Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

USDBRL

The pair trades further up the daily chart today after rising steeply last week, when Brazil’s central bank decided to cut interest rates by 25 basis points to 4.25%, which the market expected. However, during the announcement, the rate-setting committee said that the rate cut could be the last. At the same time, the Brazilian real is being pushed further down by the strength of the US dollar, which is gaining support from the ongoing coronavirus epidemic worries as well as the robust US job market data. The data on Friday showed US job growth accelerated last month, exceeding estimates, suggesting that the economy is gaining more strength. Meanwhile, the death toll from the virus outbreak climbed again over the weekend, surpassing the total fatality recorded by the SARS epidemic. In mainland China, the count now stands at 908, while the total infections count is at 40,171.

USDRON

The US dollar also gained a steeply against the Romanian leu, which has seen its price tumble, although today the CEE market currency is fighting back slightly, taking the price a bit lower. Politics in Romania rages, as the centrist government collapsed after a no-confidence vote. The vote came against Prime Minister Ludovic Orban, and it has opened the door to an early election in the European Union-member state. Orban is expected to still serve as interim chief. The no-confidence vote follows just three months of rule by the centrist minority government. As for central bank news, the country’s central bank said on Friday it was keeping its monetary policy rate unchanged at 2.50%. It added it would cut the minimum reserve requirement ratio on foreign currency-denominated liabilities of banks. The central bank also decided to maintain the deposit facility rate at 1.50% per year and the lending facility rate at 3.50% per year.

EURNOK

The pair is slightly trading in the red, although the Norwegian krone still trades near record lows after it slipped against the euro steeply in recent trading. For fundamentals, the Norwegian economy slowed down more than expected in the fourth quarter, confirming recent signs of weakness and pressuring the crown currency last week. Norway’s mainland economy, which doesn’t include the volatile oil sector, grew by 0.2% in the October-to-December quarter, according to Statistics Norway. The poll expectation was at 0.3%. Although the country defied most European economies last year, the recent signs point to it succumbing to the global weakness. The central bank raised interest rates three times in 2019. The oil industry, which is the country’s major source of growth in recent years, has showed signs that its recent investment boom is gradually ending. Manufacturing output for December also clocked in stagnant.

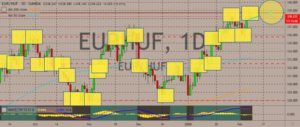

EURHUF

The pair is currently trading in red, although last week it has climbed up the charts. For fundamentals, the eurozone retail trade volume gained 2.2% on a year-on-year basis in 2019, according to the EU’s statistical office on Wednesday. The figure also saw a gain of 2.4% on average in the EU27 during the said period, according to Eurostat. The Hungarian forint then went to a record low against the euro. This CEE currency has become a financing currency in carry-trade deals, as the Hungarian central bank held an ultra-dovish stance, keeping interest rates at the lowest level in Central Europe. This situation suggests traders are using the forint to buy higher-yielding assets, and there is a build-up of short positions, showing traders’ expectations of further forint weakness. At the same time, the dollar’s strengthening had contributed to the forint’s weakness.

COMMENTS