Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

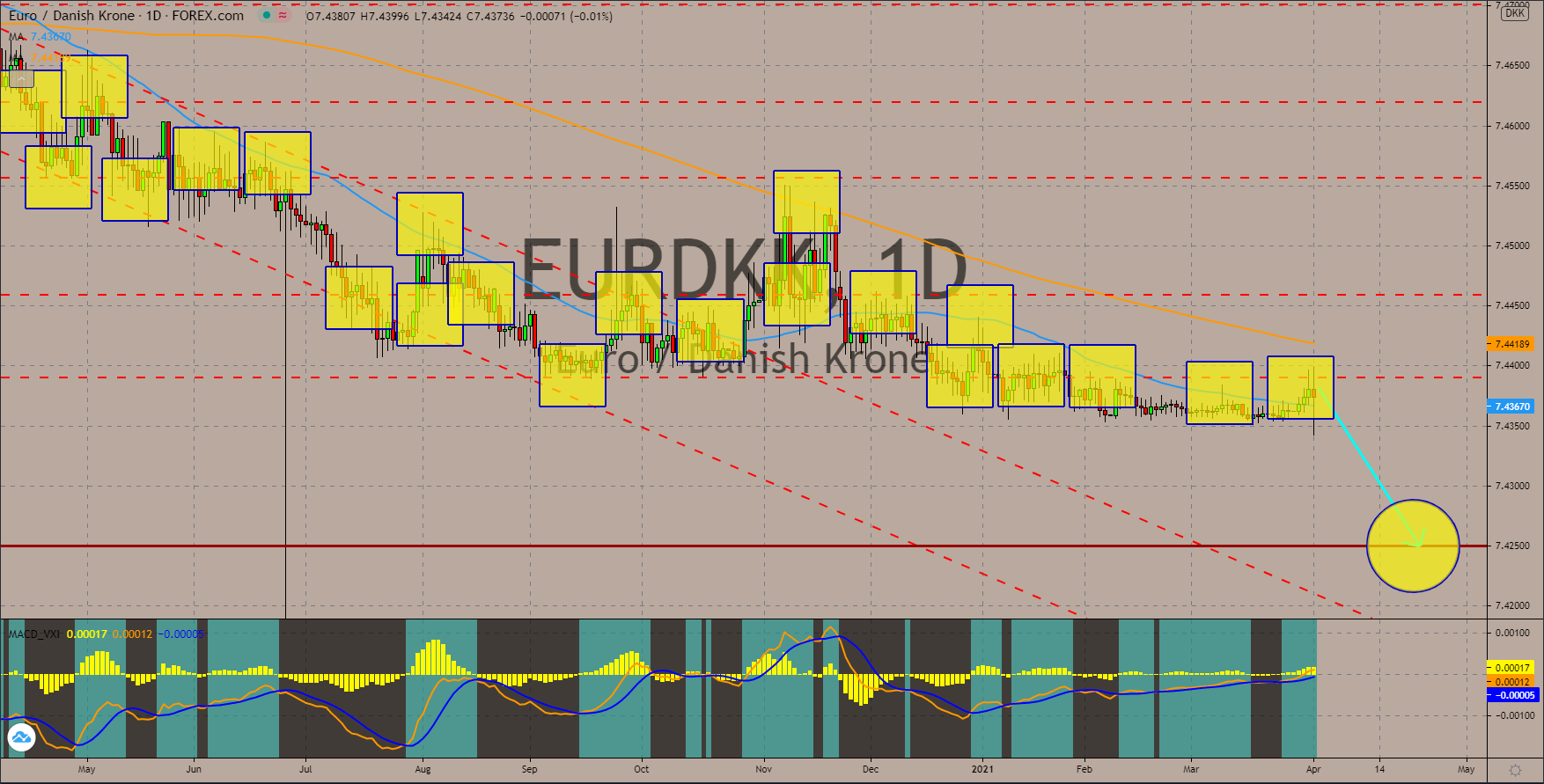

EURDKK

Despite the above EU average growth of 0.7% in the fourth quarter of fiscal 2020, analysts remain worried over the Danish economy’s Q1 2021 GDP data. This was due to a continued increase of unemployed individuals in the country. For February’s figure published on Wednesday, March 31, the unemployment rate grew to 4.2%. In the first month of 2021, the number also grew to 4.0% from 3.9% at the end of last year. These concerns will translate to higher demand for the krone in coming sessions. On the other hand, the EU and its member states posted upbeat data for the consumer price index (CPI) reports. However, this is still lower from the Eurozone’s 2.0% target. Preliminary data from the European Union showed an increase of 1.3% in consumer goods year-over-year. Meanwhile, economic powerhouses Germany and France posted 1.7% and 1.1% results. The 50-bar MA will act as a resistance for EURDKK with the MACD showing a bullish fatigue.

