Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

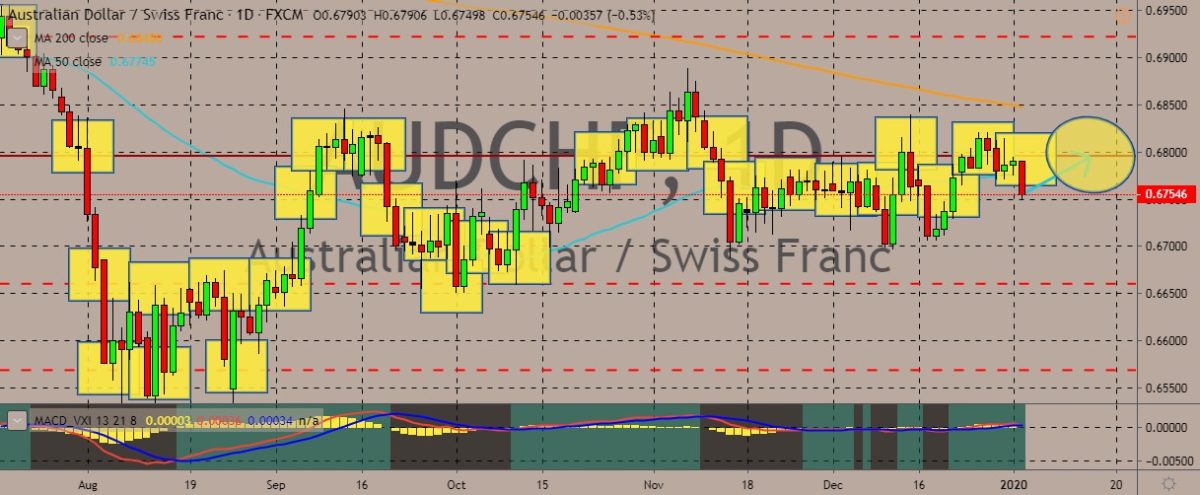

AUDCHF

The AUDCHF currency pair is still chopping sideways, kicking off 2020 with a rather tight start as both the Australian dollar and Swiss franc gain strength from a plethora of factors. Over in Australia, the Aussie managed to get a boost by the year-end, erasing much of its losses and positioning itself to enter 2020 off a good start. It has benefitted in the past weeks from positive economic data, including the November jobs report that saw lower unemployment rate and the creation of more than 30,000 new jobs for the month. This data came in with other positive releases and diminished the expectations of a February rate cut from the Reserve Bank of Australia. Investors have been hoping the rate cut wouldn’t happen since it would mean the currency would lose strength while attempting to give its economy a boost. So far, the Australian central bank hasn’t indicated it would surely implement a rate cut.

