Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

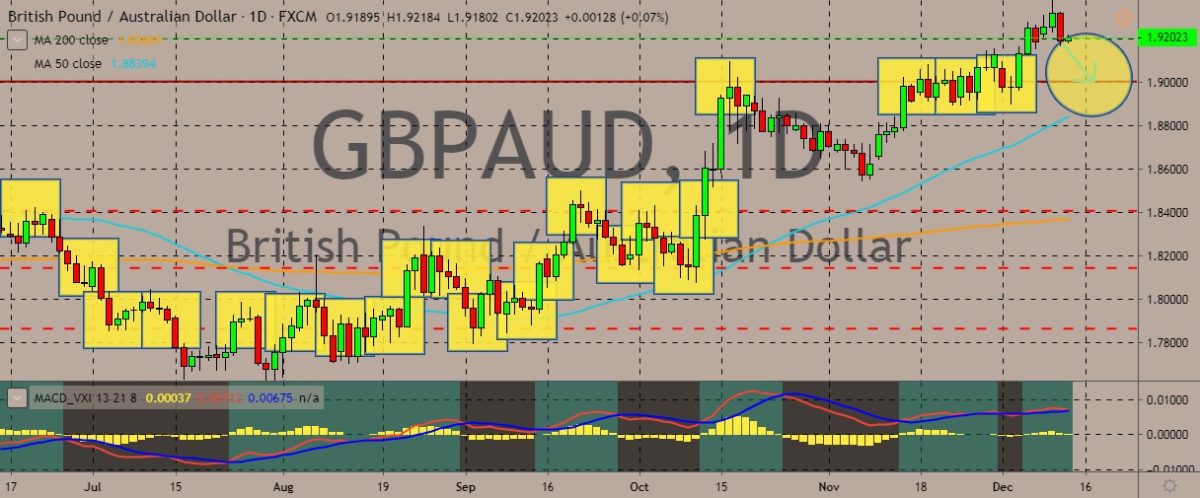

GBPAUD

The pair is trading near 2016 highs, with the price pulling back from recent losses. The British pound is under pressure as citizens head to poll booths in a bid to see whether Boris Johnson is going to acquire a majority Conservative government or Jeremy Corbyn’s Labour Party will take over the government. The Australian dollar, however, isn’t being passive. It’s moving and fighting back thanks to risk sentiment and the US Federal Reserve. Consumer Confidence declined this month, according to Westpac-Melbourne Institute Consumer Sentiment Index. The index lost 1.9% to 95.1 points, still lower than the neutral level of 100 for the previous six months. Since the RBA cut the cash rate, the index has lost 6.1%, suggesting that there are more pessimists than optimists and the cuts are still yet to show impact on household consumption. Meanwhile, the currency still gathered some strength after the US Fed left interest rate unchanged.

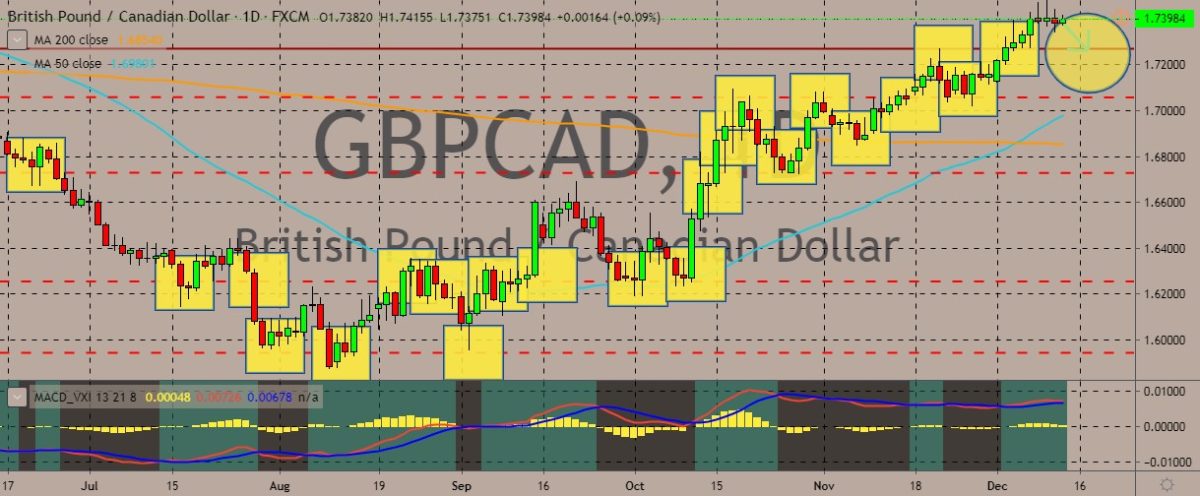

GBPCAD

The pair has apparently hit a ceiling after rallying for more than a week, now not moving much as the UK braces for the general elections. Still, the uptrend doesn’t appear to be exhausted. As for the Canadian dollar, the primary mover is still the economic data coming out of the country. Statistics Canada reported that the economy lost 71,000 jobs in November. Meanwhile, the Bank of Canada said that Stephen Poloz would retire when his term as governor of the central ends in June. According to the board of directors of the central bank, it has started a search process to find a replacement for Poloz. Before becoming the leader of Canada’s central bank in 2013, Poloz served as chief executive of Export Development Canada. He took the place from Mark Carney, who stepped down from the Bank of Canada to become the governor of the Bank of England. The recruitment process is expected to end by the spring of next year.

