Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

AUDCAD

The pair still treads the lower portion of the daily charts, with the Canadian dollar still dominating its Australian counterpart. Both the 200-day and 50-day moving average are going down, indicating the prevailing bearish sentiment for the pair. Canadian dollar traders are still largely bullish on the loonie amid hopes the coronavirus outbreak in China wouldn’t hurt the global economy too much and it will eventually fade. Experts agree the markets still believe China has the virus epidemic under control. At the same time, the Canadian dollar rolls on the movements of oil prices, being a major exporter of commodities, making it sensitive to any worries about economic growth. As for economic indicators, Canadian home sales slipped 2.9% in January from December 2019 but were 11.5% higher than in January 2019, according to the Canadian Real Estate Association. There were also some concerns about public protests.

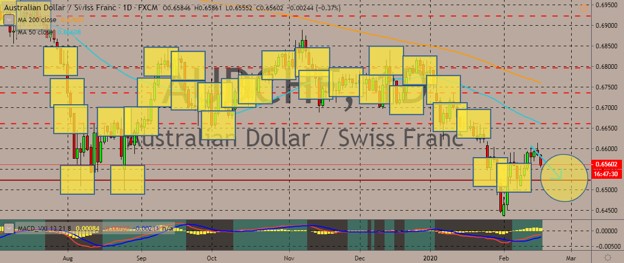

AUDCHF

Against the Swiss franc, the Aussie is also weakening, painting a very similar picture to the above chart. For fundamentals, Switzerland’s consumer price inflation remained in January, according to the data from the Federal Statistical Office. In a separate report, jobless remained unchanged in January, according to the State Secretariat for Economic Affairs (SECO). The consumer price index rose 0.2% year-over-year in January, which was the same as in December, but it also met the expectations of economists. The monthly decline was because of the decrease in prices of clothing and footwear because of seasonal sales and for medicines and international package holidays. Conversely, prices for hotel accommodation and cars increased. Core inflation was 0.2% in January, while economists expected a 0.4% figure. That means on a month-on-month basis, the core CPI slipped 0.5% in January.

GBPJPY

The pair failed to gain some further upside above the 50-day moving average. It is now trading in the red. The British pound is largely weakened by the concerns over a no-deal Brexit. Johnson’s spokesman said Britain doesn’t need any special arrangement in its future relationship with the European Union. He added it wants a trade agreement similar to other deals the EU has sealed. These comments conjured up fears of a hard Brexit and put some pressure on the British pound. The weakness, however, is cushioned amid the softer demand for the safe-haven Japanese yen. The People’s Bank of China recently implemented monetary stimulus measures, lifting global risk sentiment and eventually undermining demand for perceived safe-haven currencies. Additionally, the week ahead will be filled with important UK macro data, including the monthly employment figures and the latest consumer inflation.

CADJPY

The Japanese yen is gaining little ground against the Canadian dollar, with the price hitting the 50-day moving average. Still, the Japanese yen is facing some pressure after the dismal fourth-quarter gross domestic product failed to support the Japanese yen. Average forecast expected a 3.8% annualized contraction. However, economic activity declined 6.3%, reflecting a 1.6% quarterly contraction instead of the 1% experts expected. Private consumption slipped 11% in the fourth quarter, while business investment fell by 3.7%. With investors look beyond this, there is still a concern that the coronavirus fiasco in China may trigger another quarterly contraction, with tourism as well as trade being damaged. Meanwhile, the Covid-19 (official name of the virus) contagion rate appears to be slowing down, with the attention of observers switching to severe and critical cases, which is near 20%.

COMMENTS