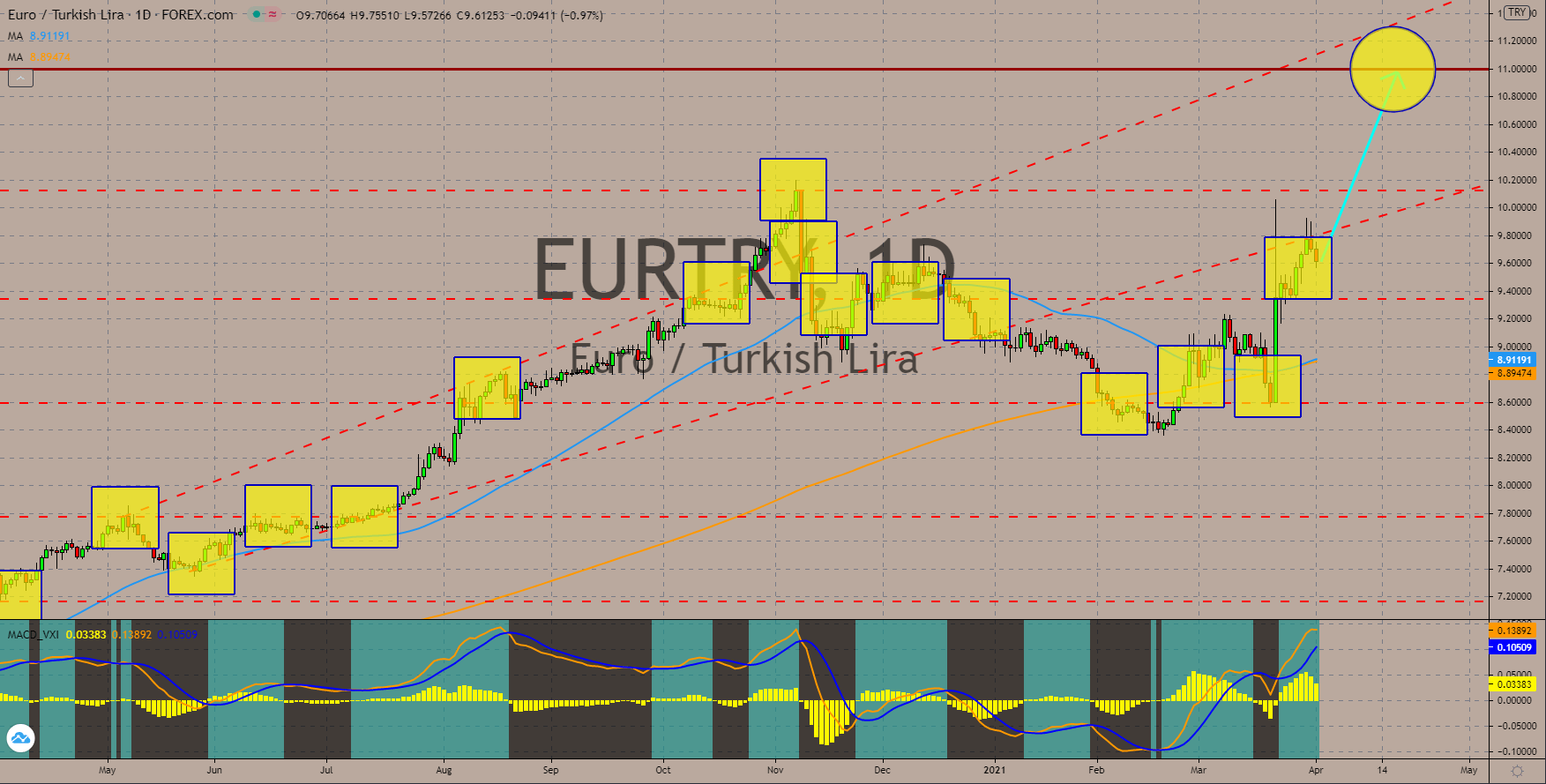

EURTRY

The lira plunged anew, erasing five (5) months’ worth of gains. This was following the recent move by Turkish President Recep Tayyip Erdogan where he sacked both the central bank governor and the deputy governor. Political economy sees the need for an independent central bank from the central government to maintain a stable economy. The same scenario happened in 2018 when Erdogan tried to control the financial sector by appointing his son-in-law as Turkey’s finance minister. From July 10, 2018 to August 18, 2018, prices of the EURTRY rose by 50%. And since the promotion of Berat Albayrak, the pair jumped by 75% to date. Analysts are expecting the continued intervention by the government in the Turkish central bank to send prices to an all-time high price of 11.00000. The 50-bar and 200-bar moving averages are expected to fail to form a bearish crossover while the MACD indicator will continue with its bullish momentum in sessions.

