Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

USDTRY

The uptrend for the pair is still intact despite the sudden pullback on December 26, and although it appears that gains will be limited for the time being, the upward trajectory seems to retain its strength. The US is still embroiled in heightened tensions versus Iran following last week’s assassination via airstrike of Iranian General Qasem Soleimani. Latest developments suggested that Iranian authorities have put a bounty on US President Donald Trump’s head amounting to $80 million. Meanwhile, from Turkey, President Recep Tayyip Erdogan said the death of Soleimani in a US drone strike raised the tensions, and the two sides should keep cool heads regarding the matter. Ankara has boosted its diplomatic contacts in the region. Erdogan added that Russian President Vladimir Putin would go to Turkey this week to discuss the matter. Russian state media previously claimed Erdogan “felt sorry” for the assassination, which Turkey denied.

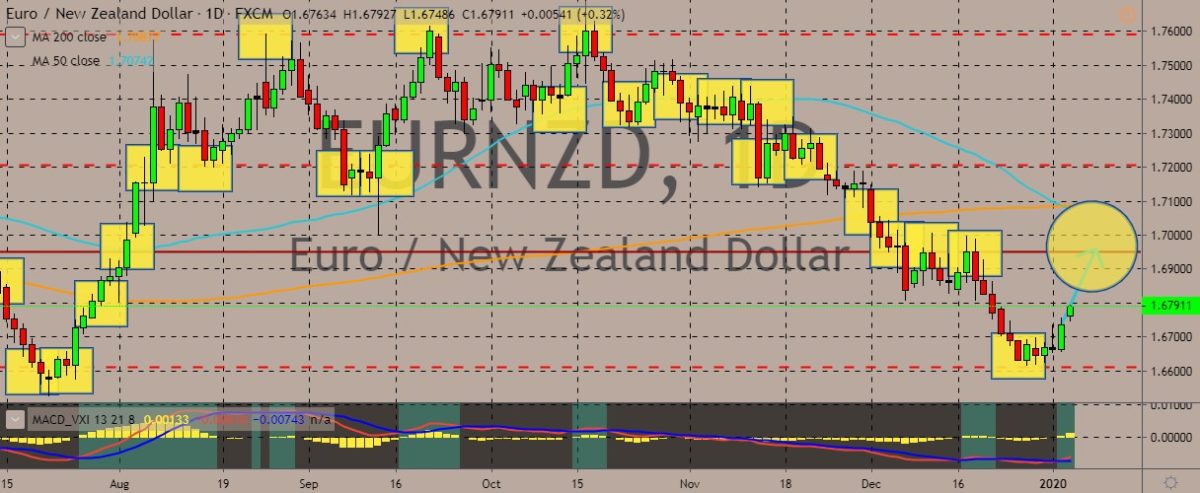

EURNZD

The pair appears to be retracing its previous downward steps in recent sessions, although downward pressure is still present after the confirmation of the death cross recently, in which the 50-day moving average crossed below its 200-day counterpart. Europe is also involved in geopolitics, as evident in the bond sales. Portugal, Belgium, and Ireland are expected to issue debt with 10 to 15 years of maturity at syndicated sales, according to Danske Bank A/S. regular auction are due from Germany, Spain, France, and Austria, ending several months of sagging prices and bringing global bonds back in demand as investors seek safe-haven assets after the US drone strike that killed the high-profile Iranian general. Also, the rising tensions between Washington and Tehran are also pressuring Europe to pick a side while Sunday saw Iran saying it would abandon its limits under the 2015 nuclear deal it had with Europe and the US.

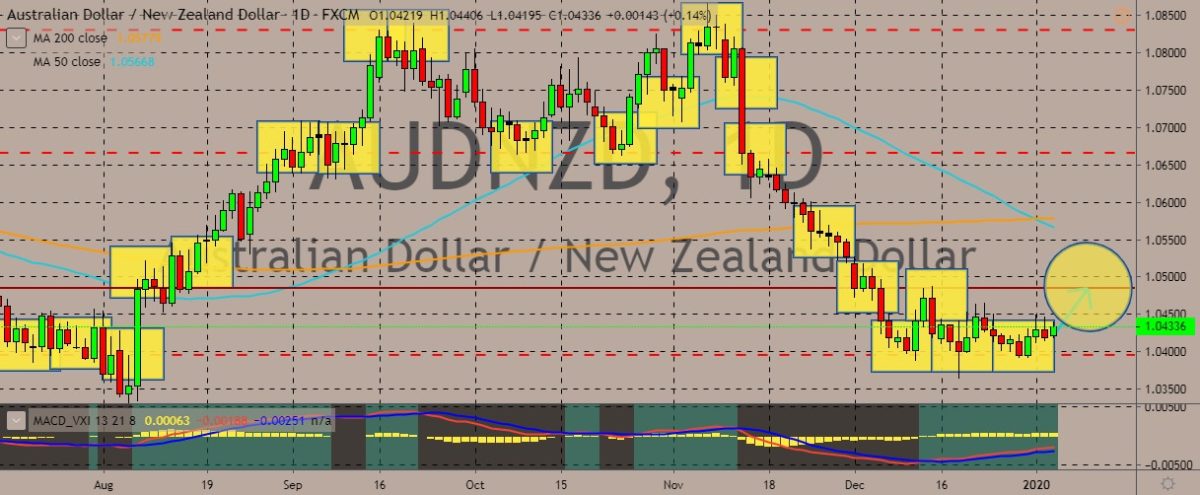

AUDNZD

Price action for the AUDNZD pair has been tight and within ranges, as the two sides struggle to get the upper hand while domestic and outside factors continue to weigh down each currency. The New Zealand dollar weakened after investors favoured less risky assets amid the rising tensions in the Middle East. Meanwhile, Australia’s on fire, quite literally. Its economy has suffered from natural disasters, threatening with the raging bushfires ravaging New South Wales and Victoria. The disaster is expected to break consumer confidence amid household’s reluctance to spend because of the sluggish wage growth. The fires also coincided with the peak of the Christmas shopping and tourist seasons. Both the antipodean currencies are reliant on free trade, meanwhile, meaning they weaken at this time of geopolitical conflict. The Aussie could, however, draw some support from gains in gold and oil prices since it’s a major exporter of gold and natural gas.

EURBRL

The pair is trading within tight ranges, although the euro appears to be slowly getting the upper hand, rising near the 50-day moving average and hovering above the 200-day counterpart. Over in Brazil, the government and private-sector economists are positive that the Brazilian economy would grow above 2%, moving on from the near-stagnation status after it emerged from a 2014-2016 recession. However, this is the third consecutive year they have been saying this, with the touted boost being dampened in the last two years by issues like delay in tax reforms, uncertainties about the Bolsonaro administration, and the Argentine crisis. The slowdown in the world economy also contributed. These same factors will also threaten the recovery this year. However, the assessment says the risks are much smaller, with incentives for economic recovery becoming better. The year 2020, according to analysts, could be the year Brazil’s economy would take off.

COMMENTS