Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

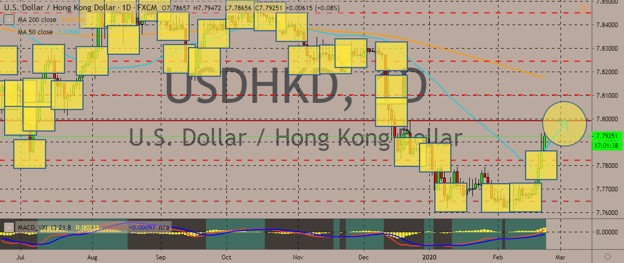

USDHKD

The US dollar continues to gain against the Hong Kong dollar in recent sessions, coming as part of a recovery from a record slump. For fundamentals, Hong Kong’s finance chief has warned the city is being threatened by a “tsunami-like” cataclysm, amid the devastation the new coronavirus is giving the businesses, which have already been damaged by months of anti-government protests. Also, the city’s lack of a bankruptcy process will only exacerbate the pain. Businesses in Hong Kong don’t have any recourse to any corporate rescue procedure when in difficult times. There is also a lack of proper legal framework for seeking bankruptcy protection means companies will be forced into liquidation. As for the US dollar, safe-haven demand is propping up the greenback’s price, with traders seeking safe asses amid the spread of the coronavirus outside China. Reports of infections without any clear link to China have also worried the World Health Organization.

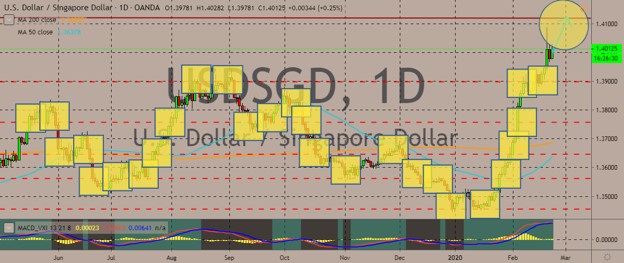

USDSGD

The US dollar is also dominating the Singaporean dollar in the trading sessions, thanks again to the coronavirus fiasco dominating the markets currently. Asian currencies were pummelled after the news of more new confirmed virus cases in South Korea and the two fatalities in Japan. The yuan also fell, while the Australian dollar, which is considered to be a liquid proxy to the Chinese yuan, declined to its 11-year low. South Korea reported the number of its confirmed virus cases more than doubled in just a single day. This raised concerns about the spread of the disease outside China. Meanwhile, Japan said two people who were on a cruise ship off Yokohama had died because of the coronavirus. The two people were a man and a woman in their 80s. Market expertsd warned regional currencies could be vulnerable to further losses, with policymakers having little wiggle room to act. Stimulus from China wasn’t also enough to quench concerns.

EURDKK

The pair hit a resistance line in recent trading and now trades in the red, weakening below the 50-day moving average but hovering above the 200-day MA line. The euro is buoyed by the Eurostat data last Friday showing the annual rate of inflation in the eurozone standing at 1.4% in January 2020, higher when compared to the 1.3% figure last December. However, the slight uptick in inflation still wasn’t enough to meet the European Central Bank’s goal, which is closer to 2%. The lowest annual rates were in Italy, Cyprus, Denmark, and Portugal. Highest annual rates were in Hungary, Romania, Czechia, and Poland. European Union leaders were trying to break the deadlock in discussions over the bloc’s next seven-year budget. Last Friday, the EU Commission submitted a proposal on adjustments that would mean an overall spending of 1.069% of the bloc’s gross national income.

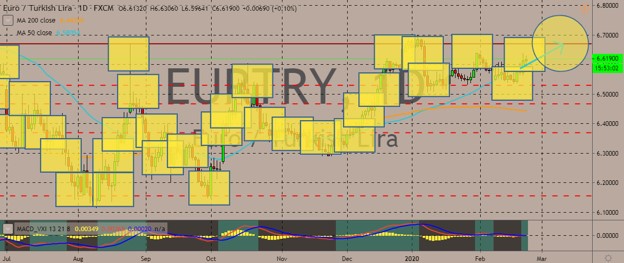

EURTRY

The euro is trading higher against the Turkish lira, rising above the 50-day moving average of the pair. The Turkish lira, along with Turkish bonds, declined on Friday amid the heightened conflict in neighboring Syrias that is unsettling investors. The markets have also been hit by global flight to safe-haven assets as a response to coronavirus worries. Syria concerns escalated after Turkish forces and Syrian rebels fought government troops in northwest Syria on Thursday. Russian warplanes hit back and escalated the fighting. The lira was also affected by the fears of the spread of the Covid-19 virus, which sent funds towards US assets and pushed the greenback to record highs. According to experts, the global risk appetite and the developments in Syria will be in focus. The currency remains fragile after the 2018 currency crisis in Turkey that saw the currency’s value halved. US sanctions also still loom over Ankara’s acquisition last year of S-400 Russian missiles.

COMMENTS