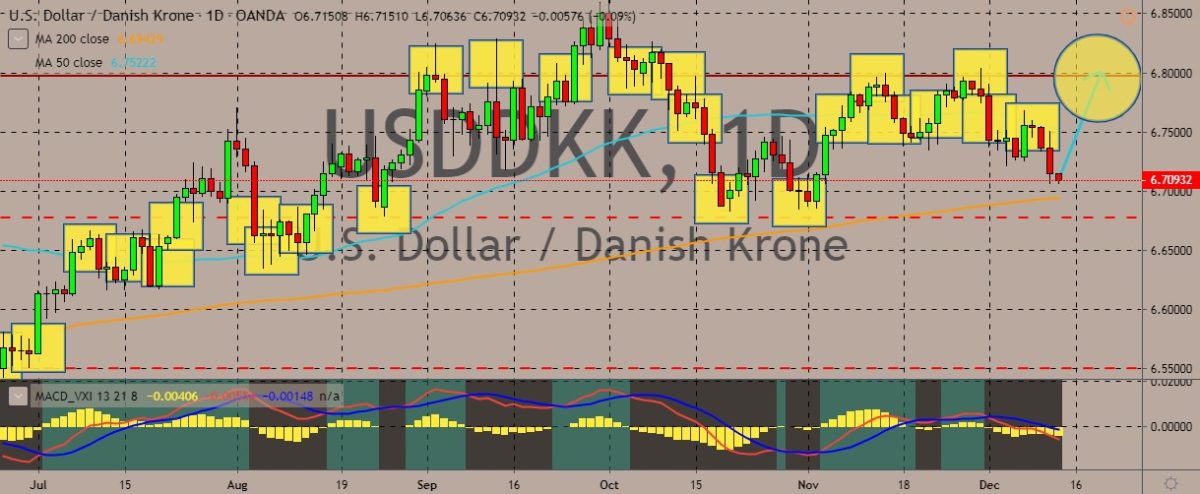

USDDKK

The pair is trading in the red, paring back all its gains last Friday and targeting the 200-day moving average. Ahead of the highly awaited Federal Open Market Committee decision senior Danske Bank analyst Mikael Olai Milhoj said that it will be keeping an interest rate cut in their forecast profile. He said the bank still believes that the US economy is more fragile than the US central bank believes, adding that the renewed trade optimism wasn’t going to be enough for business investments to rebound yet. As for the US dollar, movement also depends on the FOMC’s decision. Also, the US Consumer Price Index has beaten expectations, coming days after the better-than-expected nonfarm payrolls reports. CPI came in at 2.1%, which is higher than the expectation of 2.1%. This is the first time the print came above 2% since November last year. This is also the strongest rise in the economic indicator in 2019.

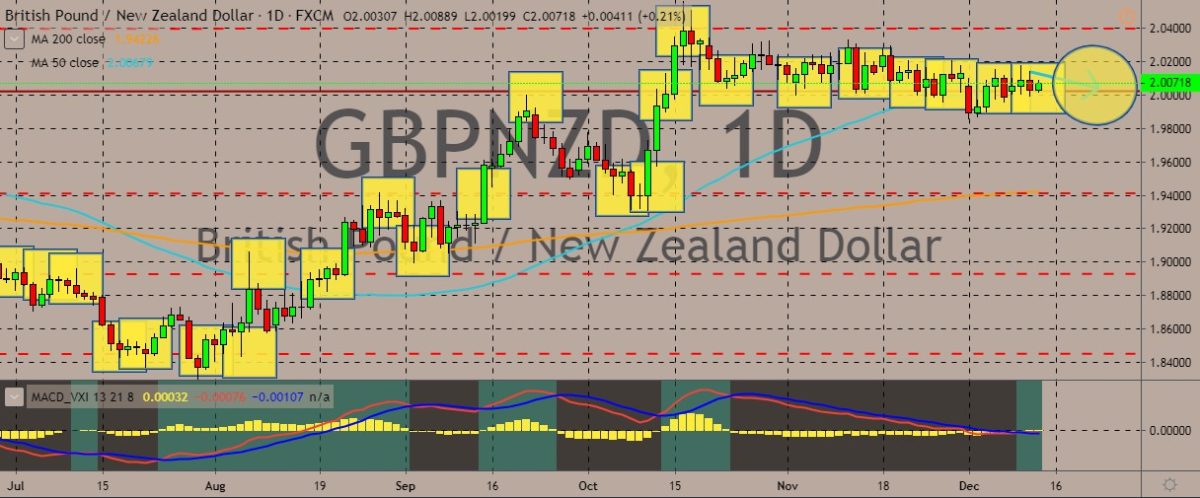

GBPNZD

The pair is trading sideways in the recent trading sessions, hovering near the flat 50-day moving average as bulls and bears engage in a tug of war for the direction. While the British pound appears cautious amid the UK general elections, the New Zealand dollar got its support from the dovish Fed outlook, which indicated that rates aren’t likely to move through the next year and beyond. The US central bank also noted that it would first need to see a “persistent and significant improvement in inflation” before it would increase interest rates. As for the British pound, polling booths will close at 11 am tomorrow. Even though current prime minister Boris Johnson’s Conservative Party has been leading in opinion polls, the fight has been tightening. This raised concern of a hung parliament. The markets are also bracing from any development in the US-China trade war, with the US set to decide another tariff imposition on December 15.

COMMENTS