Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

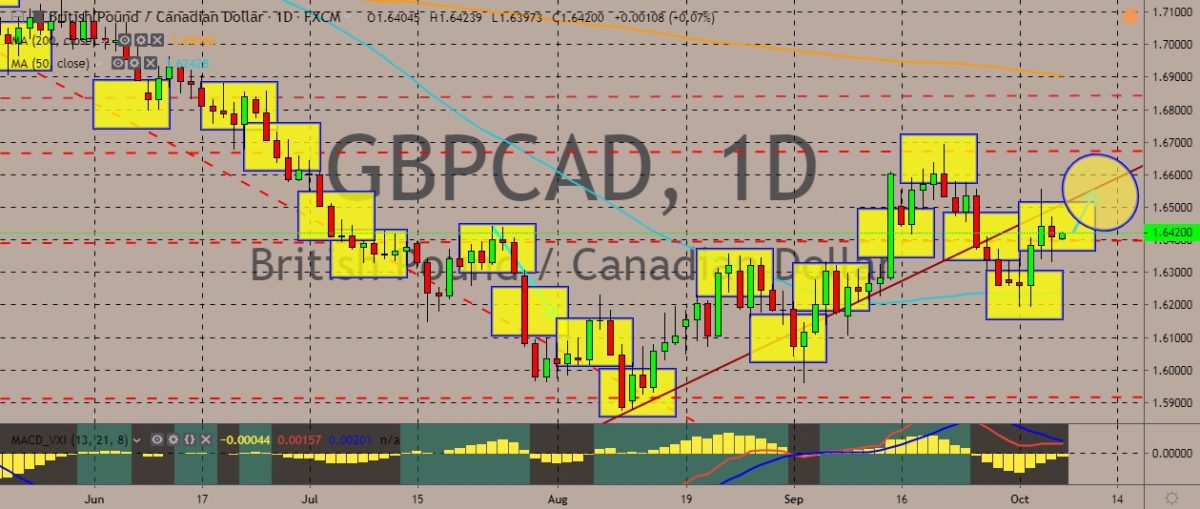

GBPCAD

The pair is trading with a bias on the upward after the British pound recently strengthened, reaching monthly highs. Last week, it traded mostly in the green, following an uptrend above the 50-day moving average. With regards to Brexit, British Prime Minister Boris Johnson warned the European Union over the weekend that he would not delay Brexit beyond the current deadline which is October 31. The movement of the pound has been driven by news about Johnson’s insistence on Brexit “come what may” and the news of a possible smooth Brexit. Over in Canada, markets were shocked after data showed the economy stalled after four quarters of growth. A measure of employment slipped, according to Ivey PMI (purchasing managers index) that released data last Friday. The seasonally adjusted index slipped to 48.7 in September after reaching 60.6 in August. The August figure was its highest since October 2018.

USDDKK

The pair is trading weaker after recently breaking out of the trading channel, trading higher than the upper band. However, it quickly went back in and down, although the overall trajectory is still an uptrend. The US dollar continues to be affected by trade news of trade negotiation progress. According to news reports, Chinese officials are starting to be hesitant to go for a broad deal. Negotiations are scheduled to start on Thursday. Vice Premier Liu He will lead the negotiations for the Chinese side. POTUS Donald Trump, on the other hand, is facing an impeachment inquiry in the House of Representatives. Over in Denmark, the Social Liberal party has recently said that it wants the country to be able to import more skilled labour from abroad. The party will demand the government consider the issue, adding that it mentioned it in its proposal for the upcoming budget. The social liberals are one of the three other left-wing parties in the country.

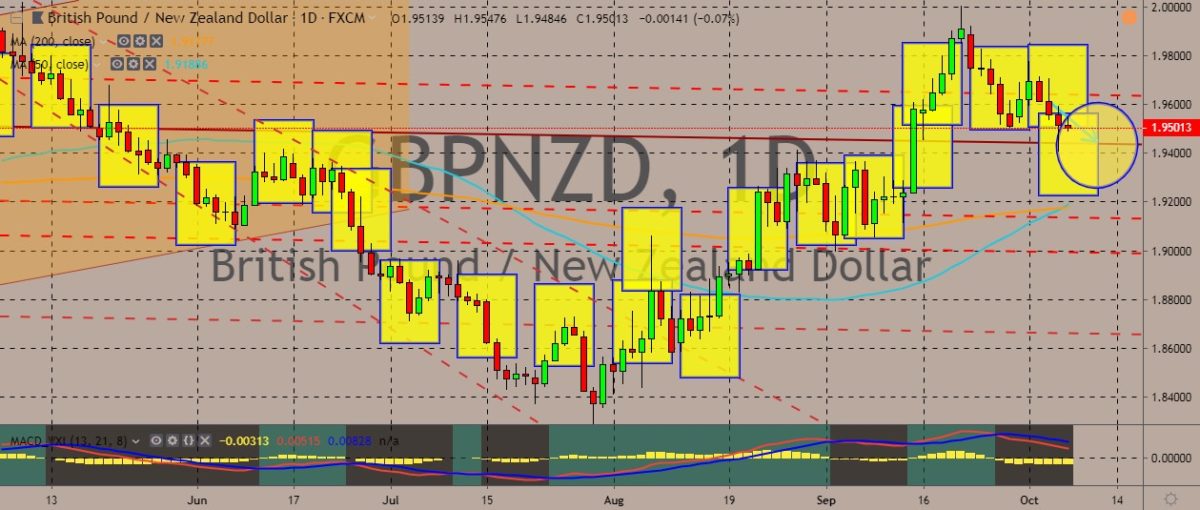

GBPNZD

The pair is trading lower in the previous trading sessions, with prices reaching weekly lows after previously climbing to monthly highs in September. However, the 50- and 200-day moving averages just confirmed the gold cross, which indicate a generally bullish sentiment from traders in the short term. Over in New Zealand, economist Cameron Bagrie believes that the economy is on its way for a “train wreck” as the slowdown in the economy slashes with social demand for change. He expects the economy would be in recession within the next two years. This statement comes on the back of poor economic fundamentals in Europe and China as well as global issues like that the trade conflict between the United States and China. On the flip side, the New Zealand economy will probably withstand the recession better than other economies. That being said, the former ANZ economist says that more clarity is needed on the government’s fiscal plan.

USDCNH

The pair is currently trading on an uptrend slumping for many sessions. It has reversed most of its previous-month gains as the dollar gathered strength. However, the past two sessions weren’t that kind to the dollar, as risk appetite slightly firms. As the USDCNH is Asia’s key currency risk measure, there has been a pronounced unwind this morning of last week trade optimism move. However, there’s low liquidity as China and Hong Kong markets are on holiday. Over in China, there has been a sharp spike in instant noodle sales in China has reignited debates over a controversial topic that asks whether consumers are lowering their consumption. The Chinese government is depending on consumer spending to help prop up the economy amid China’s protracted trade war with the United States. If the consumers are holding back their spending and consumption, this could mean the growth may slowdown faster than expected.

COMMENTS