Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

EURUSD

The pair is trading in the red in today’s trading after trading higher last week. Over in Europe, the common currency is facing tough pressure after estimates last week showed that the eurozone consisting of 19 EU countries barely grew at all in the final quarter of the year 2019. The estimate puts growth in the zone at 0.1% during the three months to the end of December. France and Italy shrank during the period, losing 0.1% and 0.3% respectively. Meanwhile, the jobs market was looking better, with unemployed people falling by 34,000. Further data, on the other hand, showed that German business morale slumped unexpectedly, suggesting the bloc’s biggest economy kicked off 2020 with a slow start after it sidestepped a technical recession in 2019. For the US dollar, the Federal Reserve left rates unchanged as Chair Jerome Powell said that the continued growth and ‘strong’ job market suggested the bank didn’t find it necessary to ease policy.

USDJPY

The dollar is rising against yen, undercutting the downtrend that started last week when investors adopted a risk-off sentiment amid the Wuhan, China coronavirus scare. The price currently uses the 200-day moving average as a support line, while the 50-day moving average trades higher than its 200-day counterpart. The Japanese yen previously trended higher against its major peers as the market grew anxious over coronavirus developments. Cases worldwide officially exceeded that of the SARS epidemic of 2003. At the same time, the World Health Organization declared the nCov as a global health emergency. Markets are fearing the outbreak, and the Chinese government’s decision to shut down public transport and quarantine millions of residents will probably negatively affect the Asian country’s economy in the first quarter of 2020. It could even lead to a contraction of growth in the country.

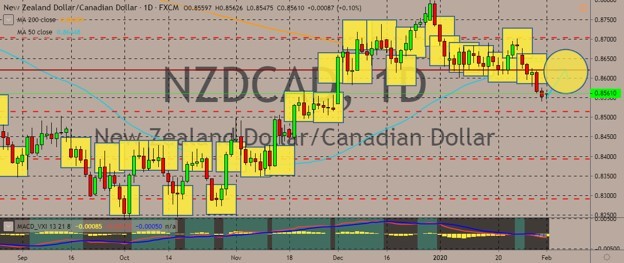

NZDCAD

The New Zealand dollar is still weak against its Canadian counterpart, slumping to one-month lows in recent trading sessions below the 200-day moving average, which has recently crossed below the 50-day moving average. Canadians evacuated from China near the ground zero of the novel coronavirus outbreak, and they will be quarantined for 14 days at a Canadian Forces Base in Trenton, Ontario, according to news. Meanwhile, markets are pricing in a near-zero change of easing by the Reserve Bank of New Zealand on February 12, with the Official Cash Rate current at 1.0%. The expectations for additional policy easing in February slipped sharply over the previous two months, thanks to the bank’s surprise decision to keep key rates steady during its November meeting as well as due to the easing in the US-China trade tensions. Still, the markets are still pricing more than 60% chance of one cut by the RBNZ this year.

GBPUSD

Last week, the pair avoided a decline in spite of the market risk-off sentiment and ended the week with a high note. There has been some market optimism over the Bank of England’s outlook partnered with the anticipation surrounding Brexit. Last Thursday, the BoE decided to leave key rates unchanged, with a vote of 7-2, which was the same split vote as the bank’s previous decision. Before the decisions, markets have been divided 50/50 over whether the bank could cut the interest rates because of worries over Britain’s economic outlook. Although the bank did cut its growth forecast, there weren’t any substantial signs that policymakers are becoming more dovish. But since the market’s currently in panicky ground, the sterling could be expected to lose some against the US dollar, the Japanese yen, and the Swiss franc in the near term. However, it would probably outperform other riskier currencies like the loonie, kiwi, and Aussie.

COMMENTS