Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

EURDKK

A handful of positive results from the bloc’s economies are supporting the EURDKK, preventing it from tumbling down. However, the bullish run of the pair is expected to end in coming sessions as the number of coronavirus cases continues to rise in Europe. The pressure brought by COVID-19 is felt by euro investors, thus raising projections the 50-day MA will gradually descend. Yesterday, it was reported that the eurozone’s annual gross domestic product dropped from 1.2% to 1.0% in the fourth quarter; and from 0.3% to 0.1% on a quarterly basis. Looking at the bigger picture, Italy is straining the strength of the single currency, countering the support coming from economic activities. And just this week, Italy recorded its fastest single-day death toll hike from the Novel coronavirus. The news is stirring speculations about the European Central Bank easing its official interest rates soon to counter the impact of the virus.

EURTRY

The tension in the Middle East and the rising risk appetite for the euro are setting a bullish course for the pair. It appears that the 50-day moving average is straying farther and farther from the 200-day moving average. Bears are having trouble reeling the pair downward despite the concerns about the eurozone’s economy and COVID-19’s impact on Italy. The reason for the Turkish lira’s weakness is the announcement of the country’s first confirmed case of coronavirus. Yesterday, Turkey’s Health Minister Fahrettin Koca announced the country now has its first case of COVID-19. A male Turkish national has been tested positive for the virus yesterday evening and has contracted the virus from his trip to Europe with his family. During the televised news conference, the Turkish official assured the family is also being monitored for symptoms and their contacts have been traced to cut down possible transmissions.

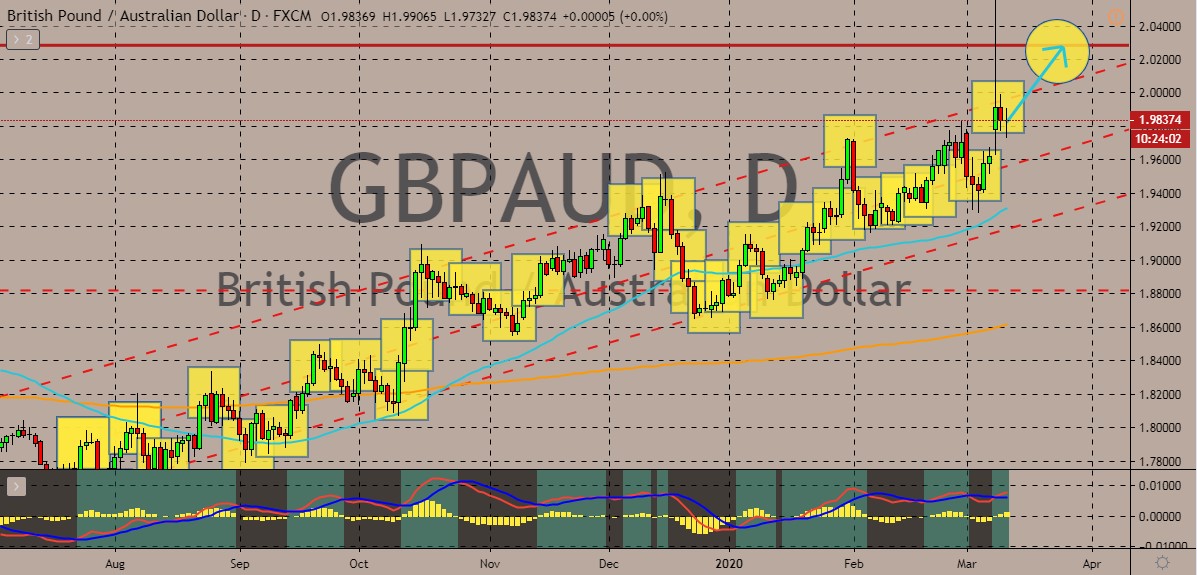

GBPAUD

Concerns over the possibility of a global recession caused the Australian dollar to remain on the defensive against the British pound. Bulls continue to prevail and are successfully pushing the pair higher as the 50-day MA continues to climb upwards. Investors are focusing on the impact of the coronavirus to the global economy, paving the way for the British pound to continue taking the pair higher. If a recession happens in Australia, it will be the first one since 1991. Economists say the combination of hits from the slowing Chinese economy because of the virus and the domestic economy that’s been dented by the bushfires earlier this year will result in a recession. According to a recent poll, Australia’s gross domestic product is expected to drop to 0.4% for the first quarter of 2020 and an additional 0.3% more in the second quarter. The pair is expected to reach its resistance before the month ends despite the lack of confidence in the UK’s business sector.

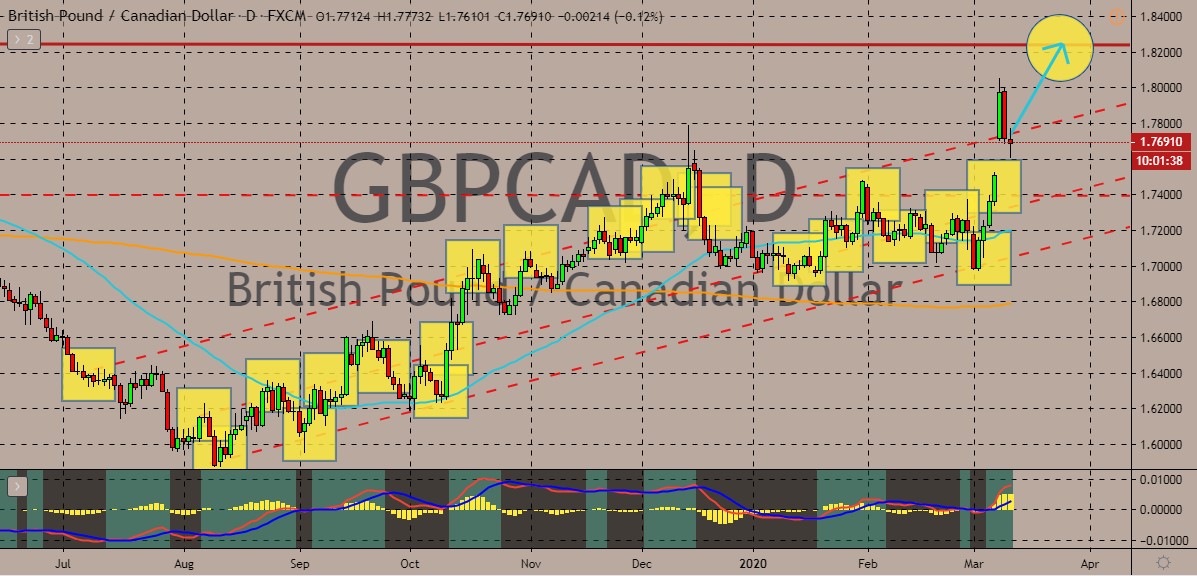

GBPCAD

After five consecutive days controlling the direction of the GBPCAD pair, bulls failed to hold on, resulting in a slight recovery for the Canadian dollar. Despite that, the pair is still seen trading on a bullish note as the 50-day moving average remains on top of the 200-day moving average. The positive figures recently recorded from the Canadian economy earlier this week supported the loonie. However, things are looking to return to a bullish track once the Canadian utilization rate for the fourth quarter gets released. The report is widely expected to show contraction, which will further empty the fuel tank of the Canadian dollar. Speaking of tanks, another concern for bears is the struggling price of crude oil in the commodity market. As oil stands as Canada’s primary export, the massive drop in oil prices will likely hurt the performance of the Canadian economy and the Canadian dollar in the foreign exchange scene.

COMMENTS