Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

AUDJPY

The pair has risen back from record lows this week, trading with some positivity for the Australian dollar. Moving averages, though, indicate the sentiment for the pair is still largely negative. Recent data suggested some good news for the Australian economy. However, the AUDJPY pair showed limited reaction due to the prevailing market risk-reset attitude. Over in Japan, Bank of Japan Governor Haruhiko Kuroda said the COVID-19 outbreak could cause serious damage on the economy, highlighting the central bank’s preparedness to take “appropriate action” to support the country’s fragile recovery. Previously, the Japanese economy expected to recover in the current quarter, only to see the outbreak hurt exports and consumption through diminishing Chinese tourists, according to Kuroda. He added the epidemic could also affect production if it goes on for too long, saying consumer sentiment is already being hurt by the health crisis.

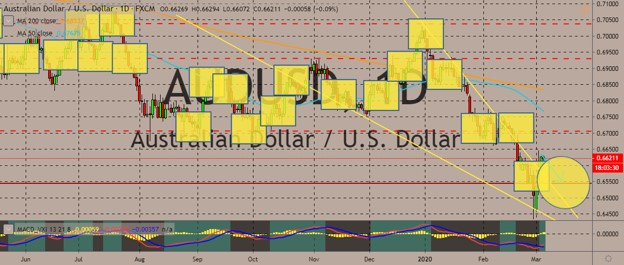

AUDUSD

The Australian dollar has also bounced back from record lows against the dollar, recovering from multi-year lows. It has also held onto its gains previously, although now the price is trading in the red. It is not a far-fetched assumption that sellers will be taking control once more after the reprieve. Meanwhile, the dollar has also bounced back against other major peers, recouping losses made in the immediate aftermath of the US Federal Reserve’s emergency rate adjustment. Data that showed acceleration in growth across US services and private employment data also boosted confidence in the underlying economy strength of the US in spite of the negative impacts of the coronavirus. As for coronavirus concerns, the US announced nearly $8 billion emergency spending bill as well as alterations to bank capital reserve requirements. The US Fed member James Bullard’s latest comments turned down call of any further cuts this month favoured the risk-tone.

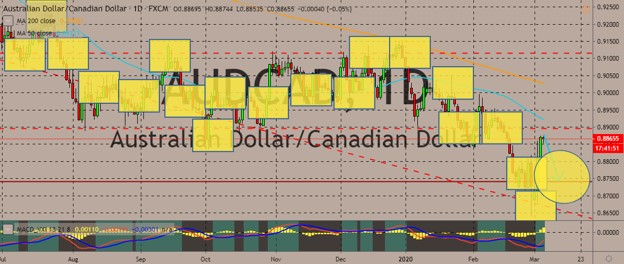

AUDCAD

The Australian dollar strengthened against the Canadian dollar in recent sessions, similarly, bouncing back from lows. The Canadian dollar weakened after the Bank of Canada imposed it highest interest rate cut in more than 10 years. It also indicated it was prepared to ease further because of the coronavirus outbreak. The BOC essentially matched the US Fed’s 50-basis-point cut during the previous day. According to the central bank, the virus outbreak was “a material negative shock” to the Canadian and worldwide outlooks as it slashed its benchmark interest rate to 1.25% from 1.75%. This instance is the first time since March 2009 it had cut by more than 25 basis points. Finance Minister Bill Morneau said the country was ready to act quickly to help companies suffering financially due to the outbreak of the new coronavirus. He added it would not need to wait for the next budget.

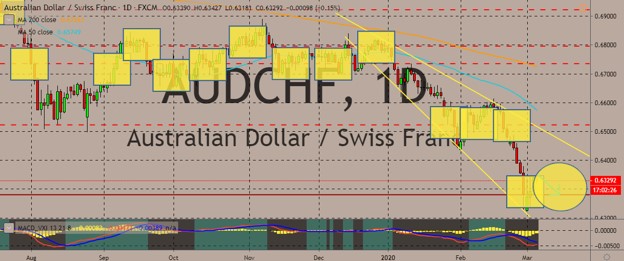

AUDCHF

Just like its performance against its peers above, the Australian dollar recovered some ground against the Swiss franc, which has been pummelling the Aussie for most of February. China’s sharp contraction in economic activity over the past month because of the coronavirus epidemic is sending jitters around the world, with Switzerland one of the countries mostly affected by the Chinese supply disruptions, according to a recent United Nations report. Switzerland is one of those economies that rely heavily on Chinese parts and components to manufacture cars, cell phones, and other products. The number of coronavirus cases worldwide has increased above 94,000. The death toll has also exceeded 3,200, with most of the fatalities occurring in China. But the fall in industrial activity had other effects, including the dramatic decline in pollution in China that is “partly related” to an economic slowdown because of the coronavirus.

COMMENTS