Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

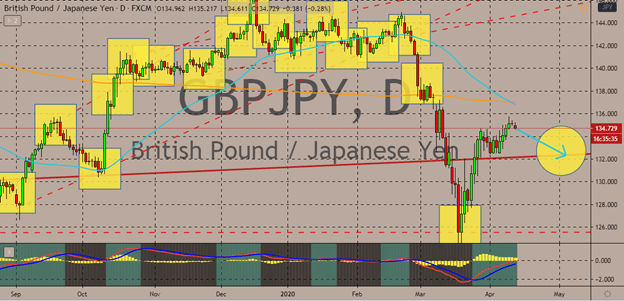

GBPJPY

Coronavirus fears caused the pair to slightly slip in today’s trading leading to a risk-off sentiment for the British pound. That coupled with the recent comment about a 30% contraction in Britain’s economy caused the pound sterling to buckle against the Japanese yen today. The pair is now widely believed to hit its support level as the Japanese yen takes control. The number of coronavirus cases is already approaching the 2 million mark and with fears continuing to loom over the global economy, it shifts the landscape in favor of the Japanese yen once again.

The bright outlook for the Japanese yen also followed the negative outlook for the global economy presented by the IMF. Just recently, the International Monetary Fund’s financial and economic assessment sparked heightened concerns of a deep recession for the global economy. The recession comes at a volatile time as the credit conditions continue to become fragile in the corporate debt sector.

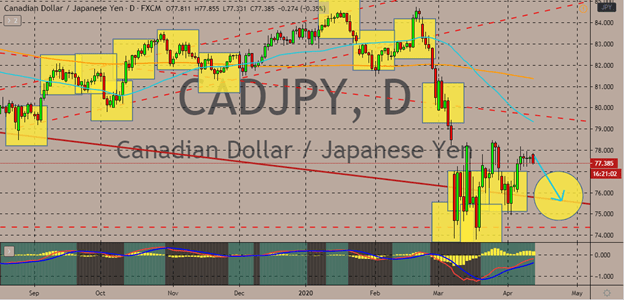

CADJPY

The Canadian dollar is in trouble against the Japanese yen in the coming sessions. The massive plunge in Canada’s employment change report from last week strained the Canadian dollar in the forex market. Last week, Statistics Canada reported an alarming plunge in the employment chance from 30.3K to -1,010.7K in March. The report gave an uneasy feeling for bullish traders about the outlook of the Canadian dollar.

Meanwhile, the unemployment rate of Canada jumped from 5.6% to about 7.8%, unfortunately surpassing the projected 7.2%. As for the Canadian dollar, the oil-susceptible currency was seen caught in a political crossfire between Russia, Saudi Arabia, and Mexico following the intense OPEC meeting. Over the weekend, the Organization of the Petroleum Exporting Countries unleashed a massive supply cut of about 9.7 million BPD, the highest in the record, to buoy crude prices in the global market.

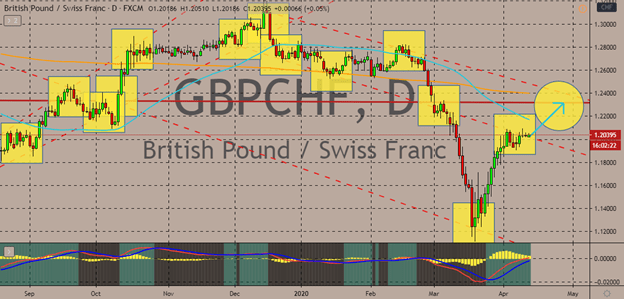

GBPCHF

Bulls are looking to push the pair to its resistance level in the coming sessions. The British pound is looking to recover some of its major loses against the safe-haven Swiss franc. Looking at the chart, the GBPCHF pair is still technically trading on bearish territories considering that the 50-day moving average has fallen well below the 200-day moving average.

The British pound received support from the mixed results from the British economy last week. Investors were somehow thrilled with the better than expected results from February that were reported late last week. Today, both the United Kingdom and Switzerland are celebrating Easter Monday, thus, resulting in small movements from the pair today. The concerning news from the recent IMF’s assessment failed to give the safe-haven appeal of the Swiss franc a boost, leaving the beloved currency on the defensive against the determined British pound.

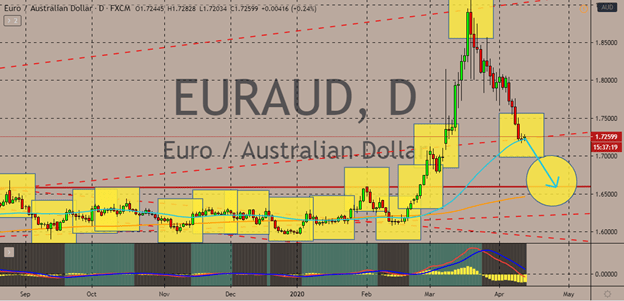

EURAUD

The Reserve Bank of Australia’s measures are starting to show promising results and the euro is in deep trouble. Bearish investors are hustling to force the 50-day moving average to pivot and dive in the trading sessions. Over the past few decades, Australia has been able to efficiently navigate through the turmoil from the global economy, and perhaps this coronavirus may end its streak. Despite negative predictions for the Australian economy, bulls remain determined to push the EURAUD pair lower.

One of the main factors in play now is that the impact of the virus on the eurozone is greater than on its impact to Australia, weighing heavily on bulls. The pandemic has greatly paralyzed the European market. It has exposed the differences between the members of the block. This is because they have struggled to agree on a unified stimulus for the whole region. Apparently, the intensity of the impact in the eurozone varies, but its biggest economies are the ones most affected.

COMMENTS