Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

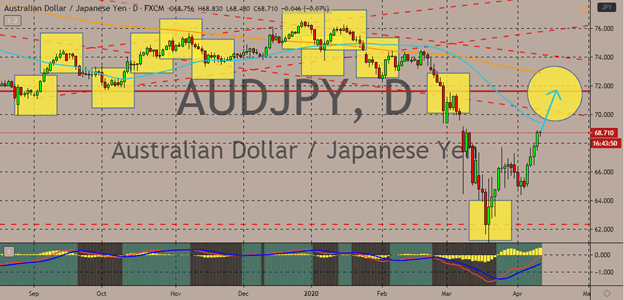

AUDJPY

The Australian dollar rallied against a number of major currencies and safe-haven assets such as the Japanese yen in today’s trading sessions. It’s expected that bullish investors will keep the momentum. They will eventually force the pair to its resistance level in the short-term run.

The reason for the Australian dollar’s strength is the difference in the approach of the RBA from other central banks. See, as major banks from all across the globe unleash unprecedented measures, the Reserve Bank of Australia appears to be relatively hawkish based on its meeting earlier this week. Technically, the pair is still trading on a bearish note. The 50-day moving average is farther below the 200-day moving average. However, bulls remain optimistic and are looking to force the 50-day MA to pivot. Meanwhile, due to the concerns looming over the Japanese economy, the Japanese yen has struggled to defend its gains against the Australian dollar.

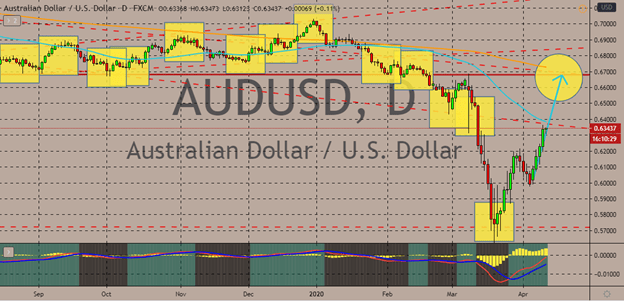

AUDUSD

The US dollar is now on the defensive in its matchup against the Australian dollar. The pair is expected to rally and reach its resistance on the halfway mark of the month as bullish investors hustle to regain their loses. It appears that the pair is still widely on a bearish track. The 200-day moving average continuing to loom above the 50-day moving average indicates this. Fortunately for bulls, the Reserve Bank of Australia’s hawkish stance against economic stimulus is providing optimism for the Australian dollar. Meaning, if the measures of the RBA continue to work, the 50-day MA pivot and overtake the 200-day MA.

As for the beloved buck, its strength in the forex market is slowly deteriorating. The number of COVID-19 deaths continues to surge within the US. As of writing, it’s reported that there are now nearly 15,000 deaths in the United States and more than 435,000 confirmed cases. Unfortunately, the numbers are still projected to rise these coming days.

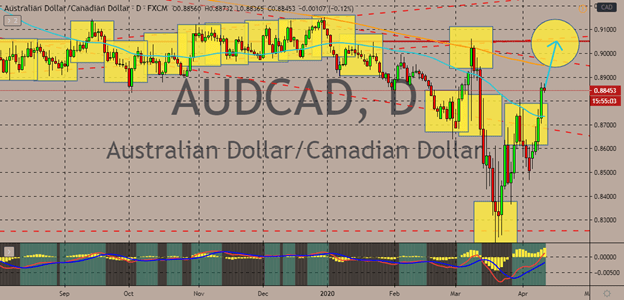

AUDCAD

Bears are back on the defensive thanks to the falling crude prices and jaw-dropping employment change results from Canada. As of writing, the pair is seen steadying in sessions but unfortunately for the Canadian loonie, it’s expected to depreciate. Yesterday, Canada reported that its March employment change figures collapsed from 30.3K to an extremely alarming -1,010.7K because of the virus.

Aside from that, the country’s unemployment rate reportedly jumped from 5.6% prior to 7.8% according to Statistics Canada. And to make matters even worse for the Canadian loonie, commodity traders are starting to worry for oil prices as projections show that prices would soon drop to their lowest levels. And as for the Australian dollar, the economic stimulus unleashed by the Reserve Bank of Australia has been working well, reviving the confidence of bullish investors. The hawkish approach of the RBA separates it from other major central banks around the globe.

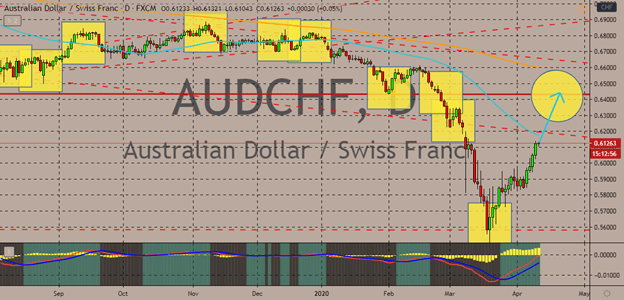

AUDCHF

As of writing, the pair looks relatively steady this Friday’s trading. The strength of the Australian dollar against other currencies such as the US dollar and the Japanese yen isn’t working for its matchup against the Swiss franc. In a recent news briefing in Switzerland, President Simonetta Sommaruga said that the government is preparing to ease and adjust the regulations and restrictions in the country to relieve pressure from people and businesses. The move somehow allowed the Swiss franc to steady against the Australian dollar in the forex market.

Looking at the chart, the pair remains relatively bearish despite the recent rallies. That is evident on the two moving averages, wherein the 50-day MA is sliding lower against the 200-day MA. According to the government, the Swiss economy could slip by 10% due to the pandemic. The country’s workforce and major industries have been affected by the paralyzing pandemic.

COMMENTS