Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

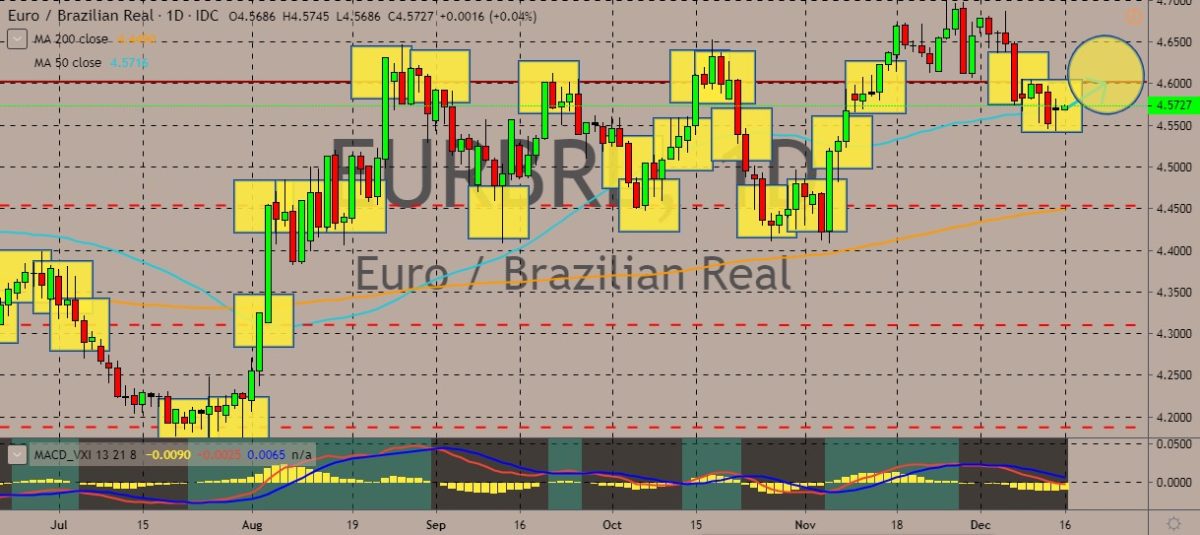

EURBRL

The pair is still on the higher levels of its trading range, trading above the 50-day moving average indicating a prevailing bullish sentiment among the pair’s traders. The pair has been trading within ranges for much of mid-August to early November before it traded higher in the latter part of November. Over in Brazil, the central bank slashed its benchmark interest rate for a fourth consecutive meeting, ignoring the drop in its currency. The rate was cut to a record low of 4.5% after the monetary policy committee approved a cut of 50 basis points. The Brazilian real has had a challenging year, falling down about 6% this year. On the flipside, the outlook for Brazil appears to be largely bullish, with the economy expanding 0.6% in the third quarter, triggering hopes of a cyclical recovery in the largest country in Latin America. Comparing it to the same quarter last year, the economy expanded 1.2%.

GBPBRL

The pair is trading up in the daily charts, with the strength in the British pound being driven up by Brexit hopes and the power of Boris Johnson’s UK election win, as markets see more direction and clarity for Brexit. The 50-day moving average is tracking up, indicating that traders are still very much bullish for the British pound, which has reached its highest level in more than two years. British Prime Minister Boris Johnson is scheduled to begin to push to secure parliamentary approval for his Brexit deal “before Christmas.” Johnson’s Conservative government plans to make fast moves to accomplish his campaign mantra to “get Brexit done.” This means ensuring that the Brexit Withdrawal Agreement bill is passed in time for the United Kingdom to complete its departure from the European Union by January 31, the current deadline. The Conservatives won 365 seats of the 650 in the House of Commons. Labour had 203 seats, its worst since 1935.

USDBRL

The pair is trading lower on the daily charts, slipping below the 50-day moving average as the Brazilian real gained ground against the dollar. The Brazilian real gathered its strength thanks to the expansion of the economy in the third quarter, which is larger than what economists have expected. Meanwhile, for the US dollar, US Trade Representative Robert Lighthizer said that the phase one US-China trade deal is “totally done.” Under the deal, US President Donald Trump promised not to pursue a new round of tariffs set for Sunday. Beijing responded by saying that it would substantially hike agricultural purchases, but it didn’t specify how much. Trump said via Twitter that “phase two” trade deal would start right away. However, Beijing clarified that moving to the next stage of the trade talks would roll largely on implementing the phase one deal first. At the same time, Lighthizer said there’s no timetable yet set for the next phase of talks.

USDRON

The pair has fallen near October lows in the recent trading sessions, going below the 50-day moving average. Over in Romania, the central bank spent less than 1 billion euros from its forex reserves to prop up the leu in November, according to an official who asked not to be named. Meanwhile, the country’s gross domestic data per capita measured in Purchasing Power Parity terms increased 65% of the EU average in 2018, up by 2 percentage points when compared to 2017. The index serves a proxy for the value added by Romanians and theoretically indicates the volume of resources they consume or invest. On the other hand, higher shares of the economy by foreign investors means lower gross national income compared to GDP. The gross national income refers to the resources left in the pockets of local natural and legal persons. This improvement in the per-capita GDP has not led to a better ranking among EU countries, however.

COMMENTS