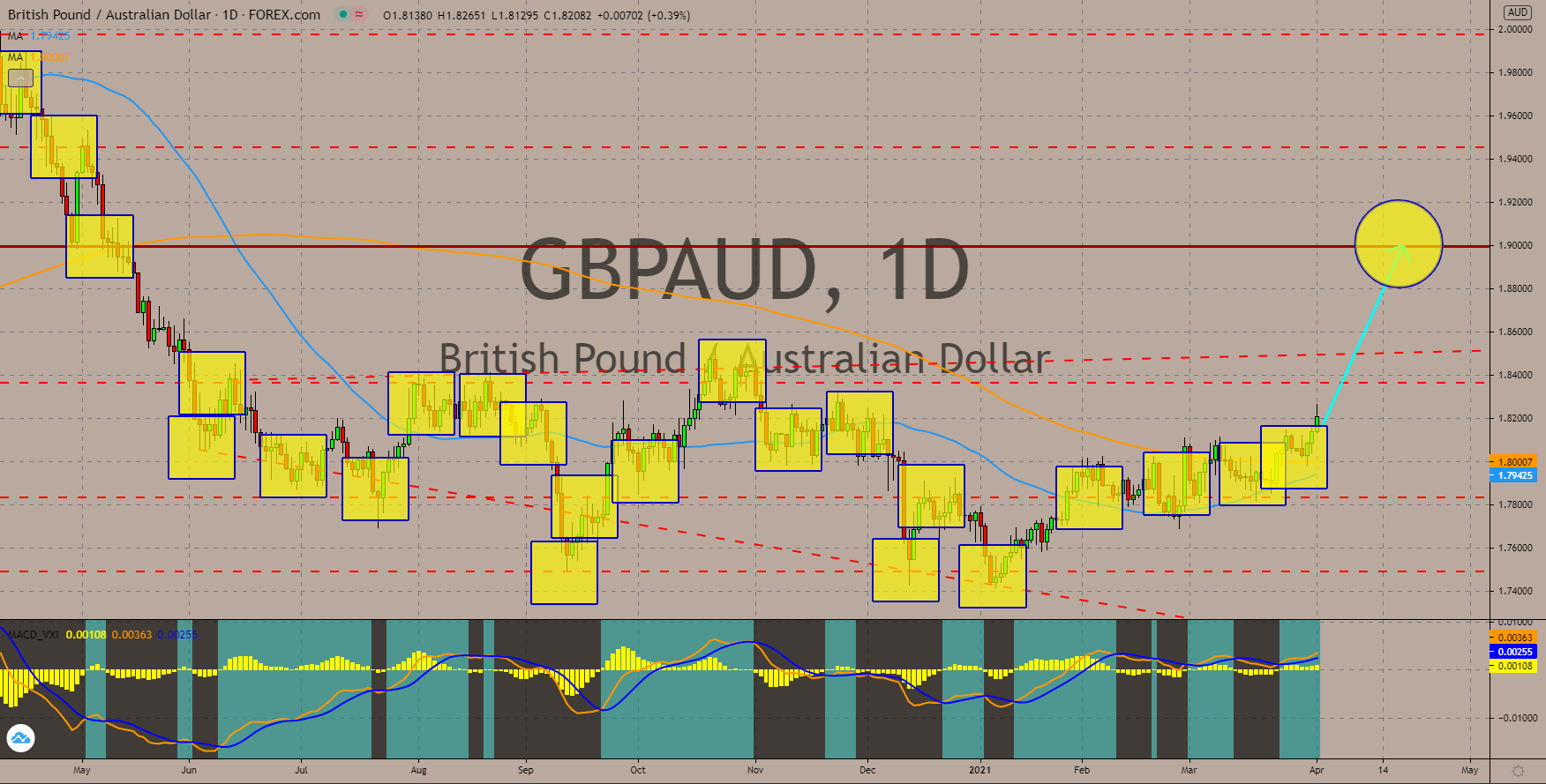

GBPAUD

The recent report from Australia is expected to ease investor’s concern over the economy. Since standing up to China’s alleged cyber espionage in 2019, Canberra was hit with different trade restrictions for its Beijing-destined exports. On Thursday, April 01, Australia posted an update for its commodity prices. The 28.2% year-over-year (YoY) growth is the ninth consecutive month of improvement. It is also the highest recorded expansion in prices since June 2017. The published data in the previous days added optimism in the equities market and grim outlook for the Australian dollar. Imports advanced by 5.0% in February after declining by -2.0% in the first month of fiscal 2021. Meanwhile, exports are down by -1.0% during the same period from 6.0% in January. This resulted in a lower trade surplus of 7.529 billion compared to 10.142 billion prior. The 50 and 200 MAs are anticipated to form a “Golden Cross”, which will further push the GBPAUD pair higher.

