Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

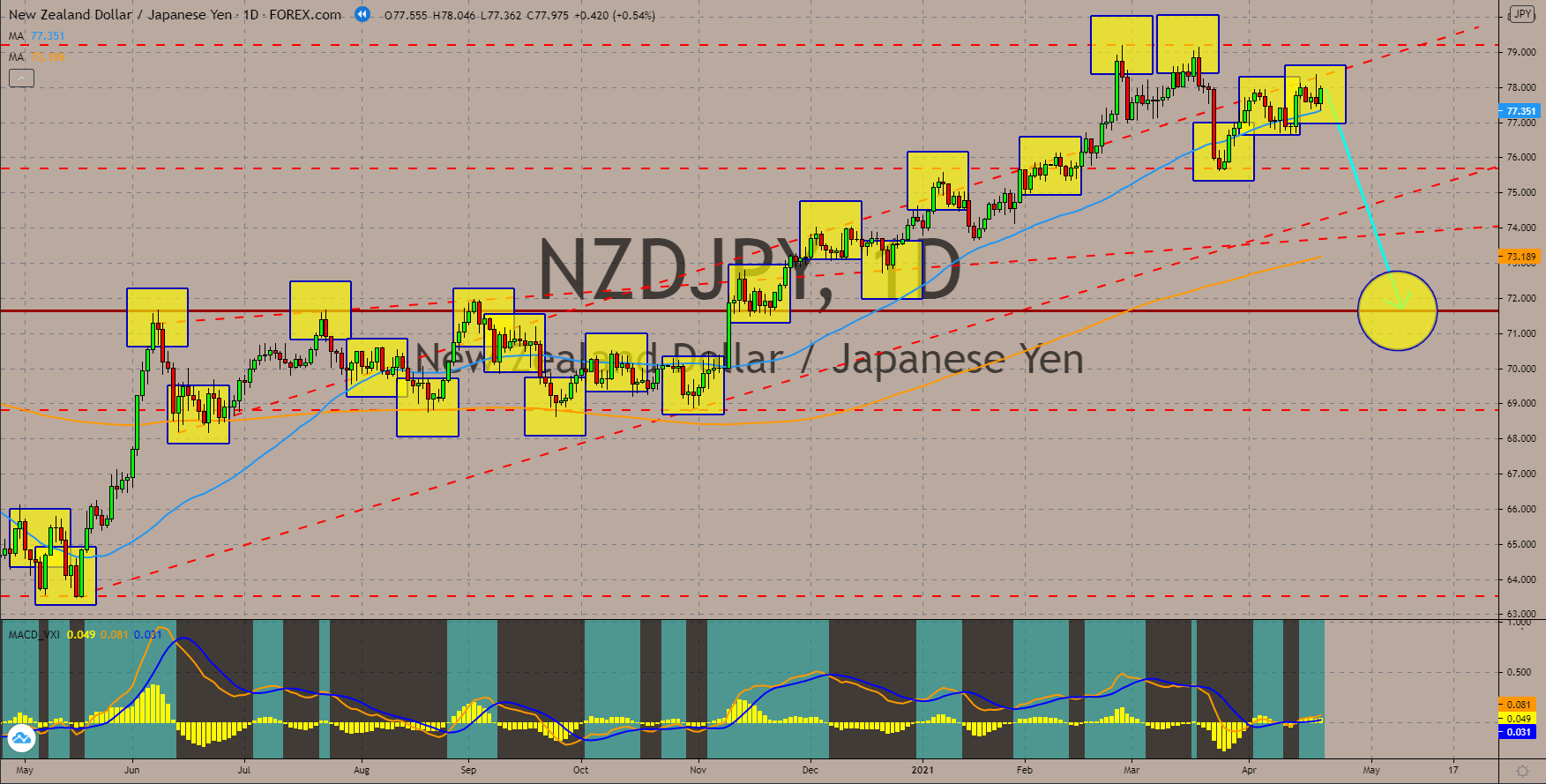

NZDJPY

Japan recorded its highest daily infections for the past three (3) months on Thursday, April 22, at 5,526. Analysts expect a surge in demand of the yen in coming sessions as investors seek haven in the local currency, which serves as a store of value. The fourth wave of the coronavirus pandemic could derail the economic recovery of the third-largest economy in the world. Analysts believe that the surge in fresh cases could also result in another delay of the Tokyo Olympics and hurt businesses. In addition to this, a possible national emergency or lockdown could be implemented in the coming days, which could last up to two (2) weeks to contain the coronavirus. The 50-day moving average at 77.351 is acting as the immediate support since the end of March, but pressure mounts at the78.000 level. Prices could revisit a major support line at 71.636. Meanwhile, the MACD and Signal lines along with the Histogram remained flat since the beginning of the month.

