Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

USDSEK

The pair appears to have failed again in its attempt to go up, with the bears taking the price lower again after recently losing against the bulls due to the heightened tensions between the US and Iran, which boosted the safe-haven appeal of the greenback. Over in Sweden, Riksbank Governor Stefan Ingves said that the central bank would more likely favour an expansion of the balance sheet if the economy deteriorates. The Riksbank ended five years of negative interest rates on December 19, when it increased the benchmark borrowing costs by a quarter point and put it to zero. Among the central banks who implement negative rates, it was the first to ditch such setup. Analysts have questioned the hike as the economy has been slowing and inflation is also expected to remain under the target of 2%. However, minutes suggested that policymakers were concerned about the possible side effects of the prolonged negative interest rates.

USDZAR

The pair is trading near multi-month lows after failing to maintain its upside momentum. The dollar previously benefitted from investors seeking safety amid tense situation in the Middle East. However, with the de-escalation of the conflict comes the weakening of the safe-haven dollar against South African rand. It is largely uncertain what effects the tensions between the US and Iran will have on the global economy, although some scenarios are possible. For one, South African raw materials could see prices going up if the tensions further escalate, as oil prices will likely go through the roof. Another scenario is that precious metal prices will likely rise, offsetting the negative impact of higher costs in oil imports. What’s certain is that if the outlook remains unclear, the rand as well as the economy will have to face volatility. There is, however, still some support for financial markets, with risk appetite for higher-yielding emerging markets higher.

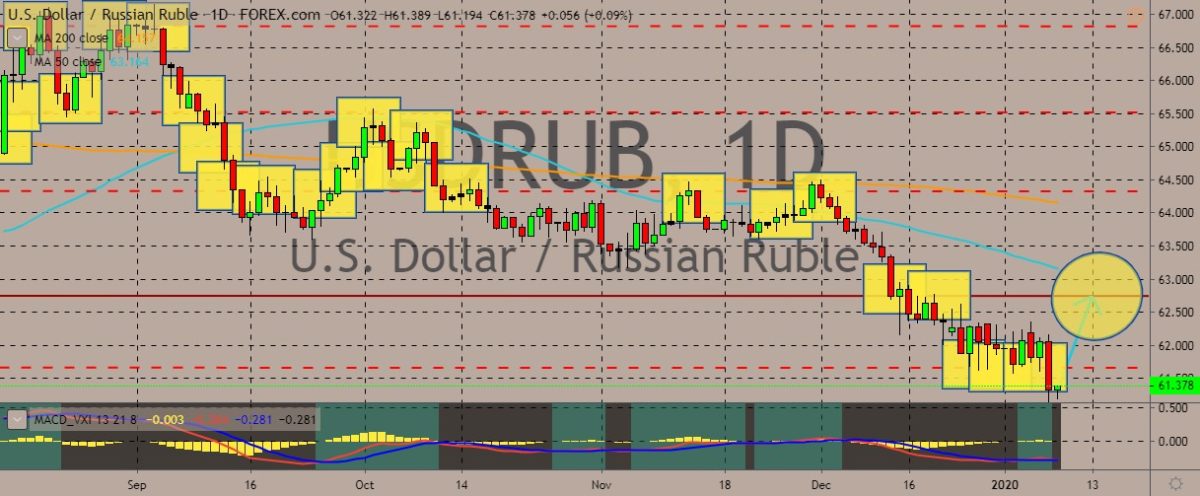

USDRUB

The downtrend and strengthening of the Russian ruble appears to have been exhausted, as dollar traders managed to slow down the gains of the Russian currency amid recent events in the Middle East. However, the dollar still finds it difficult to find a strong upside footing. For geopolitics, Russian President Vladimir Putin has met with Syrian President Bashar al-Assad as the prospect of war loomed over the region. US troops are stationed in Syria, making it a potential site of conflict with Iran. Putin has been busy amid the tensions, visiting various cities in the region. Also, he was the first leaders that French President Emmanuel Macron spoke with after the drone strike that killed a top Iranian general. German Chancellor Angela Merkel will also travel to kremlin to discuss the crisis in the Middle East. As the US strategic approach to the region remains unclear, but it appears that Russia is ready to fill any power vacuum that may appear.

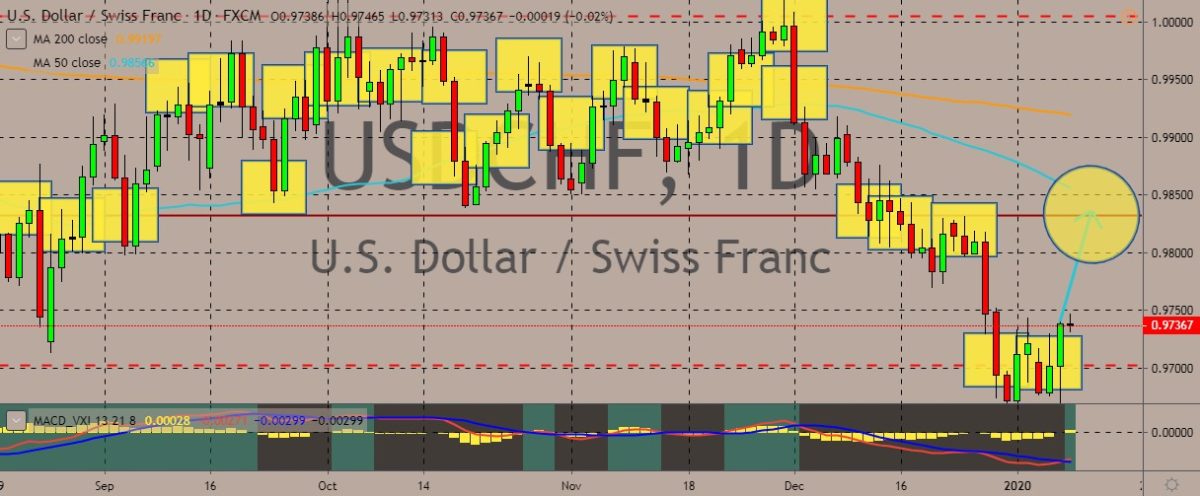

USDCHF

Unlike against other currencies, the dollar managed to retain its bullish momentum against the Swiss franc, still trading in the green. The price advanced to a five-day high with no key solid resistance in sight, indicating it could continue going up if conditions allow. This comes as US President Donald Trump confirmed that there were zero casualty in Iran’s missile strikes. Trump also noted that the Middle Eastern country was “standing down.” As a result, more traditional safe-haven currencies such as the Swiss franc didn’t have a lot of hold on trader demands. Meanwhile, the ADP Employment Change in the US came in at 202,000 in December to beat the market expectation of 160,000, supporting the buck’s rally. Over in Switzerland, real retail sales and foreign currency reserves data will be coming out in the Swiss economic market. Weekly jobless claims are also in focus of the US traders.

COMMENTS