Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

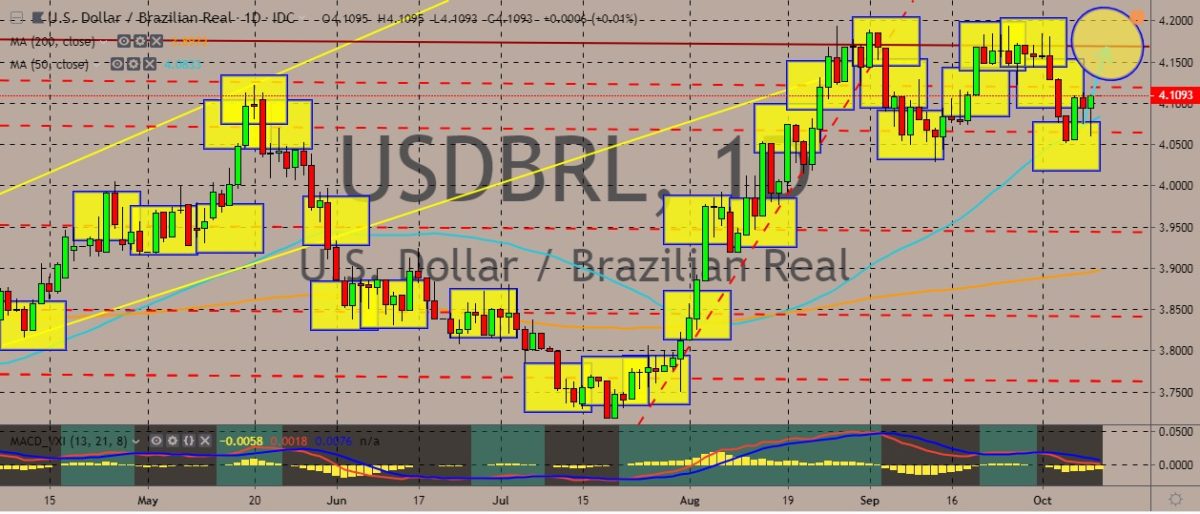

USDBRL

The pair has broken out from its downtrend and is not trading sideways. Recently, it converged with the 50-day moving average, falling down but recovering and gaining again. However, the candlesticks show a pretty solid downward pressure. Over in Brazil, the consumer price inflation slipped to its lowest in more than a year in September, according to official figures. This figure is below the bank’s target that will probably solidify the expectations of another rate cut. The benchmark ICPA index of inflation gained 2.89% in September on a year-on-year basis. This is lower than the increase of 3.4% during the previous month, according to IBGE, a government statistics agency. This goes lower than the median forecasts of 2.97%. It also marks the first time that inflation fell below 3.0%. The Brazilian central bank’s official goals for 2019 and 2020 stay at 4.25% and 4.00%.

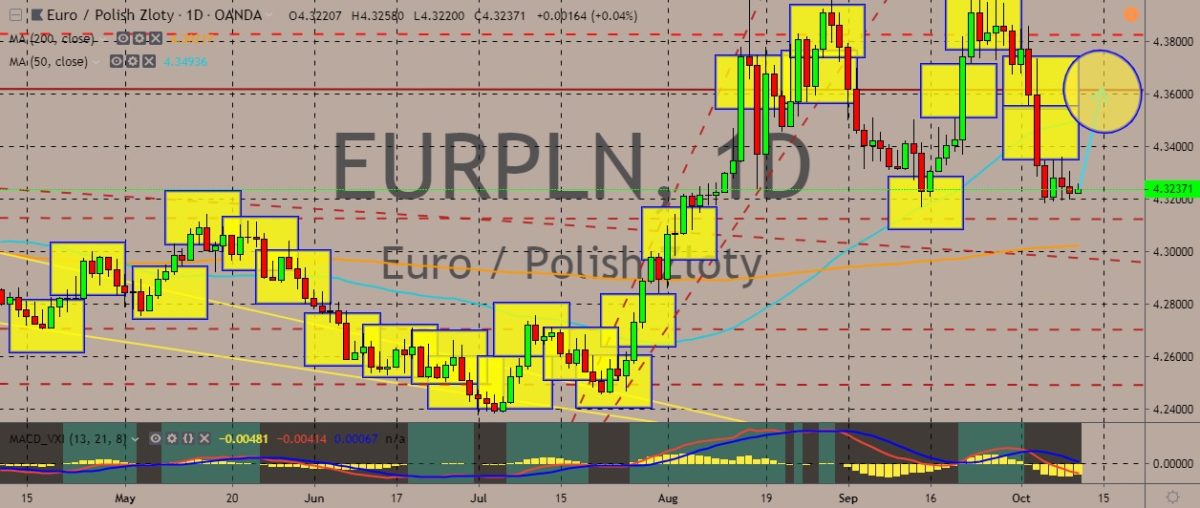

EURPLN

The pair as fallen to monthly lows in recent trading, breaking below the 50-day moving average and trading sideways in the previous three sessions. Over in the eurozone, finance ministers are claiming that the region needs countries with money to invest to boost the economy. Mario Centeno, who is chairman of the 19 ministers representing eurozone countries, said that the fiscal policy in the region should act upon the economic situation. Meanwhile, the World Bank expecting Poland’s GDP growth to be 4.3% in 2019 but will slow down to 3.6% in 2020. In 2021, the growth is expected to be 3.3%. The growth in 2019 would be driven by the growing private consumption and investment recovery, according to the bank. The next years will see slowdown in growth due to the faltering economic situation in the European Union. At the same time, Poland is seeing some increasing shortage of employees in the labor force.

USDMXN

The pair is trading in ranges that are getting tighter, with no clear trend to follow. It’s trading slightly above the 50-day moving average, which is also above the 200-day moving average. This generally indicates bullish sentiment from the traders in the short term. Overall, the movement shows a triangle formation with bias on the downward side. Over in Mexico, consumer prices eased for the fifth month in a row in September, according to official data from INEGI statistics agency. This result meets market expectations. At the same time, it further cemented the expectations for more interest rate cuts. Consumer prices gained 3.00% in the year through September and rose 0.26% in September. This is the lowest monthly figure for headline annual rate since September 2016. It falls exactly in line with the central bank’s target rate of 3%, give or take 1% for tolerance threshold.

EURSEK

The pair is trading carefully up the charts, establishing a trading channel that’s going uptrend and trading within the upper band of the channel. It has also climbed above the 50- and 200-day moving average, which indicates that the uptrend may continue at least some time in the short term. It has recently climbed to its multi-year highs. Over in Sweden, the economy is weakening while the central bank is compelled to keep benchmark interest rate at the current level of -0.25% for the next couple of years, according to the NIER think-tank. Although the country has benefitted from years of slow growth, the effects of the trade row between the US and China as well as the concerns over Brexit are finally having an impact. Recent data is also indicating a heavy slowdown. This year, NIER said that growth would slow to 1.2% from 2.3% in 2018. It will ease further 2020.

COMMENTS