Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

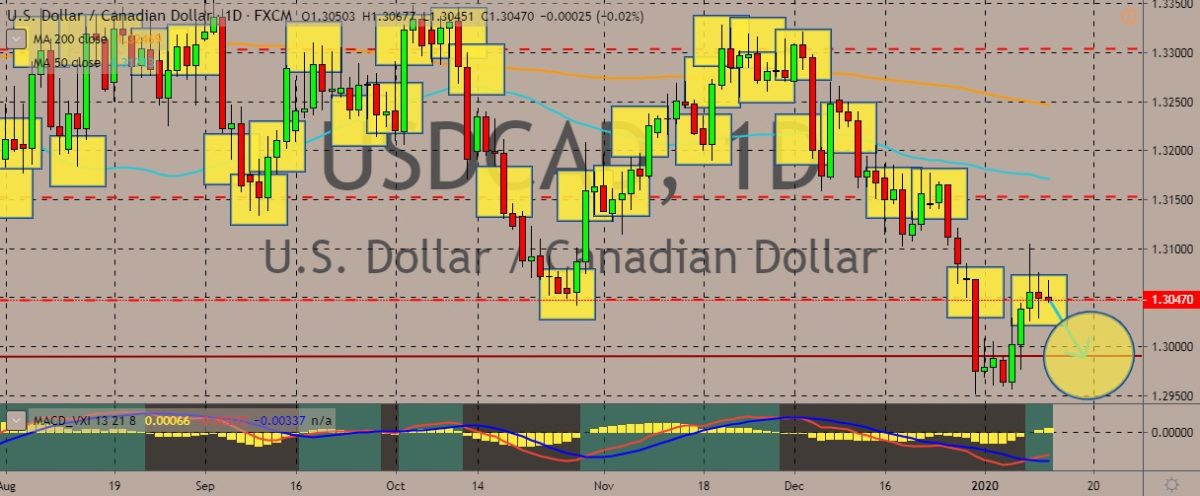

USDCAD

The pair has been trading in the red in the previous two sessions but still near the two-month highs that it recently recorded. The potential downside risks from the global trade conflicts appear to have eased, even though there is still large uncertainty around the implications of such for Canada’s economy. According to Bank of Canada Governor Stephen Poloz said that these temporary factors have hurt Canada’s economy. Poloz said that there was still a lot of uncertainties revolving around what the US-China deal could mean for Canadian exports. Also, Poloz said that the Canadian central bank will be watching the data to see if a recent slowdown in job creation would persist. Last month, data showed that the economy shed more than 70,000 positions in November. The December employment report is due this Friday. Poloz further told reporters that the fourth quarter last year had seen some unusual weather and strikes.

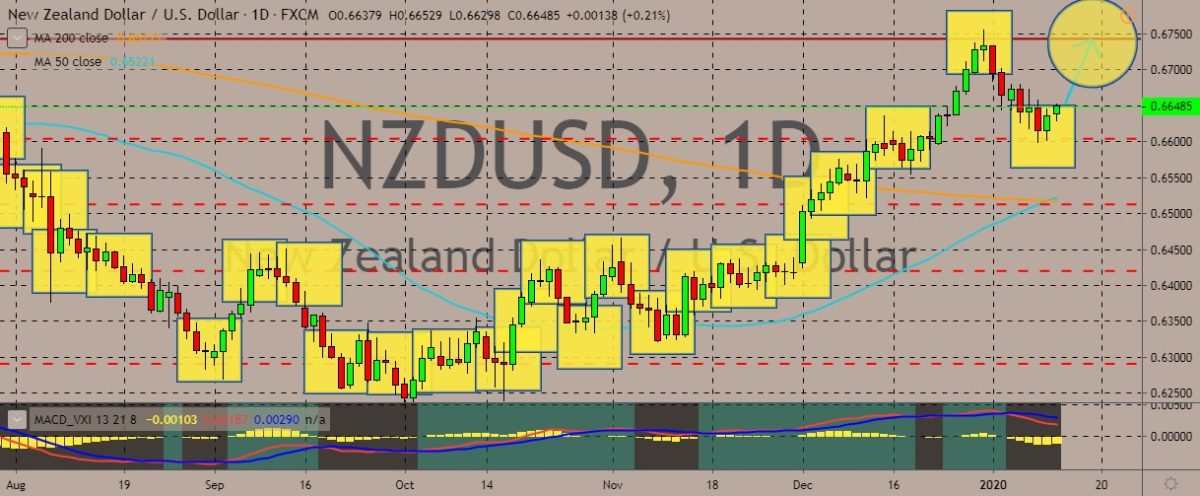

NZDUSD

The pair has slipped from record highs, trekking down to July 2019 levels. However, the 50-day moving average crossed above the 200-day moving average, confirming the golden cross and establishing the prevailing bullish sentiment for the pair. The New Zealand dollar has performed robustly against the US dollar, which has weakened after the release of the latest US non-farm payrolls report. The outcome was largely disappointing because even though the unemployment rate held steady in December, the US gained fewer jobs than the market expected. The broad decline in the dollar strength likely contributed to the upward moves by the New Zealand dollar. For figures, the US NFP report was at 145,000, lower than the expected 164,000. The NZDUSD pair is also benefitting from the optimism surrounding the US-China trade negotiations. The Chinese negotiation team will arrive at Washington on January 15 to sign an interim agreement.