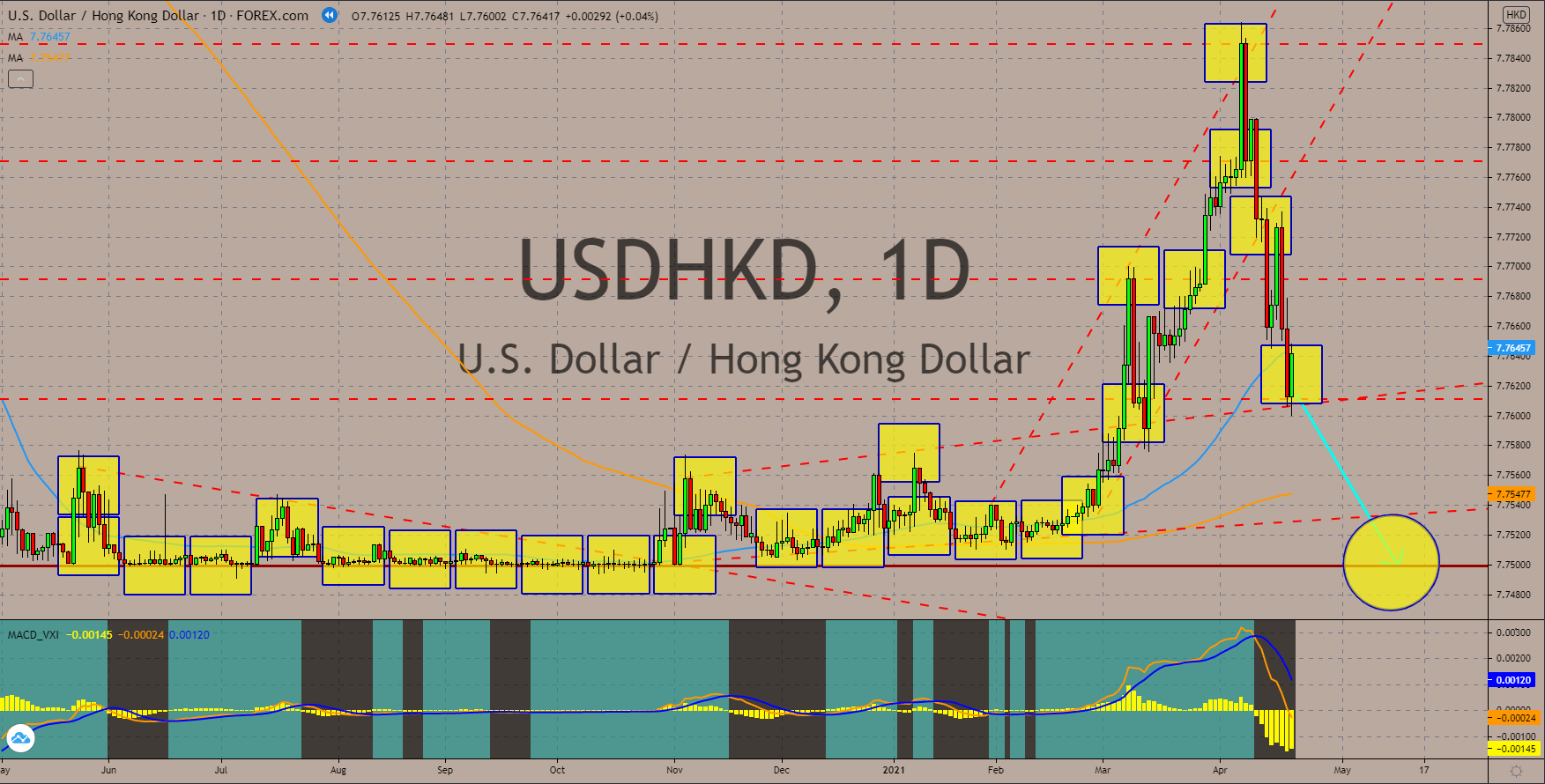

USDHKD

Despite having one (1) of the fastest vaccination programs, economic activity in the United States still fell as seen in inventory build up of crude oil. Analysts estimate a continued increase in the demand for the black gold, but results show otherwise. The American Petroleum Institute (API) posted a build-up of 0.436 million barrels last week while the Energy Information Administration (EIA) had a result of 0.594 million barrels. Meanwhile, the increase of 547,000 in the initial jobless claims report is adding pressure for the US dollar to compete with the equities market. The reported number was the lowest since the pandemic began in March 2020. Also, the US bond yield has been on a continuous decline. The 10-year bonds hit its lowest record this April on Thursday, April 22, when yield dropped to 1.545%. Prices are now trading below the 50 MA and are expected to return to a key support area at 7.75000. Meanwhile, the Histogram indicator will continue to shrink.

