Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

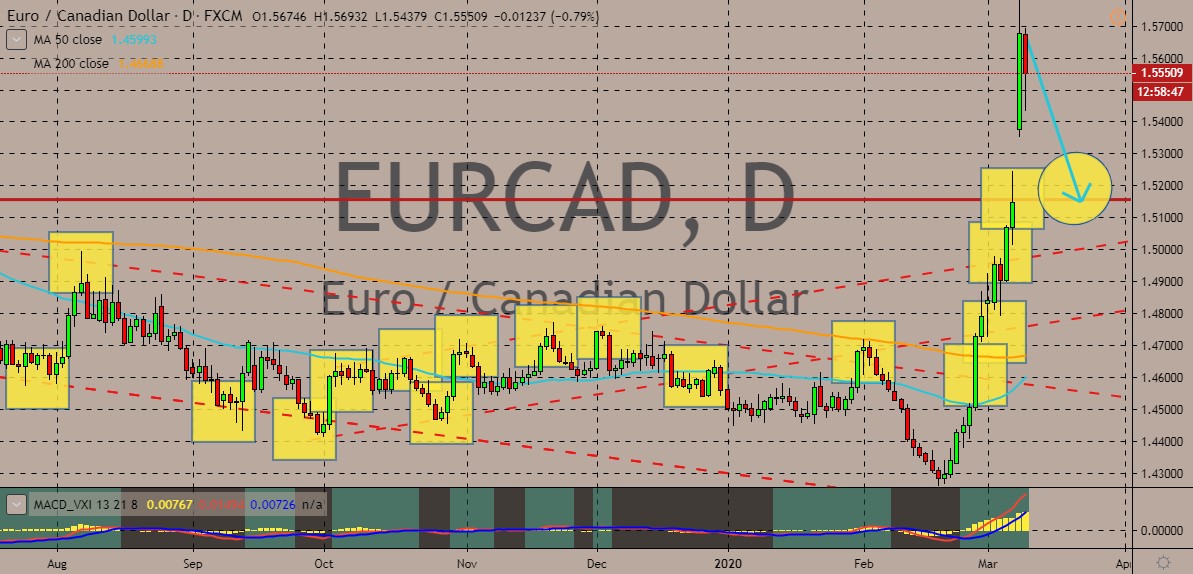

EURCAD

The Canadian dollar is looking to recover some of its major losses against the single currency. EURCAD bears are looking to take advantage of the concerns about the coronavirus spreading in Europe. The pair is currently trading above the 200-day moving average and despite bulls appearing to make their way to control the pair, concerns of investors are still pressuring the pair. The Canadian dollar’s rebound appears to be supported by the data that was reported from the Canadian economy. Despite falling, the results from the February housing starts and January building permits turned out better than expected, giving the Canadian loonie a sigh of relief. Bulls are considering moving cautiously, keeping in mind the possible economic fallout brought by the virus. However, considering expectations about another possible rate cut from the US Fed, its unknown whether the EURCAD will break its support.

