Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

USDDKK

The pair appears struggling to keep its gains and now trades in the red. Bears have been gaining traction, as indicated by the 50-day moving average’s downward slope. The Danish central bank said the country’s foreign exchange reserves increased to 429.0 billion Danish crowns, or $64.17 billion) in February from 426.3 billion crowns at the end of January. At the same time, the central bank intervened in the forex markets for the fifth month in a row, purchasing 0.9 billion crowns in February to keep the currency stable against the euro, to which it is pegged. The Danish krone has also been affected by the release of February’s Danish Consumer Price Index, which increased by 0.8%, though the report was overwhelmed by the heightened fears over Denmark’s handling of the coronavirus. Prime Minister Mette Frederiksen said tourism and transport would be affected by the Covid-19 spread. Denmark now has 59 confirmed infections.

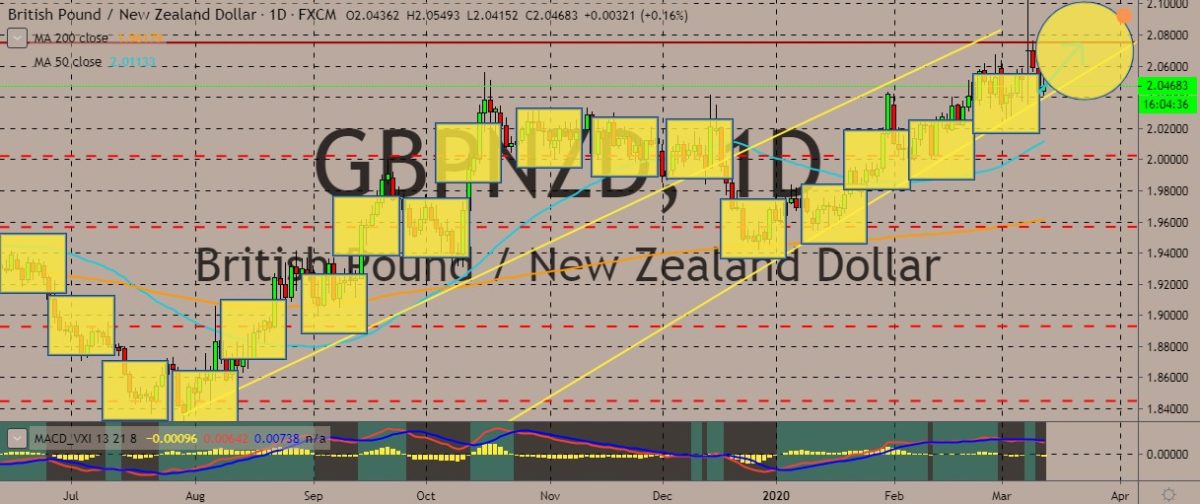

GBPNZD

The pair pulled back from recent highs in a massive move due to central bank actions. Moving averages suggest an overall bullish sentiment for the pair. The Bank of England announced yesterday an emergency cut of 50 basis points on interest rates to fight the economic impact of the new coronavirus. This move makes the BoE the fourth major central bank to impose an emergency cut amid the pandemic, after the Reserve Bank of Australia, US Federal Reserve, and Bank of Canada. The difference is the BoE also announced a new term-funding scheme to support small and medium-sized companies and new measures to help banks lend more. The Bank said risky asset and commodity prices have declined steeply, while “indicators of financial market uncertainty have reached extreme levels.” Earlier this week, stock markets saw major selloff after an emergency lockdown in Italy and fears of price war between Russia and Saudi Arabia.

USDCNH

The pair appears to be pursuing an uptrend right now, with the US dollar gaining against the Chinese yuan, climbing above the 50-day moving averages. The 200-day moving average isn’t that far above the current price. China still suffers from being the ground zero for the coronavirus pandemic, with Chinese companies unable to acquire to new US dollar loans. This inability adds to the country’s vulnerability should the yuan’s exchange rate weaken because of the decline in the country’s trade position. Estimates suggest China to be running at 25% capacity. In February, new yuan growth through bank lending climbed more than $130 billion, which is much lower than the $480 billion recorded in the previous month. Total social financing plunged last month to $123 billion, down from the $729 billion in the previous month. The People’s Bank of China has encouraged financial institutions to keep lending.

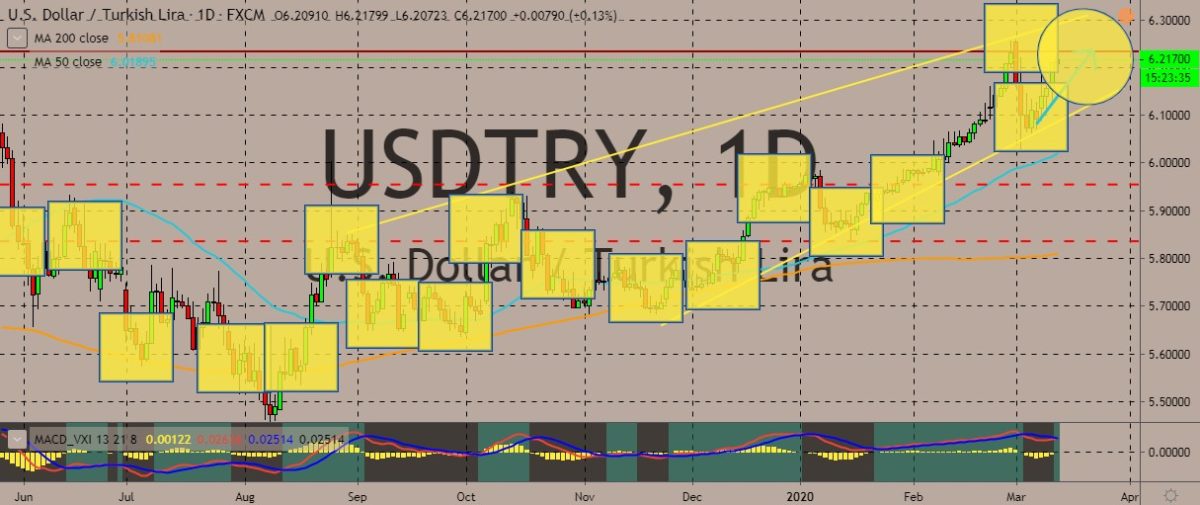

USDTRY

The Turkish lira continues to weaken against the US dollar in recent sessions, confirming the bullish trend as suggested by the 50- and 200-day moving averages. The currency has been falling against the dollar after the country reported its first confirmed coronavirus case. In equity markets, Turkey’s main stock index has declined, although shares in some sectors rose as investors expected some companies to benefit from the virus pandemic. Health Minister Fahrettin Koca said early on Wednesday a citizen had tested positive for the coronavirus, adding Turkey to the list of large, wealthy countries to report an outbreak. Koca added Turkey was ready to prevent a spread. The global spread of the virus since it started in December has prompted authorities to cancel flights, events, and conferences as they try to protect the economy. Turkey revised its 2019 current account surplus up to $8 billion from a previously announced $1.7 billion on Wednesday.

COMMENTS