Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

EURBRL

The pair has been trading bullishly in the previous sessions, although it now trades in the red, pulling back from its recent highs. Still, the 50-day moving average appears poised to go further up the 200-day moving average. This indicates more bullish momentum for the euro in the short-term. For fundamentals, Brazilian inflation slowed in February to its lowest for that particular month in more than a quarter of a century, according to a mid-month gauge of consumer price recently released. This data suggests very little price pressure in the economy. Over in the EU, finance officials are still struggling to see eye-to-eye. Prominent Brexiteer Duncan Smith accused the EU financial regulations of misrepresenting risk levels of eurozone debt, suggesting the UK played a crucial role in “mitigating” against flaws at the heart of the bloc’s banking system. He said efforts forcing UK financial institutions to follow EU rules would be bad for the eurozone.

GBPBRL

The British pound is slowly stacking up gains again versus the Brazilian real in recent trading. The moving averages still lie below the prices, indicating generally bullish sentiment for the pair. Positive vibes are welcome for the British pound amid the ongoing fears over the impact of the coronavirus outbreak on the global economy, suggesting the royal currency stays immune to sentiment over the virus. In fact, evidence to its immunity is the pound’s movement’s reliance on the EU-UK trade negotiations’ progress. Of course, any negative news about the talks and its possible failure will open the door for significant downsides, so it’s a hot subject now for British pound traders. Downside moves could be similar to those seen in 2019 when markets became jittery over the prospects of a no-deal Brexit. Officials from both the UK and the EU will meet this week to set the mandate and stance of each regarding the negotiations.

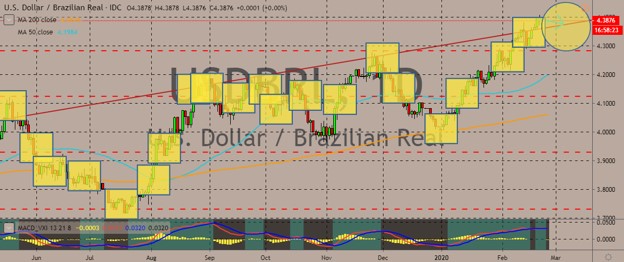

USDBRL

The US dollar weakened slightly against the Brazilian real today, although it trades near record highs against the emerging market currency. Prices trade way higher than the 50- and 200-day moving averages, suggesting the dollar might recover quickly should it continue to fall in the short-term. Reason to the dollar’s weakness is the growing expectations the US Federal Reserve would cut key interest rates this year to relieve pressure on the economy because of the Chinese coronavirus outbreak. Last week, the dollar was a superstar among currencies, rising as investors sought safe-haven refuge amid the virus crisis. Now, there could be some downsides to the dollar as rate cut expectations build, forcing the dollar to give up its gains. As for the US and Brazil, the US Department of Agriculture and Food Safety and Inspection Services re-opened the US to Brazilian beef after a 20-month suspension. Such development could prop up the BRL.

USDRON

The dollar is gaining against the Romanian leu again after recently pausing in its rally. Sentiment remains largely bullish for the dollar against the eastern European currency as evident on the moving averages. The Romanian leu is currently suffering from intense political disturbance amid the uncertainty in the aftermath of the Ludovic Orban government downfall. On Monday, the country’s Constitutional Court rules that President Klaus Iohannis should nominate a candidate for prime minister to win the support of the parliamentary majority. Earlier in February, the opposition Social Democrat Party (PSD) challenged the president’s nomination of Orban, the leader of the National Liberal Party (PNL), for prime minister designate before the top court. Orban had to form a transitional government on February 6 but instead deliberately seek rejection to give way to an early election, which the PNL hopes to win as they are ahead of the PSD in opinion polls.

COMMENTS