Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

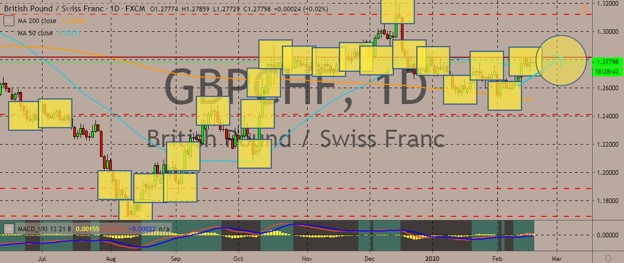

GBPCHF

The recently slumped and is now recovering, holding just above the 50-day moving average, which currently serves as a support line for the price. Previously, the pair pulled off a rally from the lows at the 200-day moving average. Worries surrounding Britain’s exit from the European Union still drive the pound sterling. The royal currency is also affected by the risk aversion caused by the ongoing China coronavirus fiasco. Recently, news broke out that the head of a hospital in Wuhan has died because of the Covid-19 virus. As a result, investors flocked to safe havens. South Korea warned of an economic emergency while Singapore Airlines cut flights. At the same time, markets were concerned after HSBC announced a massive overhaul of its business, including the cutting of around 35,000 job cuts. Apple also warned its sales will miss target because of the virus’ impact, adding to the already dominant risk aversion.

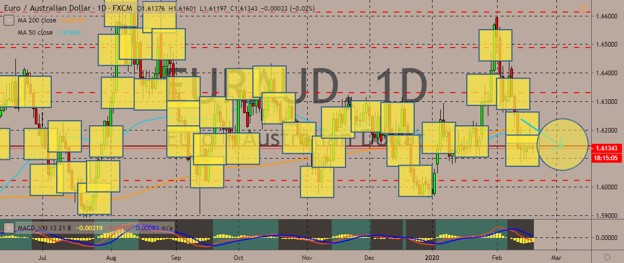

EURAUD

Despite the upside attempts, the pair still trades in the red, almost unmoving from recent levels below the 200-day and 50-day moving averages. The euro has been facing intense pressure after a German survey showed a slump in investor confidence, which added to the pessimism surrounding Europe’s largest economy and main economic powerhouse. Recent data revealed the eurozone is more vulnerable than most economies to the impact of the coronavirus outbreak that started in China. Meanwhile, the Australian dollar also wasn’t that strong to take the pair into the lower portions of the chart, with the Reserve Bank of Australia’s meeting minutes being released and showing a lot of concerns around the world. The minutes revealed the central bank’s board discussed the case for further reduction in cash rate. It also indicated the RBA was ready to ease monetary policy further if necessary, stating low rates would be needed for an extended period.

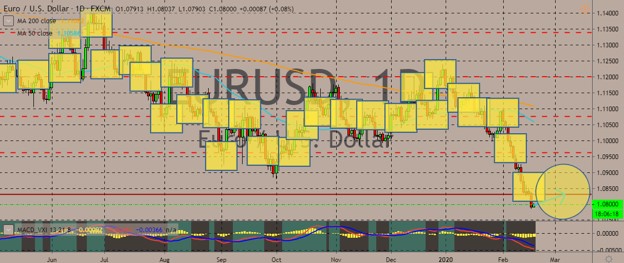

EURUSD

The dollar pummels the euro into its lowest in many years after the aforementioned data releases that showed weakness in the eurozone economy. These dismal surveys fanned the flames of suspicions the German economy would lose more momentum in the first half of the year as declining exports keep manufacturers stuck in recession. At the same time, the poor data has fuelled speculations monetary policy will remain looser for longer than what had been expected before. Meanwhile, the US economy has proven it’s more resilient than the rest of the world, propping the dollar at a four-and-a-half month high against major peers. Similarly, other safe-haven currencies like the Swiss franc and Japanese yen perked up. According to some experts, the dollar may face some downside pressure once the virus talk dies down and the impact of stimulus around the world becomes obvious.

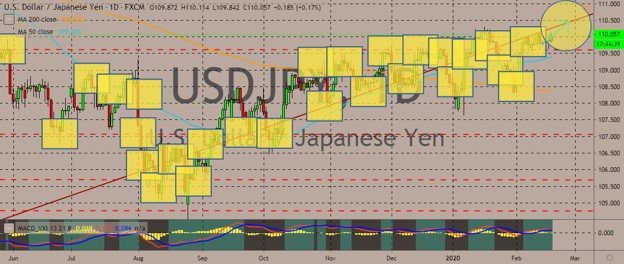

USDJPY

The pair is still on an uptrend as the world trembles on worries about the economic impacts of the Wuhan coronavirus and the weakened state of the eurozone. The US dollar is benefitting from its status as a safe-haven currency and the resilience the American economy is showing amid the uncertainty. Although its gains against the Japanese yen, which is a more traditional safe haven, is limited, the uptrend is still intact. It could go further up, given the fact that recent GDP data from Japan showed a worse-than-expected figure. The annualized Preliminary GDP Growth Rate for Q4 came in at -6.3%, coming worse than expectations of -3.7% and 0.5% in Q3. Apart from this, Japan is also being pressured by the ongoing coronavirus headwind. The country is shutting down large public events to prevent any contagion from happening. That includes the emperor’s birthday celebrations and the Tokyo marathon.

COMMENTS