Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

USDZAR

The pair is slipping to the lower parts of the daily chart, declining largely as the dollar weakens on trade news. The 50-day moving average is also poised to cross below the 200-day MA, indicating an impending death cross for the pair. Over in South Africa, the central bank has sanctioned HBZ Bank, which is headquartered in Durban and has roots in Pakistan. The allegation was that the bank violated the country’s Money Laundering and Terrorist Financing Control Regulations. As for the economy, StatsSA published earlier this month that South Africa’s Gross Domestic Product (GDP) data for third quarter 2019, and the data showed that growth contracted by 0.6%. StatSA said that the largest negative contributors to growth in GDP were the mining and quarrying industry, which declined by 6.1% and contributed -0.5% to the GDP growth. The manufacturing industry, meanwhile, lost 3.9%.

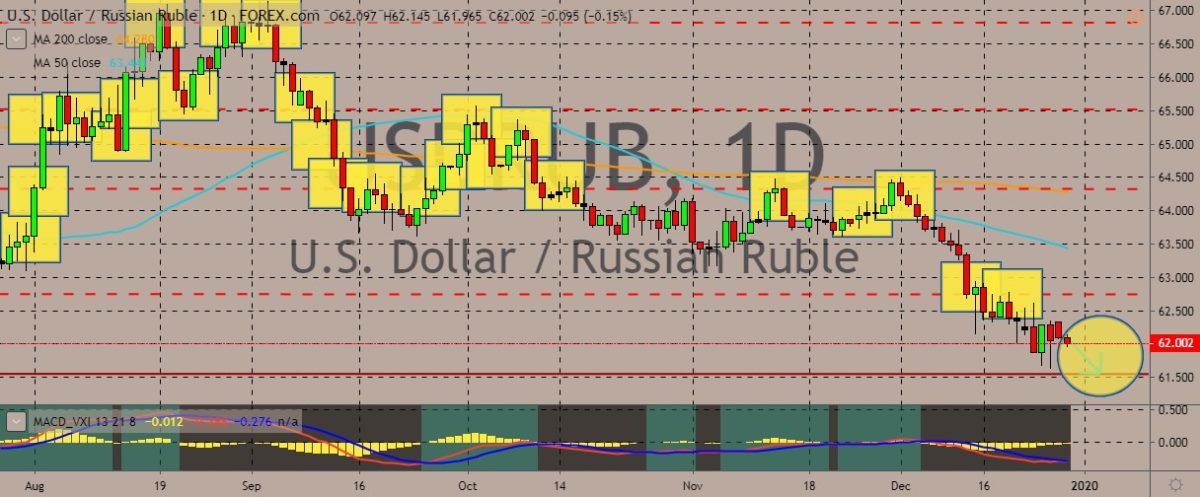

USDRUB

The pair has slipped steeply below the two moving averages (long- and short-term, respectively). It has recently attempted to reverse course but pulled back down quickly. On the political front, Russia said that it successfully thwarted terror attacks that were supposedly set to occur in St. Petersburg thanks to a tip from Washington. Russian President Vladimir Putin personally thanked US President Donald Trump. Russian news agencies said that the Federal Security Service (FSB) said that the tip resulted to the detainment of two Russians on December 27. These two Russians were suspected of plotting attacks during the new year festivities in the city. The diplomatic ties between Washington and Moscow have been embroiled in disagreements over Ukraine and Syria as well as allegations that Russia meddled in the 2016 US Presidential Elections, although Trump and Putin kept personal lines of communication open.

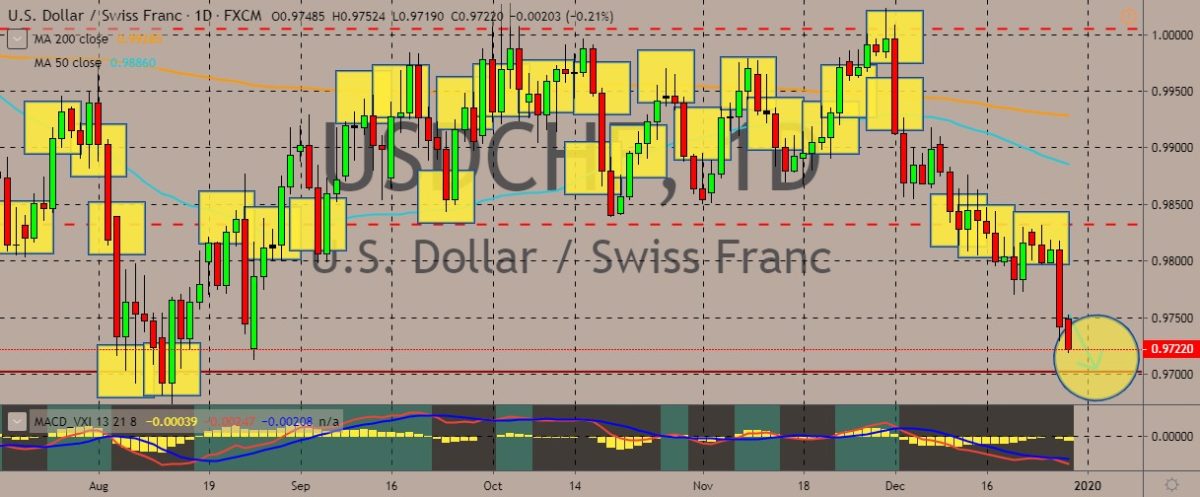

USDCHF

The pair has slipped below its August highs as the swiss franc continues to strengthen against the dollar. The dollar’s broader weakness can be attributed to the rampant profit-taking by investors of the dollar amid the prevailing optimism around the US-China trade deal. This also comes during the year-end think trading. Meanwhile, the Swiss economy is expected to lack any sustainable growth in 2020, with such growth expected to arrive in 2021 at the earliest, according to government forecasts. The Swiss National Bank (SNB) agreed and kept negative rates unchanged. According to a government expert group, the “international environment remains unfavourable” and the weak growth could continue in the eurozone, particularly in Germany, which is Switzerland’s single most important trading partner. Earlier this month, the central bank decided to keep its -0.75% interest rate policy.

USDCZK

The dollar’s weakness extends to this pair, with the price slipping sharply after it rose and converged with the 200-day and 50-day moving averages. Over in Czechia, the Czech National Bank will likely keep interest rates unchanged until the end of 2020 as the central bank board tries to weigh domestic inflationary pressures amid a weaker international situation abroad, according to a survey. The Czech central is among the few in Europe that still includes rate hikes in talks, while the European Central Bank is holding on to its loose monetary policy amid a bleaker outlook for the eurozone. But even if the economy appears ready to slow down next year, it remains propped up by strong domestic demand that is drawing strength from Europe’s tightest labour market. Consumer price growth sped up to 3.1% year-on-year in November, data showed earlier, a bit higher than the bank’s target threshold at -/+1% of its 2% target.

COMMENTS