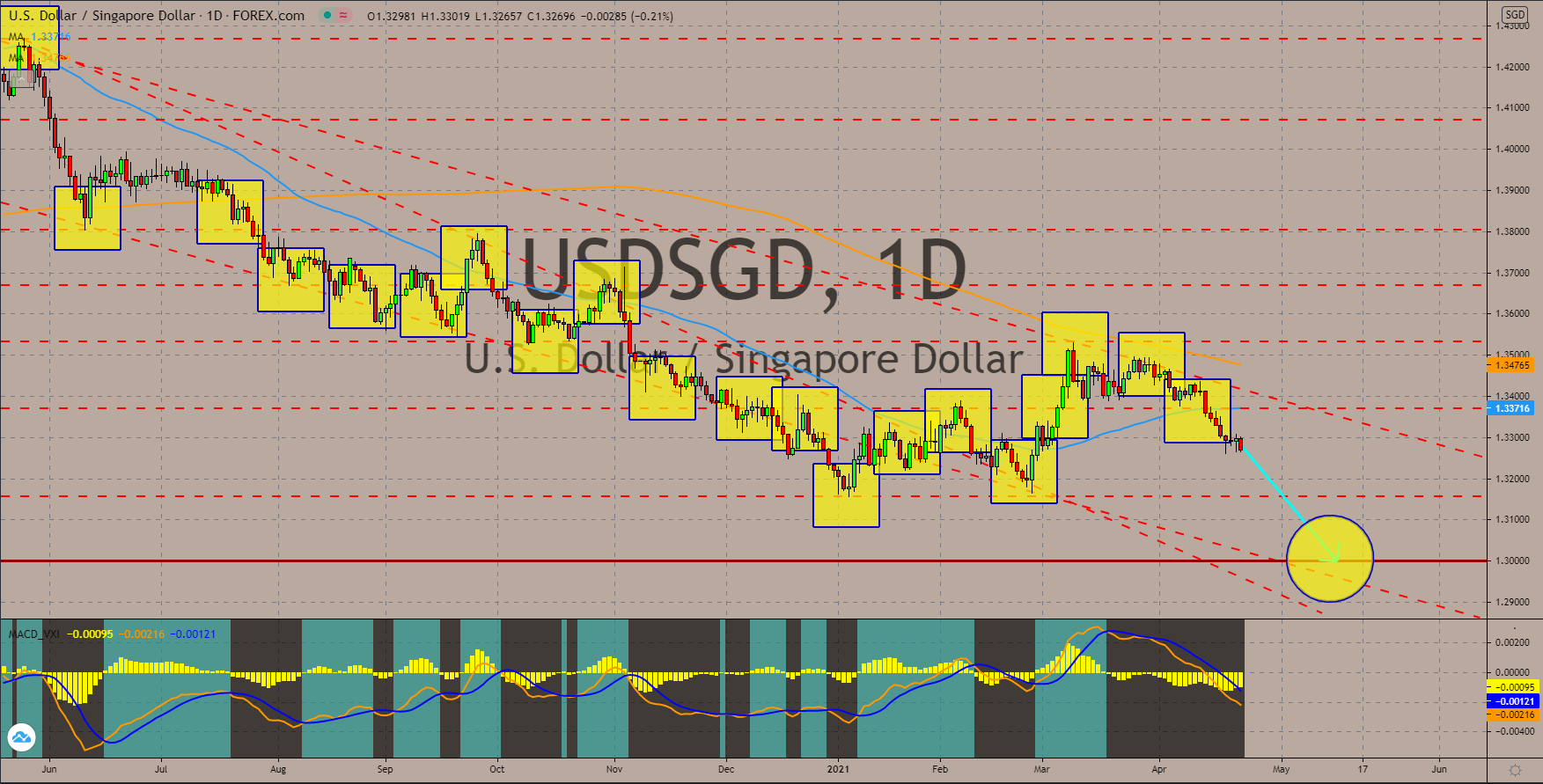

USDSGD

Singapore’s economy grew for the first time in the past 12 months after a YoY figure showed the city state advancing by 0.2% in March. The manufacturing output was the main driver behind the growth, recording a 7.5% expansion. Meanwhile, both services and construction outputs remain on the negative territory with contractions of -20.2% QoQ and -1.2% YoY, respectively. The strong demand for chips and manufacturing equipment will continue to help the Singapore economy to recover in the short to near-term. Meanwhile, the Monetary Authority of Singapore (MAS) kept its interest rate unchanged at the recent meeting. At the same time, it gave comments on the potential economic growth of Singapore. Expectations for GDP in fiscal 2021 is an increase around 4.0% to 6.0%. Both the 50 and 200 moving averages show no sign of a possible reversal in prices. The MACD line, Signal line, and Histogram are also on the lower end of their range.

