Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

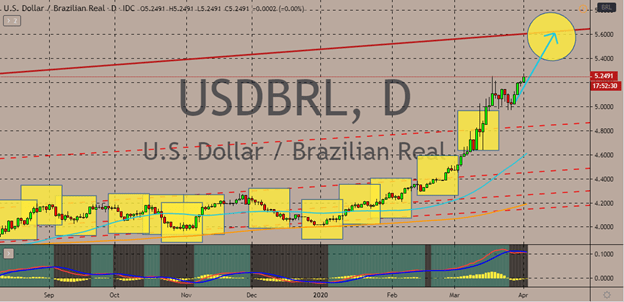

USDBRL

The US dollar rises against the Brazilian real as the global slump continues to loom over the market. Since Monday, the greenback has charged against the Brazilian real and is now on its fourth day of consecutive gains. Bulls are on full throttle mode since March began, propelling the 50-day MA significantly above the 200-day MA. As the globe confronts the devastating coronavirus pandemic, investors of the US dollar are taking it as an opportunity as markets across the globe act cautiously. Perhaps the damage brought by deadly COVID19 is one of the worst economic contractions for years, giving the beloved buck, the world’s leading global reserve currency, the upper hand in the foreign exchange market. As for the Brazilian real, it has reportedly hit its weakest level against the US dollar. And, unfortunately, it’s still projected to get even weaker as the pair is widely expected to reach its key resistance in the short-term trading.

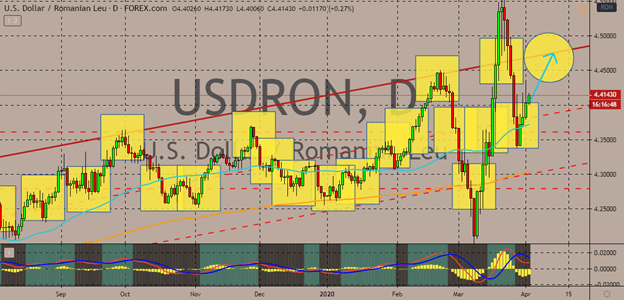

USDRON

After hitting its strongest level in the market, the USDRON met a steep dive. However, it has now managed to recover as the US dollar thrives in this stressful environment. The concerns over the massive of the novel coronavirus pandemic to the global economy have reinforced the US dollar. And considering that the buck is one of the biggest global reserve currencies, it’s bound to recover against the Romanian leu. However, it’s doubted whether the pair would break through its resistance level this time because of another looming stimulus package from the US government. As for Romania, the earlier decision of the Romanian National Bank to cut its interest has played a part in the recovery of the USDRON bulls. Late last month, the Romanian central bank had an emergency meeting where they decided to cut interest rates by 0.5 basis points. Aside from that, as efforts to buoy the economy, the bank vowed to purchase government securities soon.

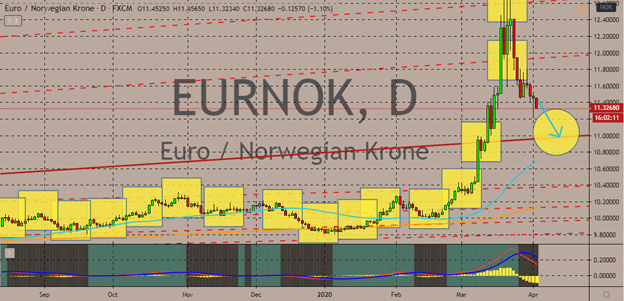

EURNOK

The rebound of oil prices in the commodity market has allowed the Norwegian krone to also recover against the euro. As the Norwegian krone hustles to ground the pair to its support levels, the pair is still technically on a bullish path. Looking at the chart, it’s evident that the 50-day moving average is still well over the 200-day moving average. Bulls have kept the momentum since March began despite the massive blows the eurozone has gotten. However, news about the US President and his Russian counterpart agreeing to stabilize the commodity market has bolstered Norwegian krone. If Trump actually works with Russia and Saudi Arabia to steady oil prices, bears might have a chance of leveling the pair to its levels prior to the March bullish frenzy. Meanwhile, for the euro, members of the bloc have conflicting ideas and plans on how to handle the economic blow of the pandemic, the dilemma prevents the EUR from defending against the NOK.

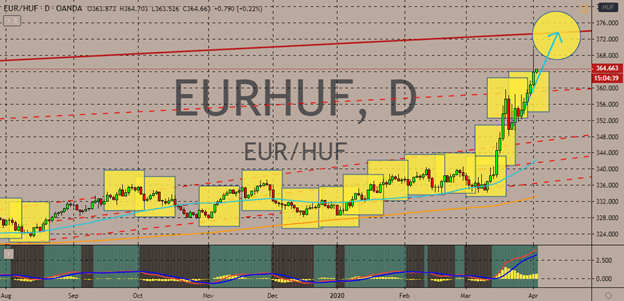

EURHUF

The Hungarian forint is deep trouble. The HUF lost all its strength following the crash of the Hungarian Manufacturing PMI. Following the record low data from the said report, bulls immediately took advantage, forcing the EURHUF pair higher. Aside from the crucial data, the forint fell to its weakest levels due to the global risk-off sentiment. Unfortunately for Hungary, its manufacturing activity collapses to levels weaker than what it experienced back in the 2008-2009 Financial Crisis. The Hungarian manufacturing data collapsed from 50.1% on the prior month to just 29.1% in March. The results show the initial impact of the virus on the sector. Investors of the Hungarian forint were gravely disappointed as the results came in way worse than projections of 47%. To put things into perspective, back in the 2008-2009 Financial Crisis, the Hungarian manufacturing PMI only dropped to 40%, and considering its drop now, it’s drastically worse.

COMMENTS