Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

USDCNH

The pair has plummeted steeply from the 50-day moving average down to its 200-day counterpart. It’s now paring back those losses, but it still has ways to go. The yuan strengthened to a four-and-a-half month high against the US dollars after the reports that the United States and China both nodded to reduce the exiting tariffs. The two sides also apparently agreed to delay the new tariffs in the pipeline. The equity markets also benefited from the report, dispelling looming gloom amid tensions over US bills on Hong Kong and Xinjiang. Meanwhile, for the US dollar, the Federal Reserve decided to hold interest rates steady during its December meeting. This paused a series of rate cuts that boosted the markets and squashed recession fears amid the ongoing trade uncertainty. The key rate now still between 1.5% and 1.75%. They had described the policy decision as “appropriate” to help extend the nation’s economic expansion.

USDTRY

Trading in the red for most of this week, the pair hovers above the 50- and 200-day moving averages on the daily chart. And although the moves have been negative, it appears that the pair is targeting a lower low to paint an uptrend after previously reaching a higher high. The two countries behind the currencies are still embroiled in simmering tensions. Recently, Turkey renounced US senators after they supported legislation to impose sanctions over its military offensive in northern Syria. The issues were also revolving around Turkey’s purchase of S-400 missile system in Russia. Meanwhile, Moscow also considers US pressures on Turkey to be unacceptable, according to Russian Foreign Ministry spokeswoman Maria Zakharova, describing US’s behavior to be out of bounds in the system of international relations. Ankara’s purchase of the missile systems prompted the Trump administration to suspend Turkey from the F-35 program.

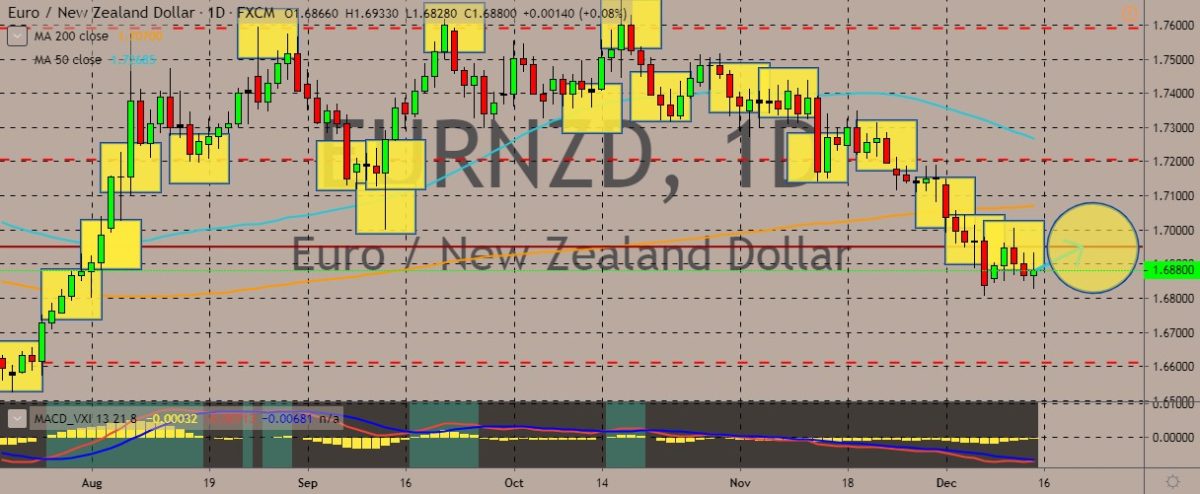

EURNZD

The EURNZD pair is trading in tight ranges, with the price staying below the 200-day MA and the 50-day MA pointing south. The biggest movement driver for the euro today is the outcome of the European Central Bank’s meeting this month. The ECB kept its interest rates unchanged, and the policy-setting meeting was also notable for it’s the first time the new ECB president Christine Lagarde headed the policy meeting in Frankfurt. The Governing Council voted to keep the main deposit rate at the historic low of -0.5%, meeting market expectations, while the marginal lending facility stayed at 0.25%. According to the ECB’s statements, the rates will stay near the current levels or even lower until it sees inflation outlook to “robustly converge” to a level close to but below 0.2%. Another condition is that the underlying inflation should remain consistently convergent with that level.

AUDNZD

The pair is trading in the red, paring back its recent gains after jumping from its August lows. The 50-day MA is heading south, while the 200-day MA is tilting north, indicating that a death cross can be expected in the near future if all things remain the same. The Australian dollar has faced pressure after the International Monetary Fund said that the federal government and the central bank should be ready to provide further stimulus to prop up the economy. In its annual report, the IMF warned the risks to the economic outlook are biased to the downside amid soft domestic confidence, heightened global policy uncertainty, and the likelihood of a faster slowdown in China. Economists are skeptical whether the government would loosen the federal purse strings. At present, the government focuses on returning to budget surplus. The fund expects that after the growth of 1.8% in 2019, the economy will expand 2.2% in 2020.

COMMENTS