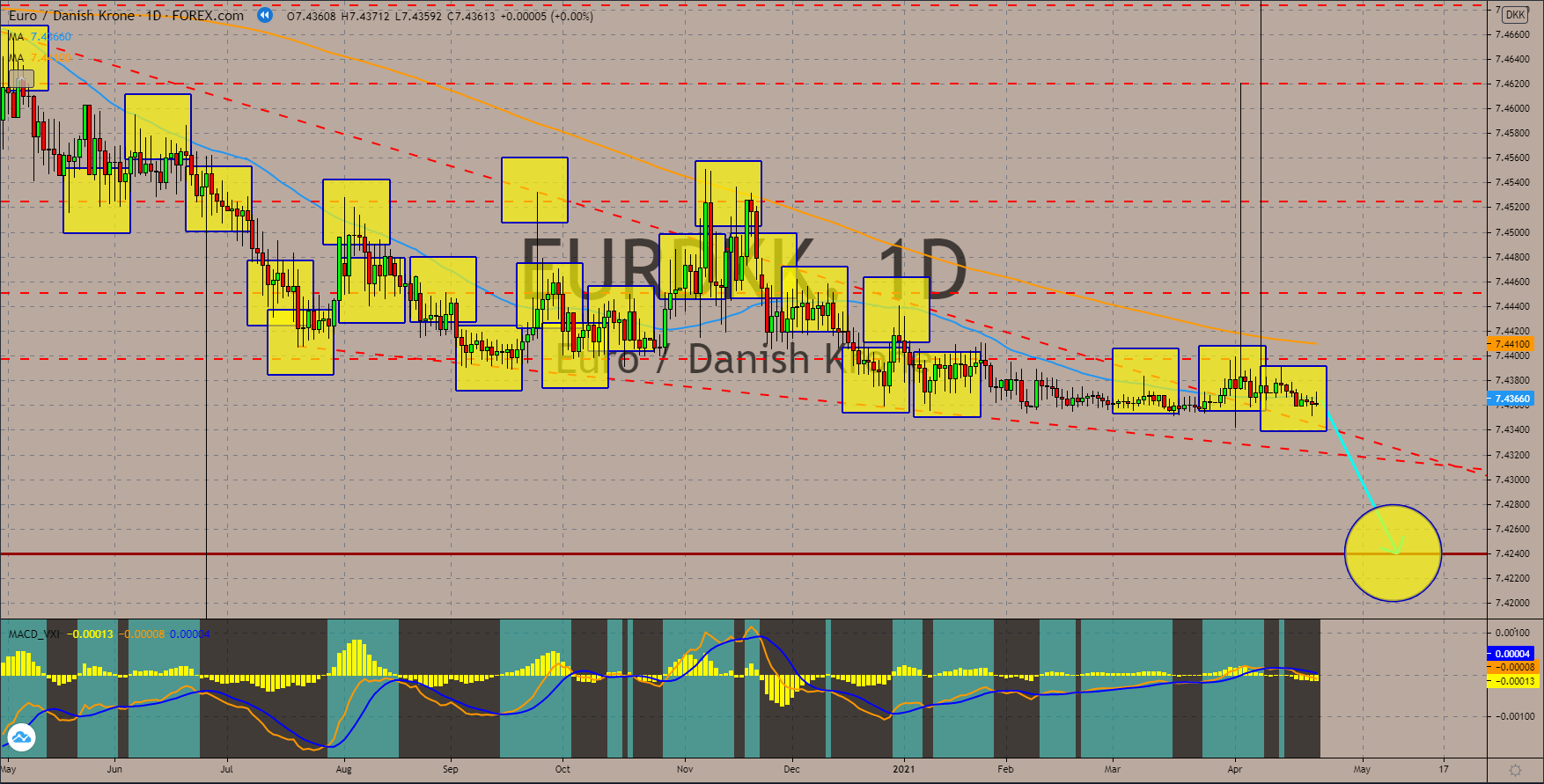

EURDKK

Market participants placed their hopes on the Danish krone as Denmark lifted several COVID-19 restrictions on Thursday, April 11. This was amid the declining cases of coronavirus in the country. Meanwhile, online job posting hit record high in March of 26,600. This was a substantial increase from February’s posting of 25,400. The private sector saw the biggest increase in job postings of 19% while the public sector advanced by 17%. On the other hand, the European Central Bank (ECB) kept its zero percent interest rate intact until the next meeting. ECB President Christine Lagarde also said that the current policies by the central bank will remain, which means that it plans to spend the remaining of the 2.2 trillion PEPP (Pandemic Emergency Purchase Programme) until March 2022. The EURKK pair failed below the 50-day moving average on Friday last week with further decline in prices expected in coming the session towards the key support of 7.42400.

COMMENTS