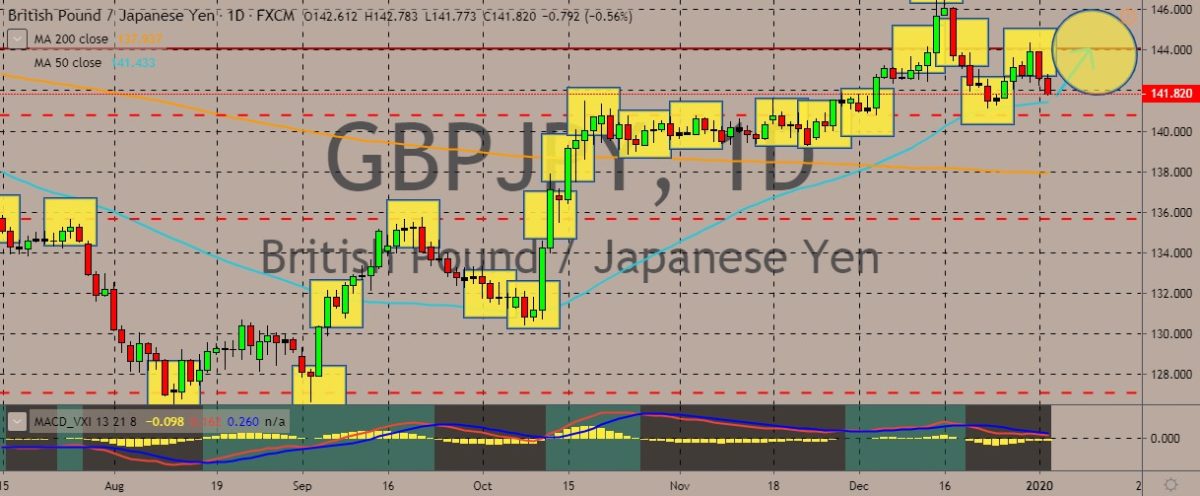

GBPJPY

The pair has been kind of bearish in the previous days toward the new year, dropping from its December 16 highs and then bouncing back from the 50-day moving average just to pull back down again near that MA. This can be attributed to some amount of risk-off sentiment with the pair as 2020 kicks into gear. However, the start of a new year generally means traders will be putting some long-term positions, and the British pound will surely be among those currencies that will have much volume in terms of these positions. In other words, the royal currency against the safe-haven Japanese yen may continue surging upwards, keeping the uptrend intact, as the controversial UK departure from the European Union continues to be worked out, with its future becoming clearer. The current flexi-deadline of the Brexit deal is on or any time before January 31. An extension of the transition period is also being considered.

CADJPY

The pair has been trading near record highs, although it has been chopping sideways in the transition to 2020, indicating traders are measuring their bets between the two currencies. It may even be said that the bullish momentum is getting exhausted, opening the way for a breakdown in the near future. This may likely be due to profit-taking on the Canadian side, with the Japanese yen still being the top safe-haven currency and as traders enter into a possible risk-off period. The Canadian dollar has been crowned as the best performing currency for 2019, generally outperforming most other peers through the year. Meanwhile, in Japan, a recent survey showed that businesses are getting more pessimistic about the economy because of the prolonged US-China trade war as well as last year’s consumption tax hike. Considering that, it is quite likely that this pair will take a bit of time to establish a proper, more sustainable trend.

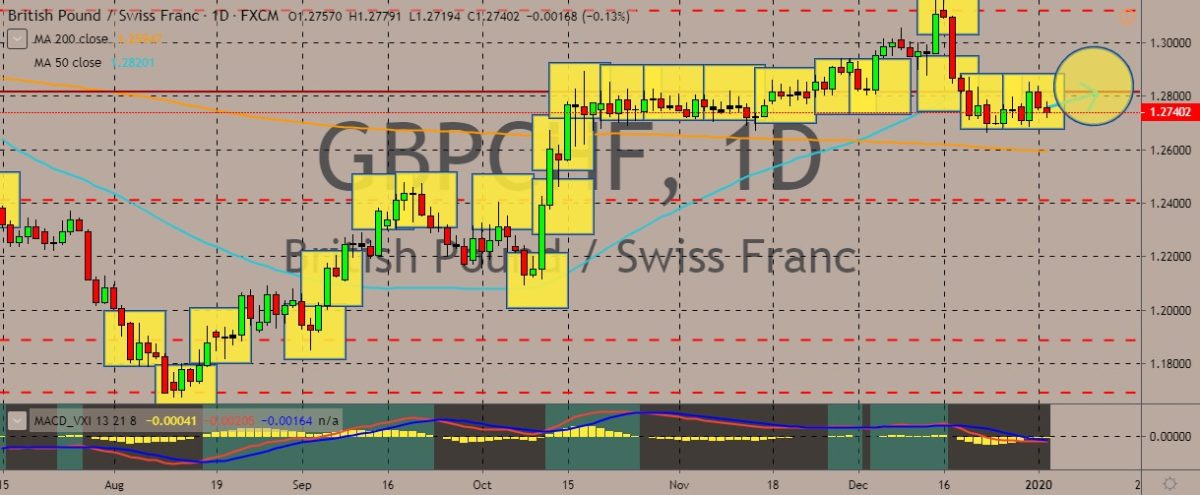

GBPCHF

The pair has been trading sideways with minimal trading volume in the past few days, having fallen from December 13 highs and slipping below the 50-day moving average. The price now struggles to break above that moving average as trades go by, effectively coming back to its range established in mid-October. With a looming threat of a technical downtrend, however, the British pound could further lose more to the Swiss franc. One common explanation in the market about the pound weakness is the fears of a no-deal Brexit between the UK and EU. However, this is not new information. Another side to look upon is the strength in the Swiss franc that has started since December, with the Swiss currency benefitting from investor expectations of extended low inflation. In December, the Swiss central bank maintained its loose monetary policy, but reiterated that it was willing to intervene if the franc remains highly valued.

COMMENTS