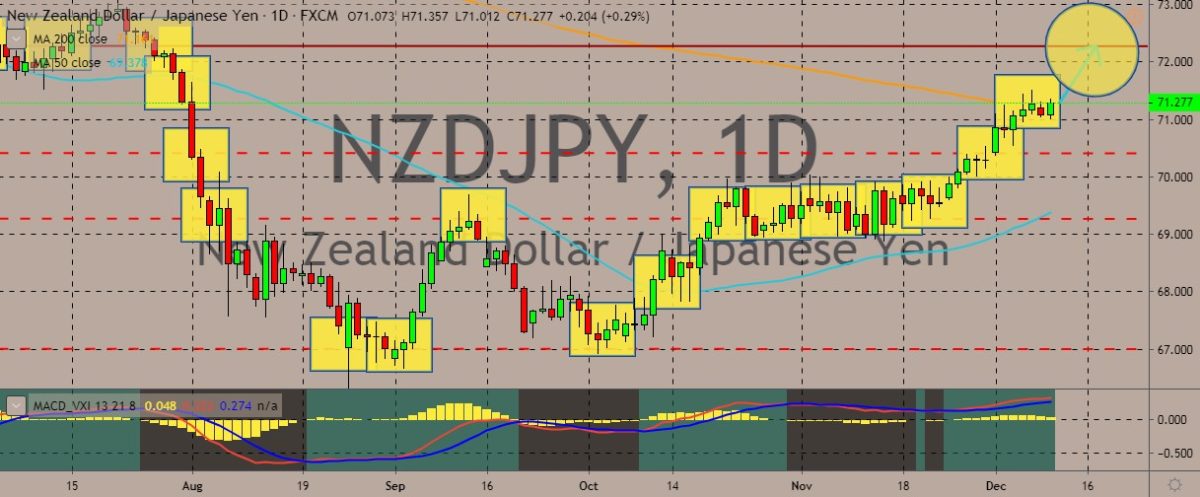

NZDJPY

The pair is trading in the green although the 200-day moving average is capping games, acting as a resistance line. Still, there’s quite a momentum for the kiwi. The overall trend is still going up, and traders are buying the currency pair. Still, the kiwi is under pressure after the unexpectedly poor report about the Chinese trade balance. China’s trade surplus narrowed to $38.73 billion in November, coming down from $42.81 billion in October. Analysts had predicted a widening to $46.3 billion. Fortunately for the kiwi, macroeconomic data was still supportive of the currency. Statistics New Zealand reported that the value of total manufacturing sales gained by 0.9% in the September quarter from the previous three months. The decline in the previous quarter received an upward revision from 0.7% to 0.5%. Meanwhile, the volume of the total manufacturing sales by 0.3% in the September quarter.

COMMENTS