Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

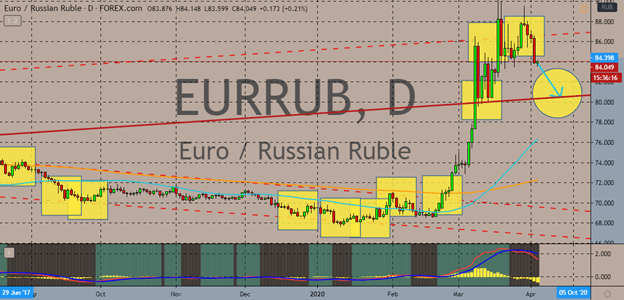

EURRUB

With the oil market starting to bounce back, the Russian ruble is starting to take back some of the major gains of the euro. Since the last few days of February and throughout the whole month of March, bears have been on the defensive as oil prices fail to recover. However, with recent talks about the US President Donald Trump working together with his Russian counterpart, President Putin, to restore balance in the commodity market is buoying the Russian ruble against the euro. Technically, the EURRUB pair is still considered on a bullish path, evident on the chart. Looking at it, the 50-day moving average took off and left the 200-day moving average near the half-way mark of March. Meanwhile, the demand fo9r the euro has started to weaken as it continues to receive blows from the US dollar and the British pound. Such detrimental blows affect the performance of the euro against other currencies such as the Russian ruble.

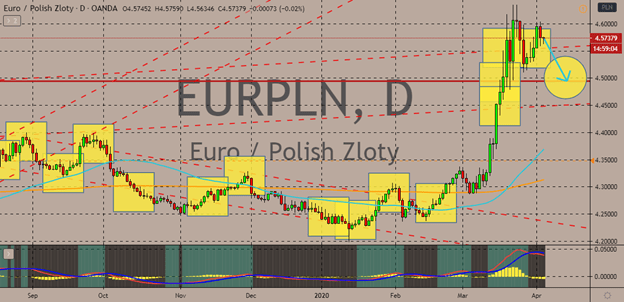

EURPLN

The euro is bound to slide against the Polish zloty, allowing EURPLN bears to force the pair to its key support in the short-term sessions. Looking at the chart, the EURPLN pair is still significantly trading bullish as the 50-day moving average climbs higher farther from the 200-day moving average. The eurozone’s single currency takes several hits against the US dollar and British pound, affecting its overall performance in the foreign exchange market. A Portuguese official warned the members of the eurozone of a possible single currency break up if the members of the bloc continue to feud about the rescue plan to save Italy and Spain. Apparently, the members of the bloc still cannot agree on a plan that would help cushion the impact on the pandemic to the most-hit countries. So far, among the members, Italy and Spain are the most virus-struck countries. Meanwhile, Poland pushes its election scheduled early next month despite the pandemic.

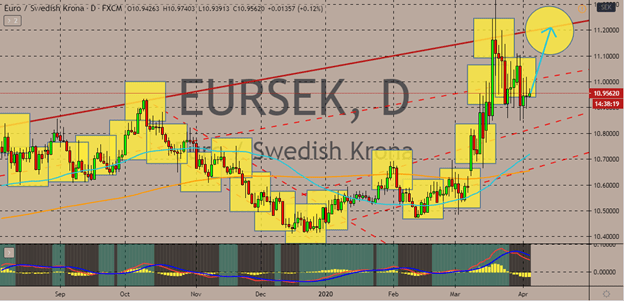

EURSEK

Both the euro and the Swedish krona are facing setbacks in the market. However, looking at it, the euro has more potential to force the direction in its favor. Considering the impact of the rallying sterling and buck, the euro remains on the positive territory against the Swedish krona. And despite the conflict between the members of the bloc, euro bulls remain determined to propel the pair to its key resistance level. Investors of the euro are looking to push the 50-day moving average away from the 200-day moving average, signaling further dominance in the pair. As for the Swedish krona, negativity brought by forecasts of 4% contraction in the GDP hits its performance in the foreign exchange market. The Swedish economy is expected to shrink significantly this year courtesy of the pandemic. The forecasted plunge is expected to rival and top the experience of the country during the global financial crises more than ten years ago.

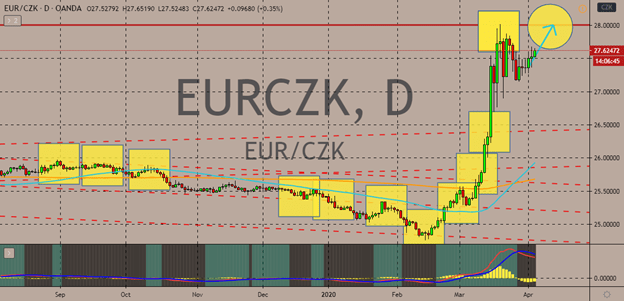

EURCZK

The Czech koruna is on the defensive against the euro. Bulls are expected to push the pair to its key resistance level before the second half of the month starts. Late last month, bullish EURCZK investors were able to lift the 5-day moving average away from the 200-day moving average. And it’s most likely that the momentum will continue, possibly allowing bulls to break through the resistance level. Just last week, the central bank of the Czech Republic slashed their official interest rates by 0.75 basis points, draining the strength of the Czech koruna in the market. The Czech National Bank decided to cut its rates from 1.75% to just 1.00%. Aside from that, at the beginning of the month, the Czech Republic’s Markit PMI dropped from 46.5% to 41.3%. The index measures the level of the purchasing managers in the manufacturing sector of the country, and its drop disappointed traders who expected it to only slide to 42.5%.

COMMENTS