Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

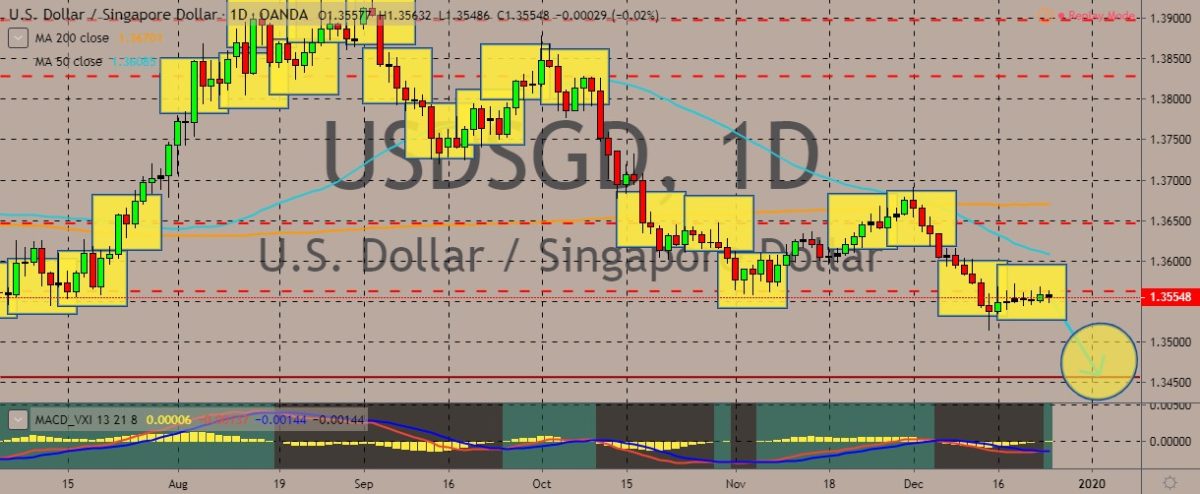

USDSGD

The pair has been trading in thin volumes as the market enters the holiday, barely moving, although it could be expected to move largely after the Christmas holiday. The 50-day and 200-day moving averages are still indicating a prevailing bearishness for the pair. Over in Singapore, the industrial output unexpectedly fell in November, showing its biggest drop in four year. The market took this as an indication that the recovery in the Asian economy is probably going to be tough. Manufacturing output last month slipped 9.3% from a year earlier, according to data from the Singapore Economic Development Board. This is the steepest fall since December 2015. The city-state’s export-reliant economy has suffered from the protracted trade war between the United States and China and from the cyclical downturn in the electronics sector. Singapore will be holding elections in the coming months, while it will release advanced GDP reading on January 2.

EURDKK

As the holiday kicks in, trading volumes have been thin for the euro and Danish krone, with the price barely moving from current levels. However, the Danish krone is expected to strengthen against the euro, which has dipped recently. Meanwhile, a member of the governing council from the European Central Bank said that the interest rates in the eurozone could remain historically low for years, but the ultra-loose monetary policy risks becoming counterproductive. Klaas Knot said that the current low rates lead to too much risk-taking by investors, while younger investors may be forced to keep increasing their savings. Knot has been a vocal and frequent critic of the ECB’s ultra-loose monetary policy and lambasted the bank’s new stimulus measures earlier this year, describing them as disproportionate. The dutchman said that he was looking forward to seeing strategic review of the ECB policy that the new bank chief Christine Lagarde promised.

EURTRY

The pair has climbed slightly in recent sessions after the euro got stronger against the Turkish lira, which has been seeing a selloff. The two moving averages remain close to each other as the chart enters 2020 territories. If the lira continues to be weak, it could threaten President Recep Tayyip Erdogan’s goal of growing the economy by 5%next year. At the same time, the lira has come under further pressure after the US Congress recently approved a bill that banned Turkey from a program to build and buy F-35 stealth fighter jets. The currency has also weakened as the central bank halved its benchmark interest rate over the past four months to 12%. This made lira-denominated bonds less appealing to buyers. At the same time, Turkey has had to deal with political and military tensions with Cyprus, following the deployment of Turkish military drones to the ethnically divided island of Cyprus.

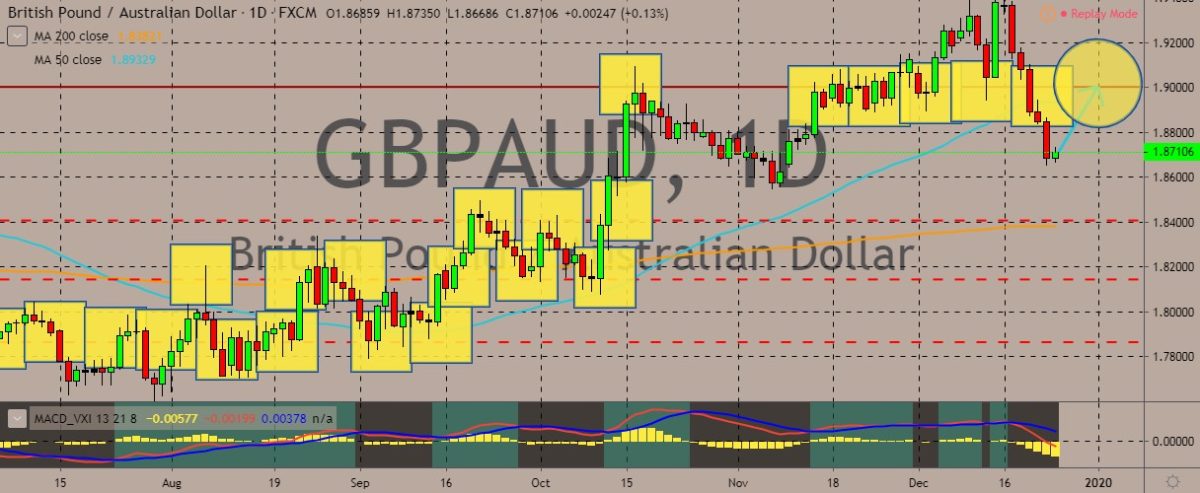

GBPAUD

The pair is looking like it could be attempting a retracement of its recent losses in the run up to the holiday, although trade volume appears to be extremely thin too. Still, the pair looks to follow a modest gain as the Australian dollar appears to be under pressure due to expectations that the retail sales growth during the Christmas holidays will slow down to levels not seen since the global financial crisis of 2008. Yet, the Australian dollar could still benefit from the apparent trade truce between the US and China, with the latter being Australia’s biggest trading partner. Meanwhile, the British pound still looks digesting the economic outlook for the year ahead. The UK is now set to leave the European Union on January 31. The outlook for the Brexit saga has become a tad clearer after British Prime Minister Boris Johnson won a decisive victory in the December UK general elections, now driving a majority government.

COMMENTS