Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

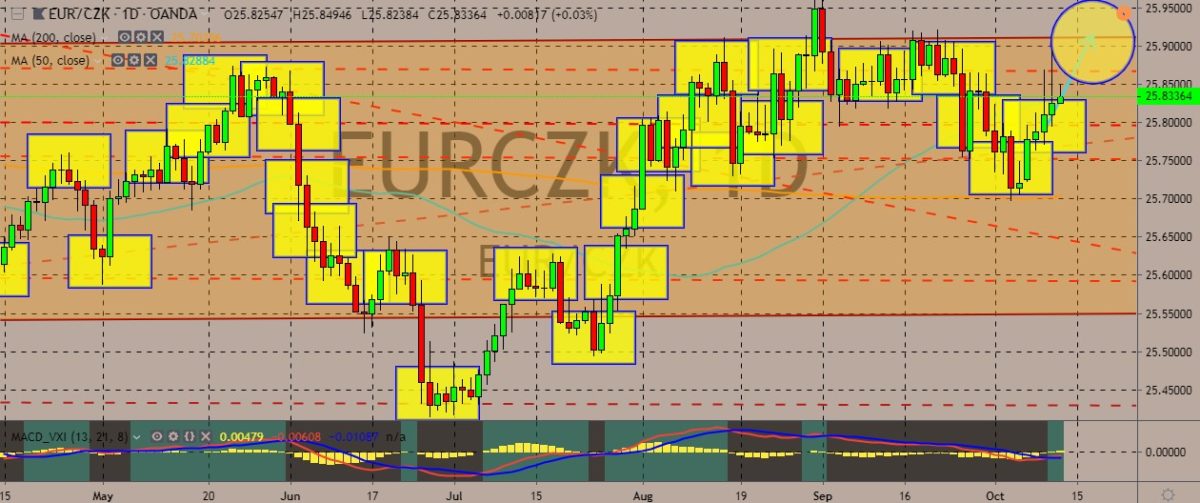

EURCZK

The pair is trading in the green territory in the past week, with the price going above the 50-day moving average. The pair has traded sideways after its downtrend in June. It has since struggled to establish a clear trend. Over in the eurozone, finance ministers have agreed on a small budget for the euro zone. This ended a couple of years of talks that exposed their regions over greater integration following sovereign debt crisis that nearly ruined the common currency. Meanwhile, Czech Republic’s price growth slowed down in September to 2.7% on year-on-year basis. The slowdown was driven by a decline in food prices. On a month-on month basis, prices slipped by 0.6%. Markets can attribute this to the fact that holiday prices usually fall during September following strong summer-months growth. National food price inflation slowed from 3.9% in August to 2.5% in September.