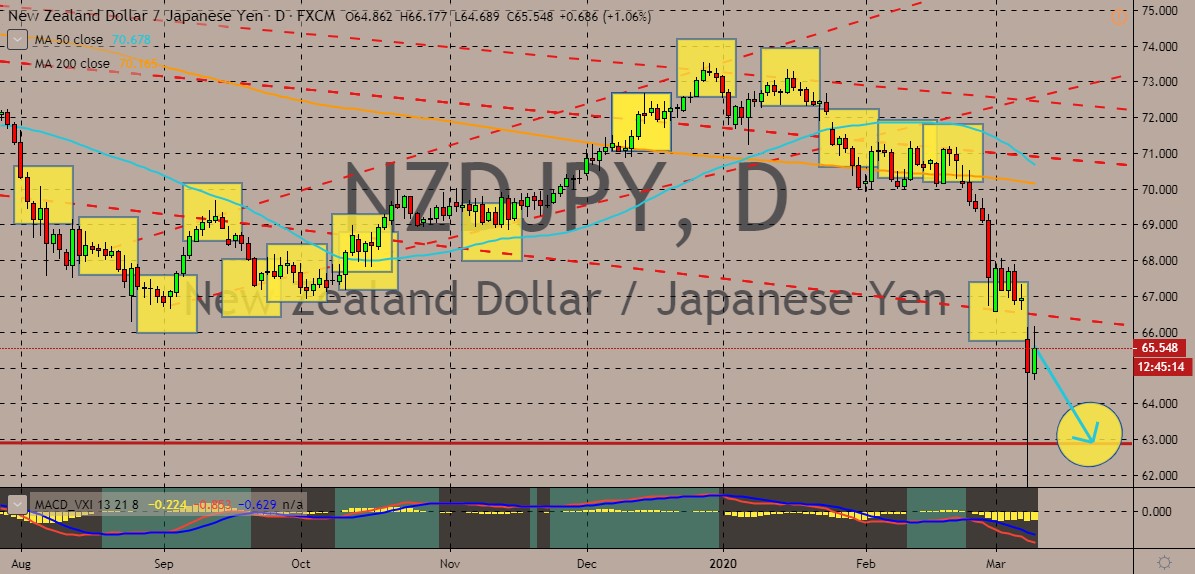

NZDJPY

Despite the rebound of the New Zealand dollar in trading sessions, NZDJPY bulls are still underperforming. The safe-haven appeal of the Japanese yen is sealing the fate of the pair – a downward run. The 50-day moving average is in for a dip as the number of cases continues to rise. Looking at it, bullish sentiment surrounds the pair considering that the 200-day MA is below the 50-day MA. However, bulls are expected to sink further in the foreign exchange scene and the improvements reported from the economic activity of New Zealand are becoming futile. Traders are scrambling to safe-haven assets as the death toll surges. And the recent collapse of oil prices has strained the strength of the New Zealand dollar, draining its fuel tank. Last week, Russia and the members of OPEC failed to reach a consensus, causing oil-sensitive assets such as the New Zealand dollar to weaken in sessions.

