Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

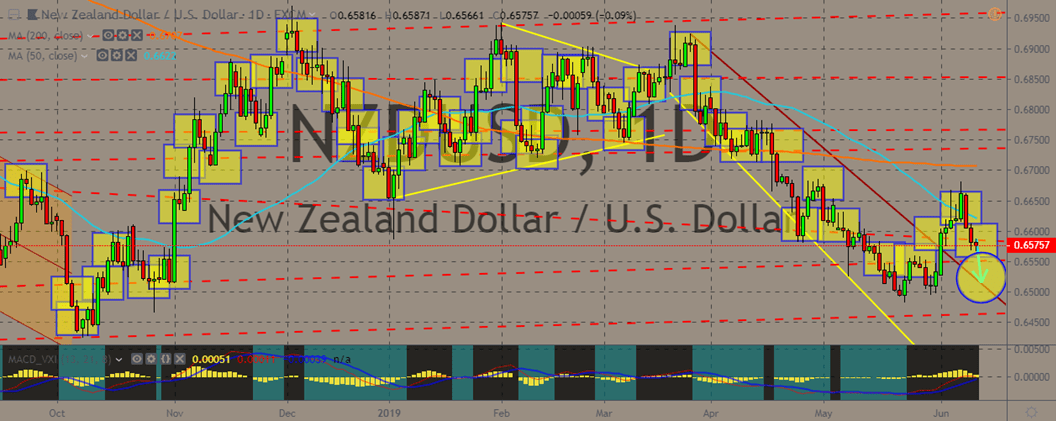

NZDUSD

The NZDUSD pair is continuing a downward trajectory today as bullish news comes in for the US dollar. This is the second day of decline for the pro-risk NZDUSD pair, effectively extending the previously slight declines. Although apparently weakening on the charts, the kiwi might be able to find some support over the coming weeks if economic forecasts are right. In the focus of investors is the GDP reading for the country’s economy to be published later in the day. Markets are betting that the Reserve Bank of New Zealand will slash its cash rate again before the year ends. The bank slashed rates 1.5% last month, which was a new record low, due to missed inflation and a slowing economy.

Meanwhile, on the buck side, the US currency managed to pick up some steam thanks to softening expectations of Fed rate cuts. This comes after US President Donald Trump canceled tariffs on Mexico. NZDUSD downward trend is expected to continue.

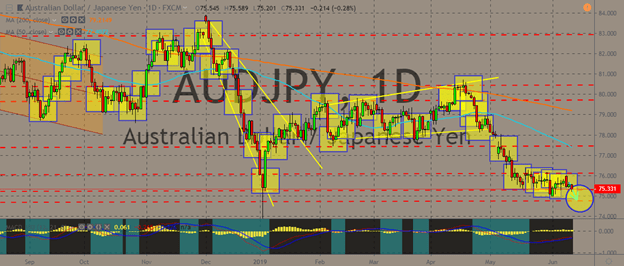

AUDJPY

The pair is suffering from intraday lows as AUDJPY traders apparently focus more on the lackluster PPI to bet on weaker factory activity, coming after China published inflations number. The pair has just come back on firmer footing after the global risk appetite slightly reappeared after the cancellation of the US tariffs on Mexico, as well as because of fresh hopes of trade talks between the US and China. The Japanese yen strengthens against most major currencies as more traders appear lesser willing to take on risky assets, in which case we are witnessing the appeal of the Japanese currency as a safe-haven asset. Domestic appears to be backing such sentiment, with Japanese core machinery orders increasing 5.2% in April from the previous month after increasing 3.8% in March. Corporate Goods Price Index increase by 0.7% in May on a year-on-year basis. The yen is expected retain its strength in the short-term.

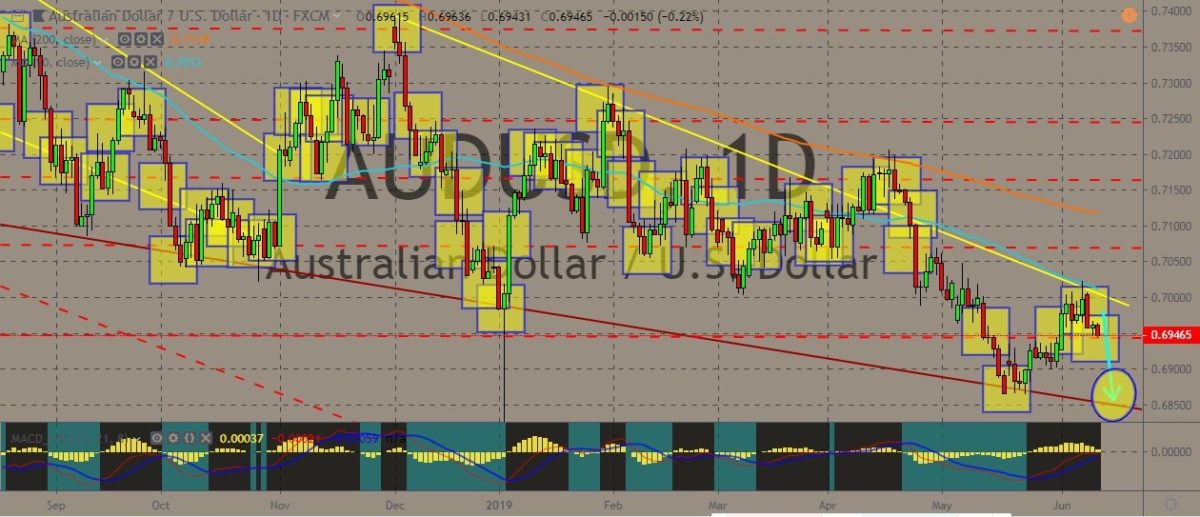

AUDUSD

The AUD further weakened against the dollar as the pair continues the pullback to a return to the 0.6900 are, with the 50- and 200-day moving averages indicating a similar trend as the current price movement and after the 50-day MA almost met with the price. This continues the established downtrend over the last 6 months. The pair could probably continue going downward in the short-term if the pair breaks the current support level. Again, the dollar managed to offset the positivity in AUD as the buck got broadly stronger against other currencies, with its safe-haven appeal also coming into play as tensions continue to loom in the market. This comes after the loonie was supported last week by US data that boosted expectations of Federal Reserve cuts in 2019. That boost ultimately wasn’t enough to push the pair towards a key moving average. Overall, the pair is expected to be within the lower support levels of its downtrend.

AUDCAD

The AUDCAD pair is continuing its downtrend after recently testing the upper levels of the channel, with some solid resistances pushing the pair into the lower area. However, one could also see slightly solid support levels at the current price, suggesting that it could also trade sideways before going back up again. More likely, however, is that the Canadian dollar would be slightly volatile in the near term as US President Donald Trump could possibly eye Canada next after threatening Mexico with 5% tariffs on all products if the Mexican government fails to put a stop to the influx of illegal immigration to America. Although it could be a problem, Canada is now more dependent on the Comprehensive and Progressive Agreement for Trans-Pacific Partnership. On the charts, 50- and 200-day moving averages just recently formed the Golden Cross, which indicates a continuing slump in the pair in the near term.

COMMENTS