Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

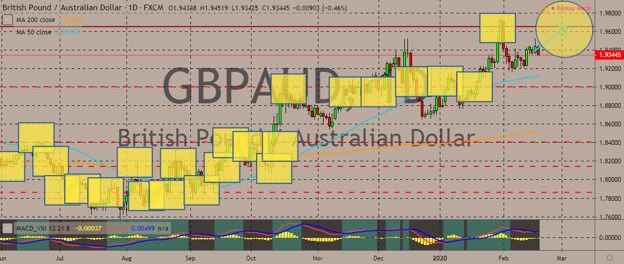

GBPAUD

The British pound traded in the red previously, but prices still lie above the 50-day moving average. The Australian dollar is currently facing intense pressure by the increasing Australian unemployment and ongoing uncertainty about the true economic effect of the coronavirus over Asia-Pacific economies. However, the gains in the Aussie were capped by the uncertainties over European Union trade. The Reserve Bank of Australia considered cutting interest rates at its last meeting. However, it didn’t pull the trigger since the rates are already too low. The economy, too, appeared to be moving slowly in the direction of inflation and unemployment targets. On the flipside, if trade and coronavirus uncertainties prevent the labor market from improving, the Australian central bank may be compelled to lower rates in their next meetings. Meanwhile, negotiations between the UK and the EU are expected to kick off in March.

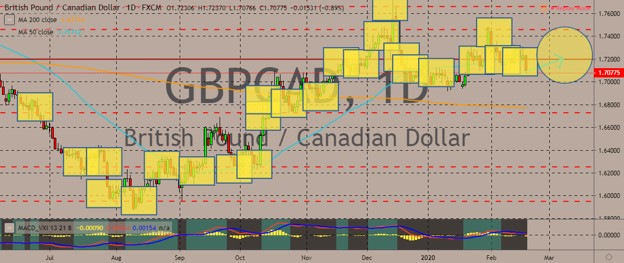

GBPCAD

The Canadian dollar has gained some ground against the British pound in the previous session, with the price slipping below the 50-day moving average but staying above the 200-day moving average, indicating the bulls still have the upper hand in sessions. The Canadian is likely to weaken after the evidence of the coronavirus spreading outside of China boosted demand for other less-risky currencies. Previously, the price of oil, which is one of Canada’s major exports, increased after the US government reported a much smaller-than-anticipated rise in crude stocks. Meanwhile, the British pound is expected to gain ground following the better-than-expected UK retail sales data. The data showed British consumers started to spend again at the beginning of 2020, recovering after the lacklustre end of 2019. Consumers were also more confident in January, with annual sales increasing 0.8%, which is better than the expected figure.

USDDKK

The pair has pulled back from recent record highs, and a reversal might be on the horizon. It’s far above both the 50-day and 200-day moving averages, indicating extreme bullishness for the US dollar. For fundamentals, the Danish krone is shaking off the decline in February consumer confidence, which dipped from 4.5 to 3.3. This figure failed to weaken the Danish krone against its rivals. It benefitted from the resilience of the euro, which insulated the krone from any anxiety over the domestic outlook. Even so, the Danish krone’s gains might be limited because of the global impact of the Covid-19 outbreak. The krone’s potential might continue to be limited the economy cannot demonstrate greater signs of resilience in the weeks to come. The DKK’s performance can also be negatively affected by any tumble in this Friday’s eurozone manufacturing PMIs due to Denmark’s close relationship with the eurozone.

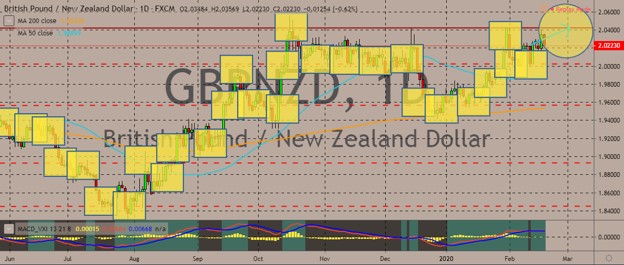

GBPNZD

The New Zealand dollar was stronger against the British pound in the previous sessions, pulling back after the British pound rose steeply. The pair still lies above the 50-day moving average, which in turn is traversing areas above the 200-day moving average. Meanwhile, the NZD can be expected to weaken amid the ongoing uncertainty at the economic impact of the coronavirus crisis and growing mistrust of what Chinese officials say about the disease’s spread. Earlier, Reserve Bank of New Zealand Adrian Orr gave a speech and said he’s “in no rush to go lower” on the official cash rate, which caused the New Zealand dollar to spike. However, the optimism was quickly overshadowed by the news from China’s Ministry of Commerce, which confirmed some of the negative impact of the Covid-19. Also, the city of Daegu in South Korea, which is more than 1,400 kilometers from the city of Wuhan, reported 35 new cases of the coronavirus.

COMMENTS