Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

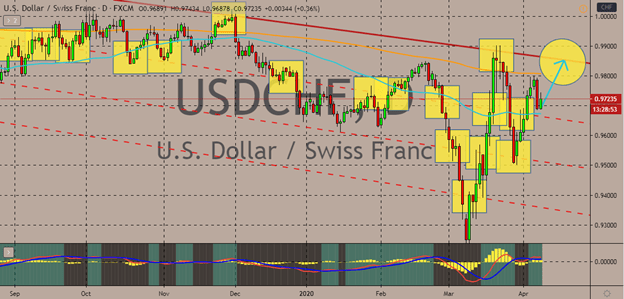

USDCHF

Bullish traders managed to force the pair back up after the fall yesterday. The USDCHF pair took a dive in the trading sessions on Tuesday. This is following the weakness of the greenback from the surge of the DJIA. It’s worth noting that the pair remains in bearish territories. This is due to the 50-day moving average continues to trade below the 200-day moving average. Still, bullish investors are determined to prop the pair to its resistance level in the coming sessions.

The Swiss franc is weakening against the US dollar and other major currencies. This is due to the central bank’s sight deposit holdings. It recently hiked to its second-highest level in about 12 months. It’s worth noting that the Swiss National Bank has been working for more than a year to depreciate the value of the Swiss franc in the foreign exchange market due to the massive increase of investors seeking its safe-haven appeal. And because of the pandemic, the Swiss franc has appreciated in value.

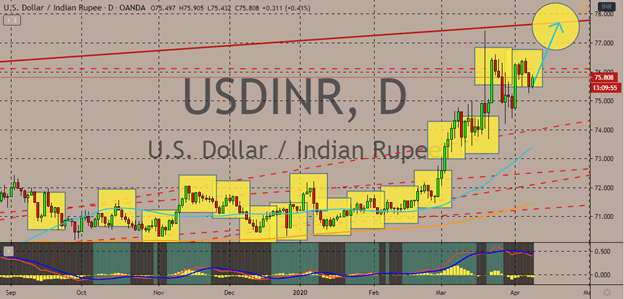

USDINR

As India becomes paralyzed and the situation there continues to worsen, the Indian rupee remains on the defensive against the US dollar in the market. The USDINR pair recently reached its all-time highest as the Indian rupee fails to defend itself. Unfortunately for bearish traders, the pair is still widely expected to continue to climb in the coming sessions. Looking at the pair, it’s seen that the 50-day moving average remains significantly farther away from the 200-day moving average.

The Indian rupee will remain under pressure as the damage of the coronavirus pandemic to India’s economic activities becomes more evident. Just recently, the HIS Markit India services business index dropped below the 50-mark that separates contraction from expansion. Economists believe that the worse has yet to come to the country as their lockdown there has just begun following the announcement of Narendra Modi, the Indian Prime Minister.

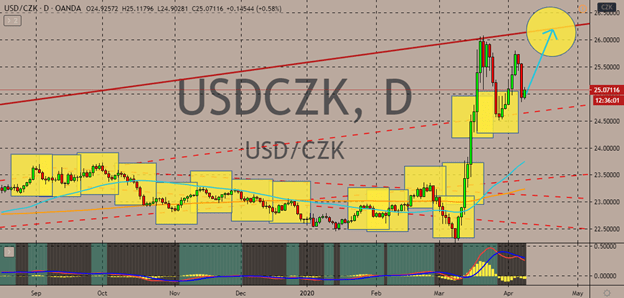

USDCZK

In the recent sessions, it has been a constant tug of war between bulls and bears for the USDCZK pair. The Czech koruna’s attempt to recover continuously gets foiled by the US dollar. However, the results from the Czech Republic’s unemployment rate caught investors off guard as it remains unmoved for the month of March. The results from the unemployment rate prevented the greenback from pulling the pair higher this Wednesday.

However, it’s still believed that the pair will eventually climb back up to its resistance levels by the half-way mark of the month. Despite recent contractions, the pair is running on bullish territories as the 50-day moving average continues to advance against the 200-day moving average. Meanwhile, the US dollar remains prominent in the foreign exchange market. This is despite the massive surge in the number of coronavirus cases in the United States. It is now the country with the highest number of cases.

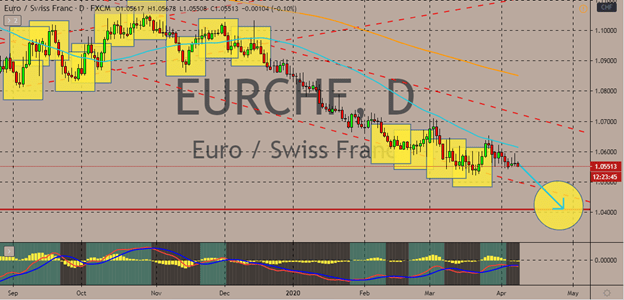

EURCHF

Unlike its performance against the US dollar, the Swiss franc is dominant against the bloc’s single currency. Analysts expect that the bears will force the pair lower to its support level by the latter half of April. In recent months, the Swiss National Bank has worked on deprecating the value of the Swiss franc against major currencies such as the euro. However, as Europe continues to receive blows from the devastating pandemic, the Swiss franc would most likely remain on top of the euro as investors run towards the safe-haven appeal of the currency.

In recent months, the Swiss franc has been in demand due to the fears of the paralyzing pandemic. However, the franc momentum against the euro is somehow disrupted by the rebounding US stock market. See, since the week began, US indices have managed to bounce backs thanks to the revived optimism of stocks traders. This optimism also affects the Swiss franc but has not influenced the euro.

COMMENTS