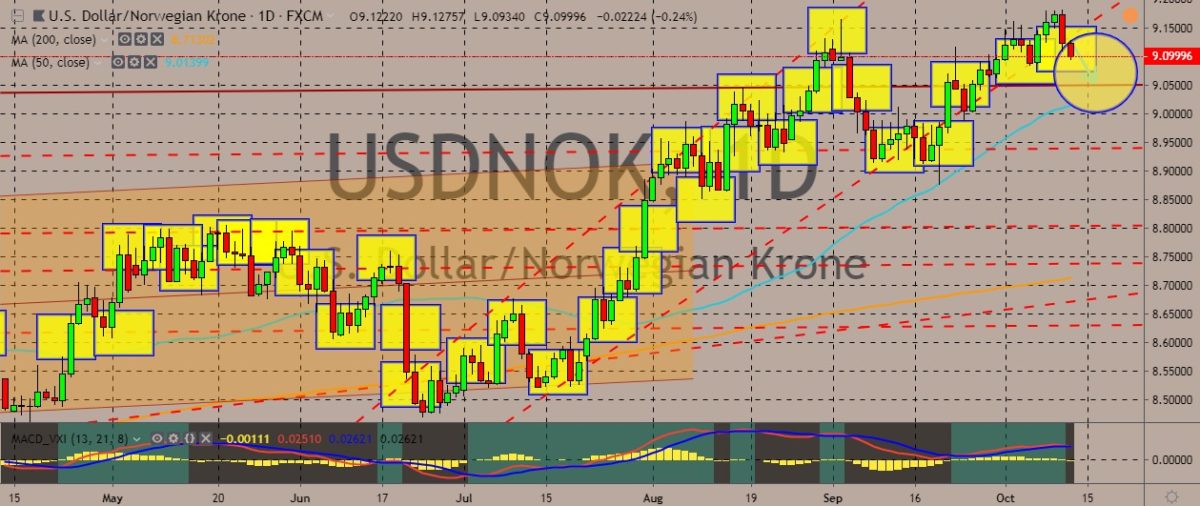

USDNOK

The pair is trading in the red for the previous two session, slipping back to monthly lows. Since July, the overall direction of the pair is an uptrend, trading higher than the 50-day and 200-day moving average. Norway’s monthly inflation gained by 0.6%, while its yearly core inflation for September topped forecasts, increasing from 2.1% to 2.2%. Norway’s economy appears to remain solid, with the inflation level above the Norges Bank’s 2% target. On the flip side, the as global growth slows down in general, the currency’s traders are becoming more worried that the effects of such a global slowdown will affect the Norwegian economy that largely relies on trade. Slsat month, the Norges Bank went against the tide and slapped its fourth rate hike in a year to cool down an economy that bumps up oil investments. It raised its benchmark rate by a quarter of a percentage point to 1.50%, which was its highest level in five years.

USDILS

The pair continues its downtrend after it form the cup-and-handle pattern in August, trading mostly above the middle line in the trading channel and crossing over the 50-day moving average but below the 200-day moving average, reinforcing the reading that the sentiment for the pair is mostly bearish. For fundamentals, Israel has reportedly agreed to reopen economic agreements with the Palestinians, and it has paved the way to a compromise on fund transfers to the Palestinian Authority. This comes as part of the move that recently enabled the transfer of tax receipts of Palestinians. For eight months, the Palestinians have been refusing to receive the taxes that Israel collects on their behalf. The refusal comes from the Palestinians demand that the Paris Agreement, which dates back to 1994, should be renegotiated and be updated. Palestinians are also demanding the removal of restrictions to Palestinian exports to Israel and other countries.

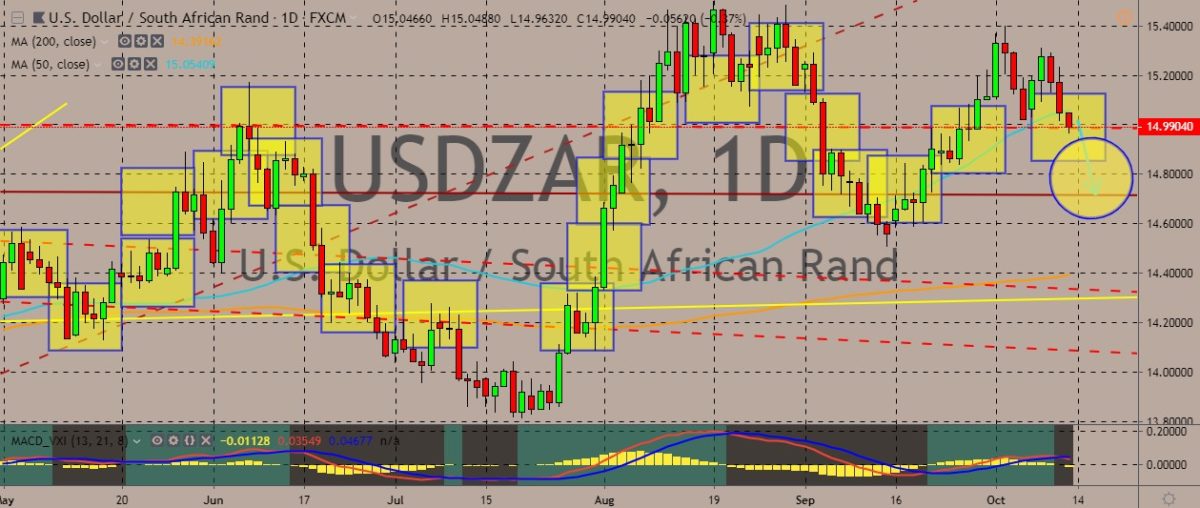

USDZAR

The pair is trading in the red as the price dips below the 50-day moving average. The pair is now on a downtrend, with signs that it would continue its rising wedge pattern. The South African rand traded stronger against the US dollar as hopes of progress in US-China trade talks dampened demand for the dollar and propped up emerging market currencies. Top US and Chinese negotiators recently finished the first day of trade talks. US President Donald Trump described the meetings as “very, very good negotiation with China.” The rand apparently is riding the wave of optimism, albeit cautious, with markets perceiving that the US-China trade talk uncertainties somewhat decreased. However, it can be seen that the mixed signals from the negotiating countries are keeping the bullish traders cautiously at bay. Trade-sensitive currencies perked up even as the US and China may only agree to a “partial” trade deal.

COMMENTS