Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

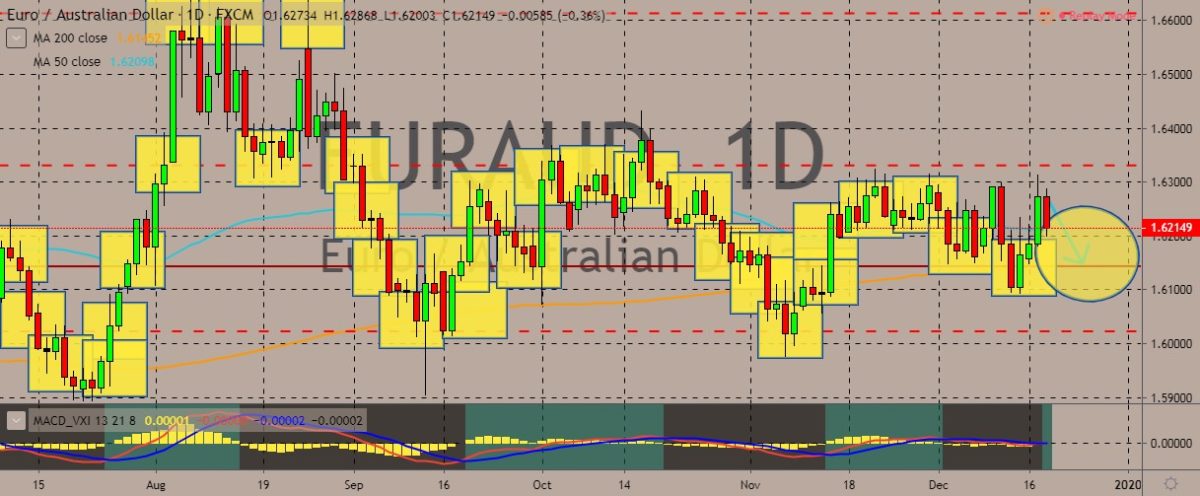

EURAUD

The pair is trading in the red as the Australian dollar pares back most of its losses to the euro in the previous sessions, creeping back down to the 50-day moving average. It’s highly likely that the next move will be in favour of the Australian dollar. The most obvious reason, of course, is the blowout jobs report that eased the market concerns about the future of Reserve Bank of Australia interest rates. Australia created 39,900 new jobs in November, according to the Australian Bureau of Statistics data. The unemployment rate was down to 5.2% from 5.3% in October. This data is very significant for the RBA, as it has flagged the labour market as the most important driver of its approach to the interest rates. That is because any rise or fall in unemployment can have significant impact on both wages and inflation, which the RBA has been trying to lift back within its 2% to 3% target band for years.

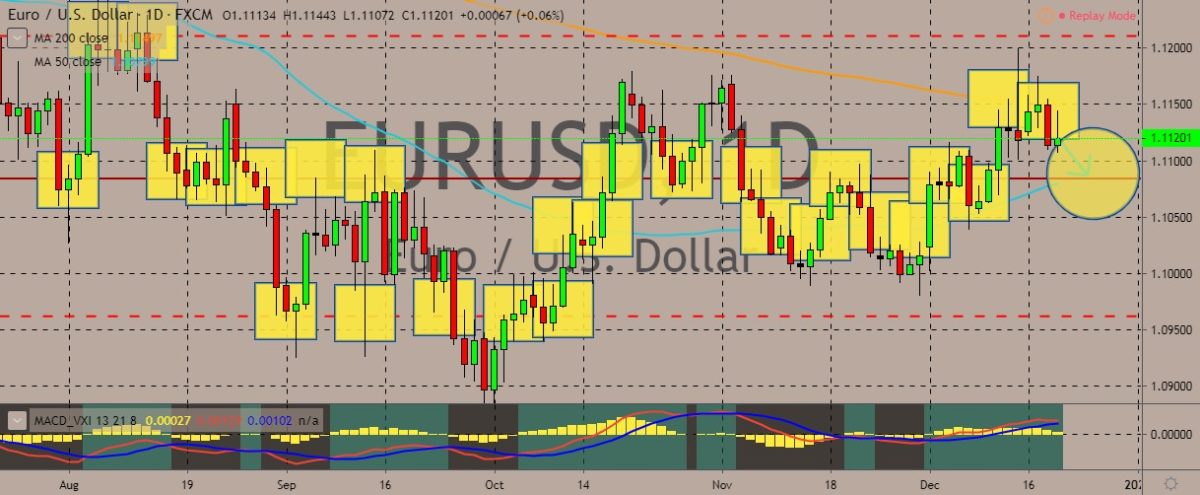

EURUSD

The pair is trading in the green today, but its bullishness may prove to be short-lived as the 200-day moving average above could come into play to push back the price down. Also, the dollar bulls are getting stronger, boosting the dollar after a string of strong US economic data releases. The releases also made a near-term rate cut from the Federal Reserve less likely. As for the eurozone, the cautious upbeat mood over a US-China phase one trade deal has yet to reach the consumers. Confidence dropped from -7.2 to -8.1. The fourth quarter offered mixed signals from economic indicators in the eurozone. On the one hand, there have been signs of bottoming out in business activity, which had been considered an encouraging sign of growth. But on the other hand, there has also been a downtick in the manufacturing PMI as well as today’s weak consumer confidence reading.