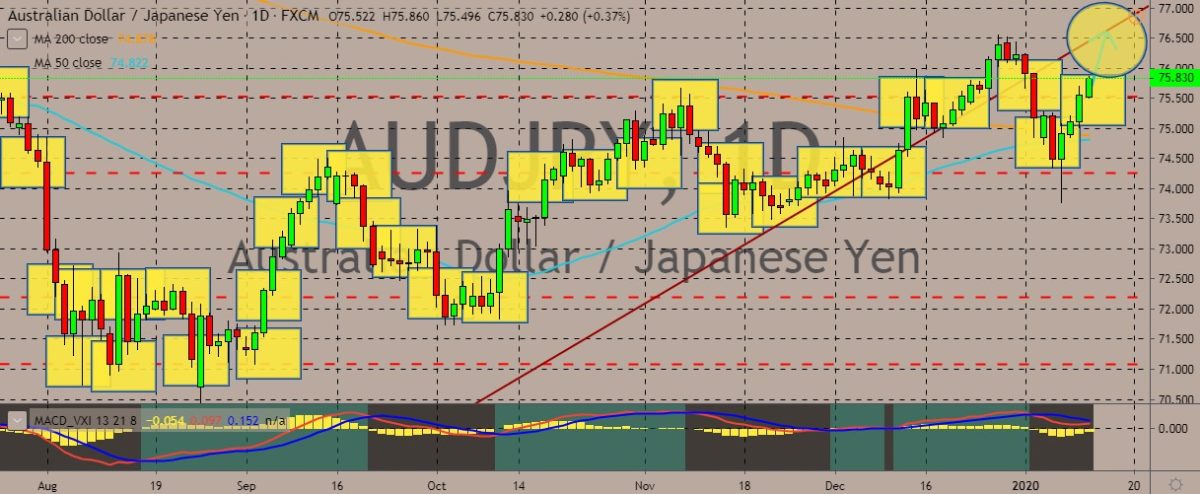

AUDJPY

The Australian dollar rallied in recent sessions amid the optimistic outlook for the US-China trade deal. Australia is among China’s biggest trading partners, so good outcome for China in said trade war is also seen as good result for Australia. However, the gains could soon be limited if one considers the still-raging bushfires that has been ravaging the “Lucky Country” for an extended period. Investors are getting increasingly wary that the unprecedented bushfires could damage the country’s economy. The damages are expected to run to billions, and analysts are predicting that consumer sentiment, retail spending, and tourism will take some damage. These sectors account for more than 3% of the economy. The wildfires’ effects have also been felt in the country’s slowing tourism and other key sectors. Killing more than two dozen people and more than a billion animals, fires have destroyed more than 1,800 houses and an untold number of buildings.

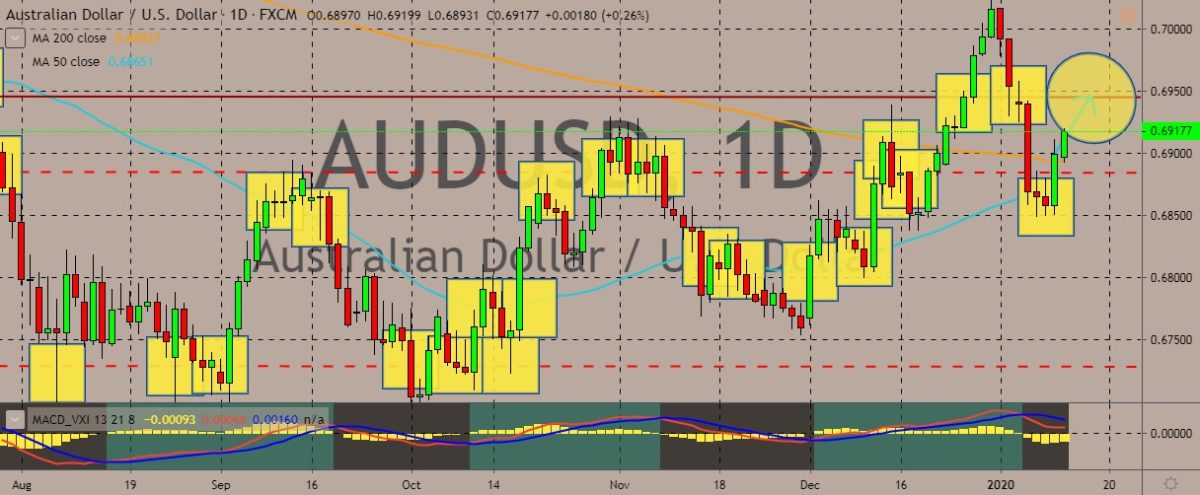

AUDUSD

The pair climbed higher than the 200-day moving average, indicating bullish sentiment prevailing at least in the short-term. Also, steep gains have been recorded in the last couple of sessions. The bullish potential, however, remains capped despite the optimism. Contributing to the upside is the weaker-than-expected non-farm payrolls data from the US coinciding with the multi-month high retail sales for November in Australia. Australia’s retail sales crossed a 0.4% positive forecast to 0.95. Meanwhile, in the US, the average hourly earnings slipped to 2.9% from 3.1% forecast and previous. Elsewhere, the risk-on sentiment is probably boosted now that the US-Iran war is likely already averted, since neither the US nor Iran took any major actions in recent days. However, Tehran reportedly arrested UK ambassador to Tehran, gaining the ire of the UK and the EU leaders, mainly from Germany and France.

COMMENTS