Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

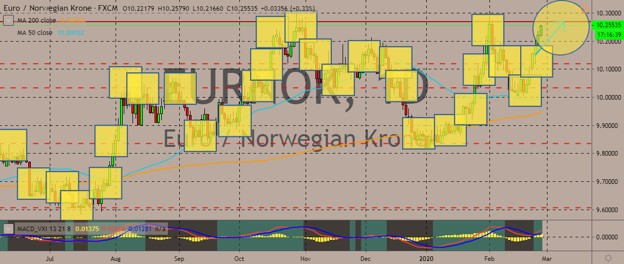

EURNOK

The pair is climbing steeply, stacking up gains as the 50-day and 200-day moving averages indicate bullishness for the euro and bearishness for the Norwegian krone. The krone is currently slated as the worst performing currency in the fx market. As if evidence to this is the NOK’s failure to rise against the euro despite the strong Norwegian data. Instead, the anxiety over the global spread of the coronavirus Covid-19 are growing, and oil prices are being affected. The Norwegian krone is a currency often linked to oil prices. Therefore, oil price weakness is leading to huge NOK losses. There has been a slight oil price recovery yesterday, but that was not enough to boost the Norwegian krone. Overall, the outlook for Norway’s currency is dim amid the coronavirus worries. The lack of a significantly strong domestic news is also not helping. Meanwhile, Norwegian unemployment improved from 4.0% to 3.9%.

EURHUF

The euro’s gains against the Hungarian forint is slowly diminishing, with the pair pulling back from recent highs. The forint is stacking up some gains against the euro after the Hungarian central bank decided to hold rates and pledged to act, if necessary, to control inflation. It said it would use its tools to reach its inflation target if a long-lasting change in outlook necessitates policy action. After it hawkish message following a higher-than-expected January inflation, which ran above the top of the 2% to 4% target at 4.7%, the bank said it would monitor new economic data next month during its quarterly inflation report. The combination of a suddenly high inflation and the weakness in the Hungarian forint, which plummeted to record lows, compelled the bank earlier in the month to say it would use all tools at its disposal to combat the high inflation. The comment pulled Budapest interbank rates higher and stabilized the currency.

EURRUB

The euro is gaining against the Russian ruble, with apparently so solid resistance in the short term. However, the 200-day and 50-day moving averages still indicate that traders’ sentiment are bearish for the pair. The Russian central bank earlier in the month lowered its key interest rate to 6.00% on Friday, saying it may switch to a loose monetary policy stance later in the year as inflation was slowing down faster than expected. The rate cut met most expectations from the bank, but some analysts expected the central bank to leave rates unchanged amid the volatility in the global market. As for the coronavirus fiasco, the US just accused Russia of spreading disinformation, which promotes unfounded conspiracy theories and alarm behind the new coronavirus outbreak, trying to dent the image of the US around the world. State department officials responsible for fighting disinformation said false personas were on social media to advance Russian talking points.

EURPLN

The euro is also making huge gains against the Polish zloty in recent sessions, with the price rising above the 200-day moving average after briefly trading below the lower 50-day moving average. Poland and the EU are locked in a budget spat, where Warsaw wants the new EU budget to be larger than the previous one. The EU budget negotiations have been stalled at the end of last week, and it has since revealed rifts between countries in the North and South of the now 27-member bloc and between the East and the West. The Frugal Friends, composed of the Netherlands, Austria, Sweden, and Denmark, want to lower the new budget to 1.00% of the gross national income, while Polish Prime Minister Mateusz Morawiecki wants the EU budget to be increased to 1.3% from 1.16%. German Chancellor Angela Merkel said Germany was prepared to accept more but said European Council President Charles Michel’s 1.074% compromise was too high.

COMMENTS