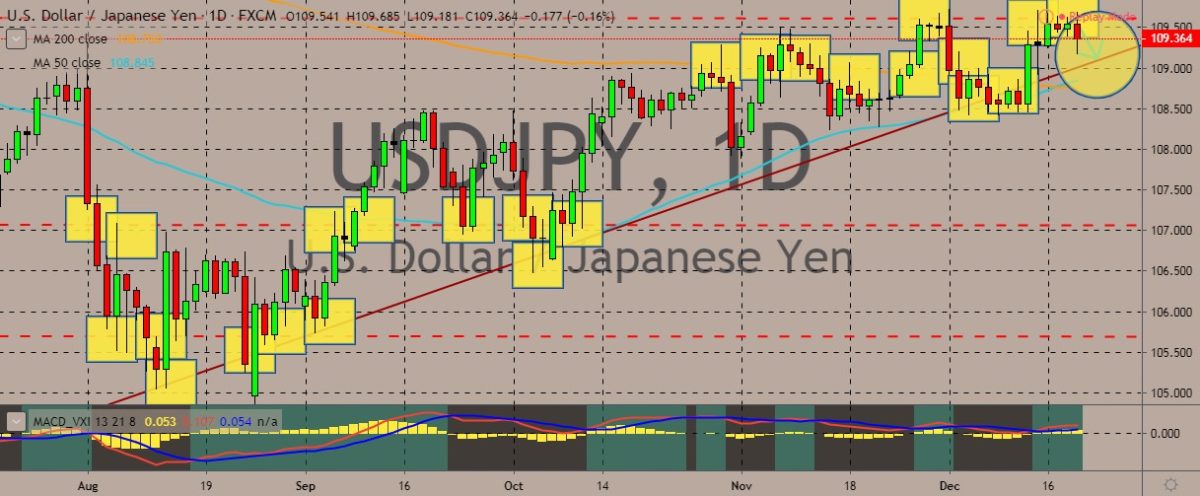

USDJPY

The overall trend for this pair is still up, with the prices currently going for a higher low. The uptrend could be sustained for some time as the 50-day moving average already crossed over the 200-day moving average, forming a golden cross and flagging bullish sentiment among the pair’s traders. The dollar is recording a strong week since early November thanks to the growth in economic releases. US growth moved up in the third quarter, according to the government. There are also signs of a moderate expansion on the economy as the year ends, supported by the strong labour market. Gross domestic product gained at a 2.1% annualized rate, according to the Commerce Department. Meanwhile, consumer spending was also stronger than previously expected. The GDP and personal consumption data are signalling that the US economy will enter 2020 on a strong, firm footing.

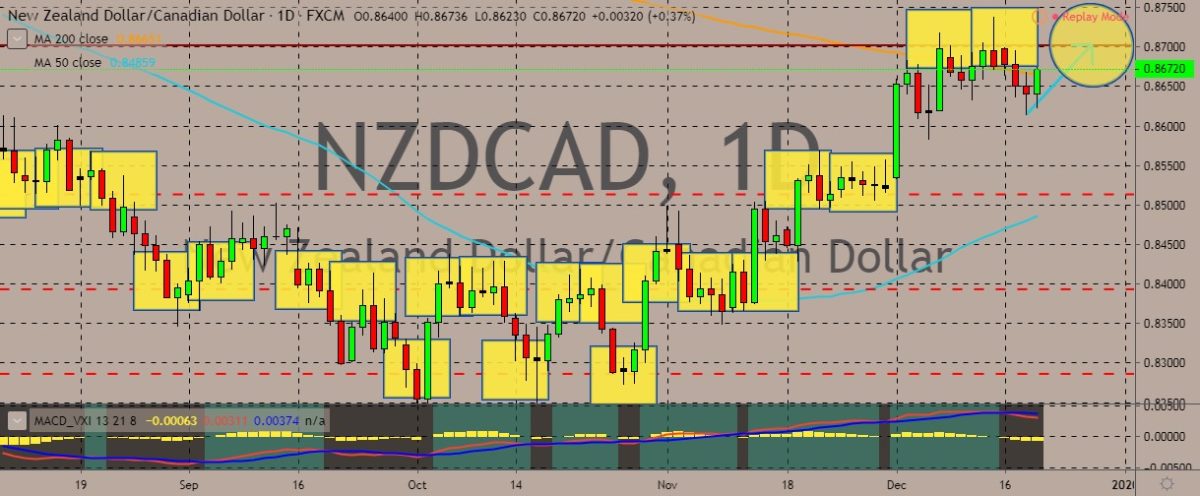

NZDCAD

The pair is trading in the green, paring back all of its losses and adding some more gains as the Canadian dollar weakens against its New Zealand counterpart. Over in Canada, retail sales apparently plummeted unexpectedly in October. This comes as the latest in a series of lacklustre economic data releases, which traders may believe to force the Bank of Canada to put rate cuts back on the table. According to Statistics Canada, the retail trade dropped by 1.2% on lower sales of motor vehicles and parts. The Bank of Canada has kept its overnight interest rate unchanged for more than a year even as many other international peers have cut their rates. It predicted a 1.3% increase in domestic fourth quarter growth in October. Meanwhile, Canada lost an unexpected 71,200 jobs in November, and this has been the biggest decline since 2009. National unemployment rate climbed to 5.9%, which is the highest in more than a year.

COMMENTS