Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

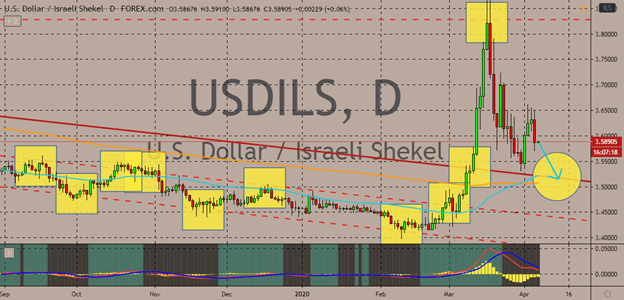

USDILS

The Israeli shekel has managed to push the pair downward after it peaked at its resistance level in the earlier half of March. Since then, bulls have struggled to prop up the pair despite the massive demand and love for the greenback in the foreign exchange market. Looking at the charts, it appears that bulls have not yet dominated the pair as the 50-day moving average has just recently advanced against the 200-day moving average. And things could still change, and bears could still force the 50-day MA lower as the Israeli shekel hustles to reach its support levels before the second half of the month. Just yesterday, the Bank of Israel has decided to cut its interest rates from 0.25% to just 0.10%, slashing deeper than the projected 0.18% prior. Negative rates aren’t taboo anymore in Israel as the authorities work hard to buoy the economy amidst the pandemic. The Knesset passed an amendment to add billions more to help Israel fight the virus’ impact on the economy.

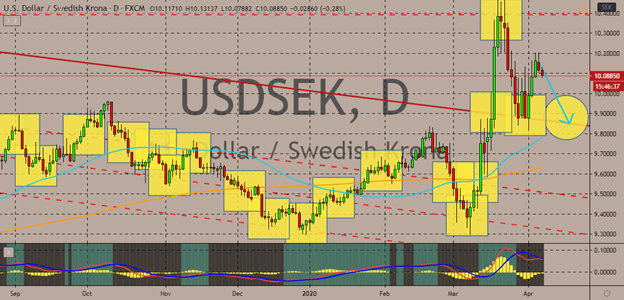

USDSEK

Despite the contractions recorded from the Swedish economy, USDSEK bears remain determined to push the pair down to its support levels. Apparently, bulls are still dominant as the 50-day moving average continues to advance farther away from the 200-day moving average. Earlier this month, both the manufacturing and services PMIs from Sweden reported contractions for the month of March. The manufacturing PMI reportedly crashed from 52.7% prior to just 43.2%, falling way deeper than the projected 52.4%. Meanwhile, the monthly Swedish services PMI dropped from 56.4% to just 46.9% according to the official data released last Friday. Meanwhile, as the coronavirus pandemic continues to wreak havoc, more upcoming stimulus measures from the US authorities could potentially weaken the US dollar. In that case, bears will have a better chance of breaking through the key support levels in the upcoming trading sessions.

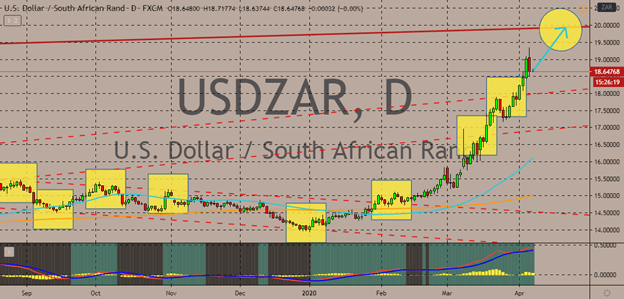

USDZAR

The South African rand remains on the defensive against the US dollar despite its attempt yesterday to recover. Following yesterday’s drop, the greenback immediately pushed its gas pedals, causing the pair to steady this Tuesday’s trading. With that, it’s believed that the pair could still eventually reach its resistance level by the halfway point of the month. The price trend is bullish as seen evident on the 50-day MA and 200-day MA condition. Meanwhile, in South Africa, the central bank said yesterday that it would be providing regulatory relief measures for local banks to support them in managing the impact of the coronavirus pandemic. According to reports, the measures include capital reliefs on restructured loans that were already in good condition prior to the COVID-19 pandemic. Aside from that, the Prudential Authority of the South African central bank would also lower the liquidity coverage ratio and lessen the capital requirements.

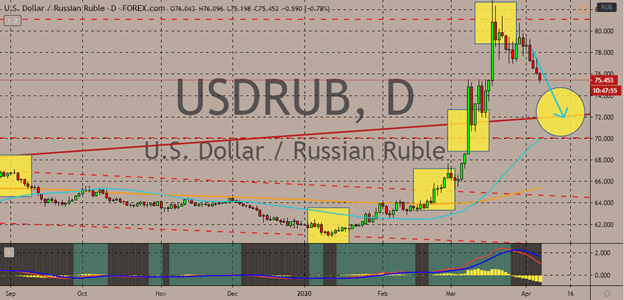

USDRUB

The Russian ruble advances against the US dollar as oil prices start to recover. Aside from that, bearish traders are taking advantage of the greenback’s confusion from yesterday’s news from the stock market. Apparently, the buck buckled after the Dow Jones Industrial Average rallied about 800 points in the stock market thanks to the sudden surge of optimism. The reason for the DJIA’s rally is the Billionaire Bill Ackman. However, what confused traders are the concerning expressions from bot the CEO of JPMorgan and Ex-FED Chair on separate interviews. Following Monday’s event, the US dollar further buckled against the Russian ruble. Looking at the chart, the pair is still technically trading on bullish grounds considering that the 50-day moving average is still well above the 200-day moving average. Meanwhile, crude prices are starting to recover thanks to the efforts of Trump and Putin, playing in favor of the RUB in the forex market.

COMMENTS