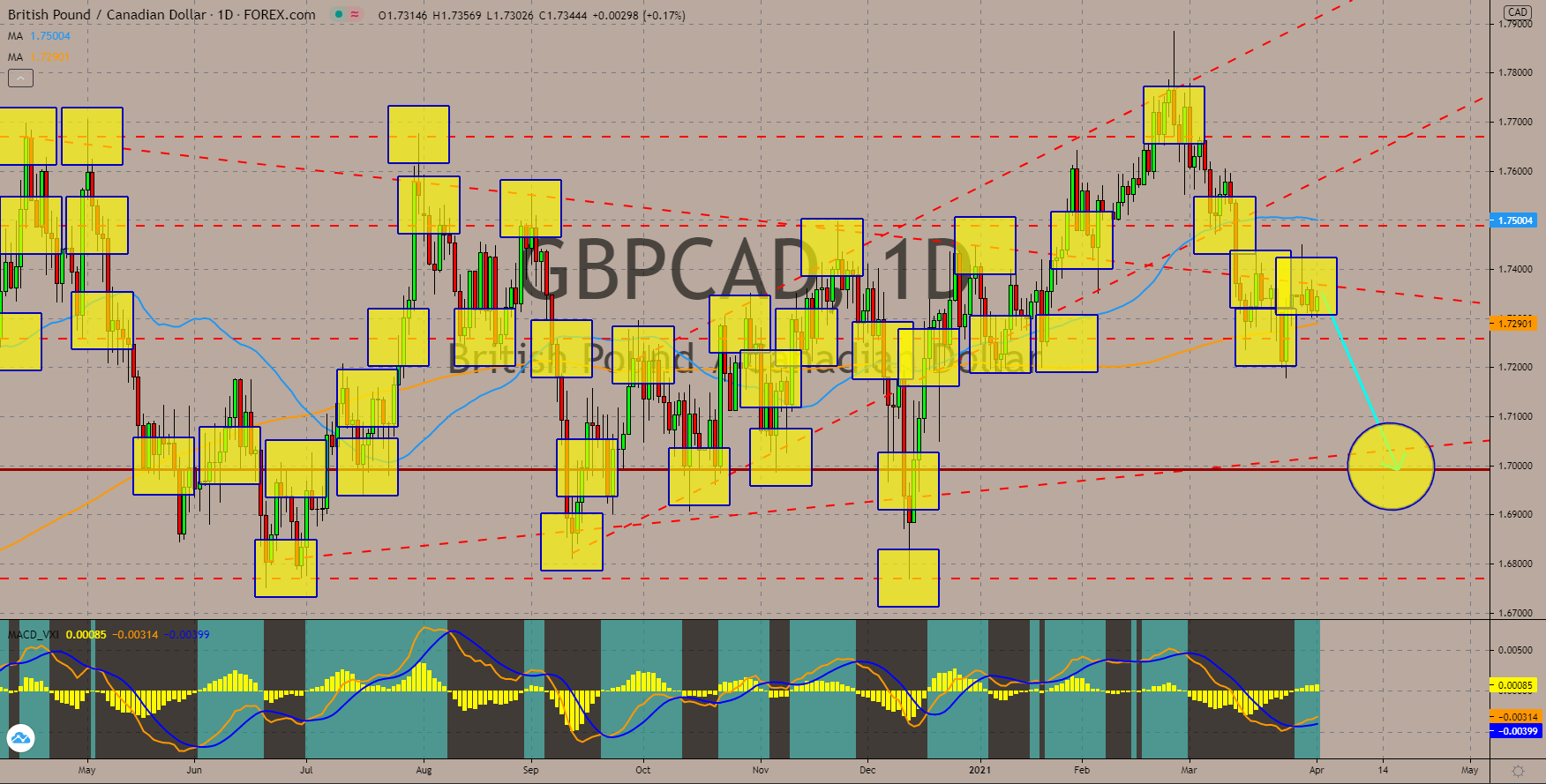

GBPCAD

The British economy has fared better than its former peers in the European Union. In the last quarter of 2020, Britain expanded by 1.3%. This shrugged off investors’ concern over the UK COVID-19 variant discovered in December. While analysts are worried about Denmark’s first quarter, they are optimistic with the prospect of a better GDP result in Q1. This was due to the rapid vaccination program by the British government, which puts the United Kingdom ahead of Germany and France with the vaccination rate. Currently, there are 30 million Britons, or half of the UK population, who have either received partial or full vaccine jabs. In Mid-March, the government has started to ease restrictions, which will help the UK economy to recover from the pandemic. Finance Minister Rishi Sunak sees the British economy going back to its pre-pandemic level at the end of 2021. The GBPCAD is expected to break down from the 200 moving average.

COMMENTS