Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

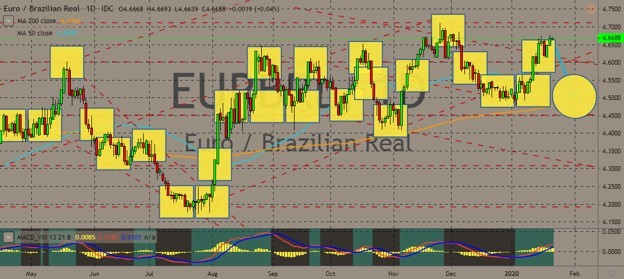

EURBRL

The pair will experience a pullback in coming sessions toward its 200 MA. Last week’s report for Brazilian Foreign Exchange Flows showed the real currency recovering from the recent outflow of foreign cash. This was amid the economic uncertainty surrounding the global market. The inflow of foreign investment last week marks the signing of the US-China phase one trade deal. Net capital inflows reached $1.11 billion, a huge improvement from the -$9.49 billion on the second week of January. The figure also represents the biggest positive report since the second half of 2019. Furthermore, Brazil’s employment record maintains its figure for the month of December. Analysts are anticipating an improvement in the data following the phase one deal. On the other hand, analysts are anticipating France Business Survey to plummet in today’s report, marking its return below the 100-points level.

USDBRL

The pair will fail to breakout from a major resistance line and move lower below 50 MA. Brazil’s economy is likely to pick up in 2020 with an estimate percentage growth of 2.1%. The figure was double the projected growth for the year 2019. A strong consumer spending will lead the growth, coupled with the boost of privatizations in Brazil. Furthermore, the US backed the country’s candidacy for the OECD (Organisation for Economic Co-operation and Development) membership. Brazil’s planned 5G rollout will also make the country attractive to foreign investments. This was amid the US-China tension regarding the use of Huawei technologies. America accused the company of spying for the communist party. In 2019, Brazil also reap the benefits of the US-China trade war. This was after the PRC (People’s Republic of China) imported a total of 80% of the country’s soybean imports from Brazil.

USDRON

The pair will continue to move higher after it broke out from a resistance line and from 50 MA. The United States has been militarizing the eastern bloc following the fallout of the US-Turkey relations. The US and Russia also pulled out from the 1987 INF (Intermediate-range Nuclear Forces) treaty in 2019. This increases the possibility of Europe becoming a battleground for the US and Russia once again. In line with this, America had already deployed troops in Romania and installed THAAD (Terminal High Altitude Area Defense). The country was also a recipient of the US-made F-35 fighter jets after the widening gap in the relationship between the US and Turkey. In addition, Lockheed Martin, a US company, is planning to develop artificial intelligence (AI) projects in Romania. The militarization of the eastern bloc will boost the demand for the US dollar. The THAAD cost $3 billion while the F-35 will cost $1.5 trillion over its 55-year life span.

EURNOK

The pair will have a pullback movement in coming sessions as the crossover between MAs 50 and 200 looms. Norway derived its $1 trillion sovereign wealth fund from the country’s oil production. With the European Union moving towards a greener economy, however, the bloc’s relationship with Norway might put to and end. Despite this, people managing the wealth fund are optimistic about the fund’s future. On October 2019, the SWF reached its highest record of 10 trillion Norwegian crowns or 1.11 trillion US dollar. The fund also said it is moving away from the European Union as the global economic slowdown creeps on the EU’s largest economy, Germany. The fund which owns 1.5% of global stocks also announced that it will be moving some of its investment from Europe to Asia and the Americas. Moreover, Norway is leaning towards the United States for help of raising its claim to the Arctic region.

COMMENTS