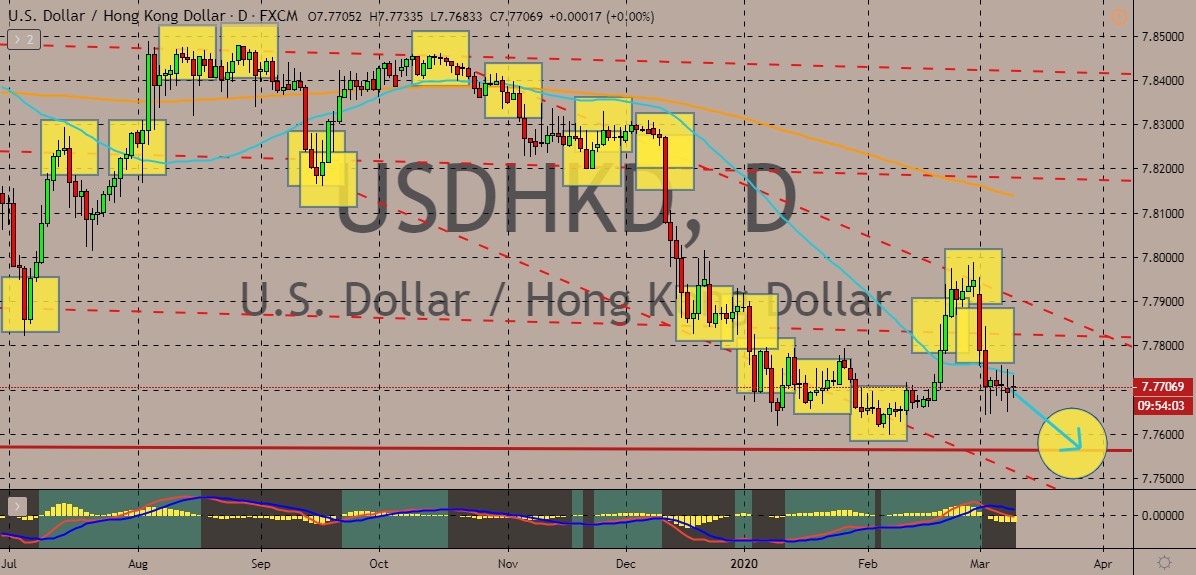

USDHKD

Speculations for another possible rate cut from the United States Federal Reserve by next month is causing the US dollar to falter against the Hong Kong dollar in the foreign exchange scene. Looking at the pair, the 50-day moving average is trading far below the 200-day MA, signaling a dire bearish situation for the USDHKD pair. According to recent reports, Wall Street now expects the US Fed to slash its official interest rates to zero as a drastic measure against the effects of the coronavirus. The fall of US stocks and crude oil isn’t also helping the US dollar’s case against the Hong Kong dollar. A group of experts and economists were asked, and it was found that about more than 50% of them believed the US central bank will push its interest rates to zero, further straining the strength of the US dollar. It’s also worth mentioning the recent rate cut of the HKMA barely lifted the pair, suggesting the buck is still weaker.

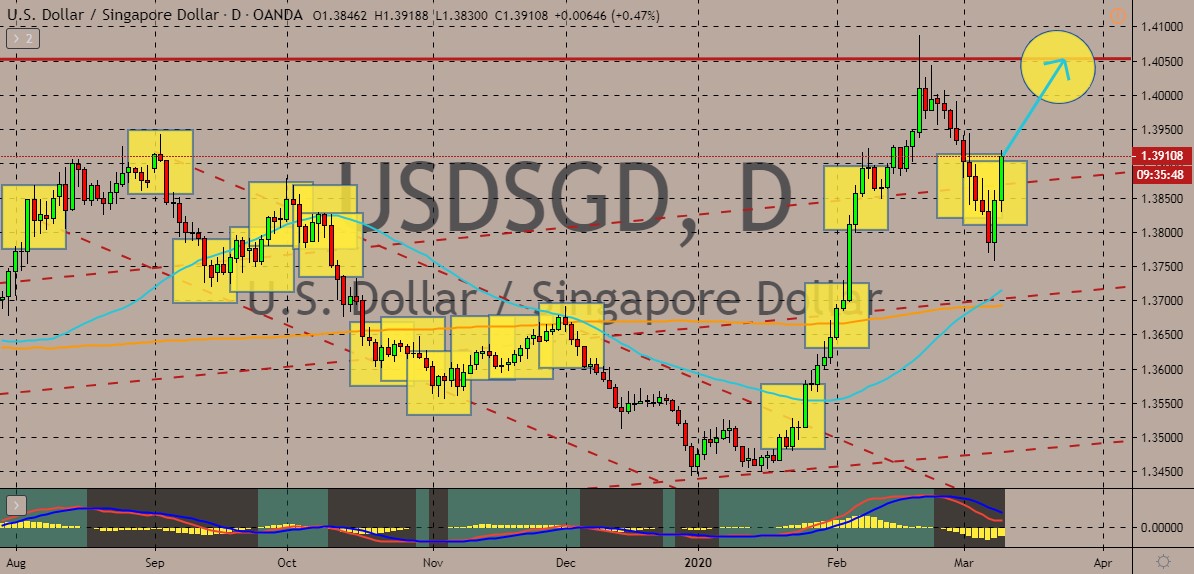

USDSGD

Despite the efforts of the Singaporean dollar to force the USDSGD pair lower, the US dollar’s bullish fate still looks promising. After diving during the first few weeks of the year, the 50-day moving average is back on top. The recent contractions recorded in the Singaporean economy isn’t helping bears to prevent the pair from declining even lower in sessions. The ASEAN currency first attempted to make a recovery in recent sessions, forcing the USDSGD downwards. However, the recent announcement of the United States president supported the beloved greenback, reinforcing it against the Singaporean dollar. Yesterday, Trump announced another stimulus in the form of tax cuts for wages. This cut will affect every type of earner, from part time employees to even hourly wage earners. The move also comes after the recently signed billion-dollar spending package that aims to support business in the United States.

COMMENTS