Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

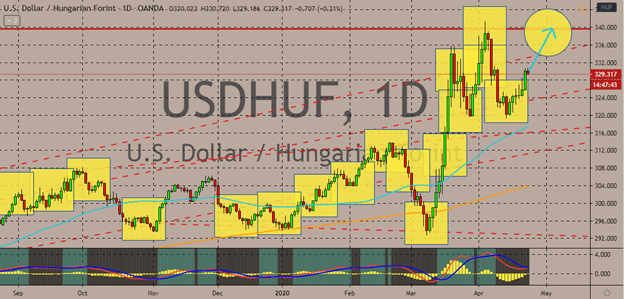

USDHUF

The Hungarian forint has managed to steady against the US dollar this Thursday. This is in thanks to the broad retreat seen by the US dollar. However, it’s widely expected that the pair will climb to its resistance in the coming trading sessions. Looking at the pair, it appears that the US dollar has completely dominated the Hungarian forint. The 50-day moving average trade higher from the 200-day moving average. Also, there have not been any high importance reports or events from the Hungarian economy this week. That shifts the focus of investors on the ongoing chaos faced by the oil market which has raised concerns towards the whole market.

The overall concern of the financial market makes other currencies such as the Hungarian forint currencies less attractive and raises the spotlight to safe-haven currencies such as the US dollar. Meanwhile, the US dollar is facing temporary weakness as the US Senate approves another coronavirus rescue package.

USDMXN

The Mexican peso is on its back foot against the US dollar despite the slight turbulence faced by the USD today. Projections say that the pair will hit its resistance by the end of the month of by early May. Looking at the chart, it appears that bullish investors aren’t fazed by the efforts of bears. We see the 50-day moving average remains significantly higher against the 200-day moving average. Of course, the safe-haven appeal of the US dollar that has been recently boosted by more events in the market has proven to be the greatest weakness of bearish traders.

Meanwhile, the US dollar has retreated this Thursday. This follows the US Senate approving another $500 billion coronavirus rescue package to help small businesses across America. The new round of stimulus has affected the strength of the US dollar this Thursday. However, it’s expected that bullish investors will brush it off eventually. They will then continue pulling the pair upwards to its resistance level.

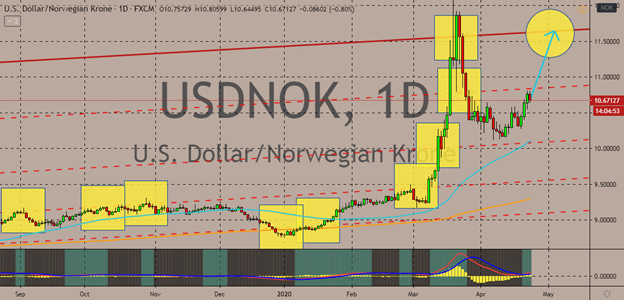

USDNOK

Bullish investors are getting back onto their feet after the historic plunge of the crude market earlier this week. However, as of today, the pair has steadied due to the broad retreat faced by the greenback. Still, it’s believed that the pair will once again climb to its resistance level in the coming sessions. The pair returned to its upward direction after the unprecedented fall of crude oil which stirred chaos in the financial market and reinforced the US dollar.

Also, crude oil is one of the main exports of Norway, thus if the crude market continues to spiral in chaos, the US dollar will continue to have the upper hand against the Norwegian krone. Most of the revenue earned by Norway on its crude exports enter the country’s Sovereign Wealth Fund. Thus, the Norwegian krone is also a commodity currency with strong correlations with crude prices. However, the $500 billion second wave rescue package of the US Senate drained the USD today in the sessions.

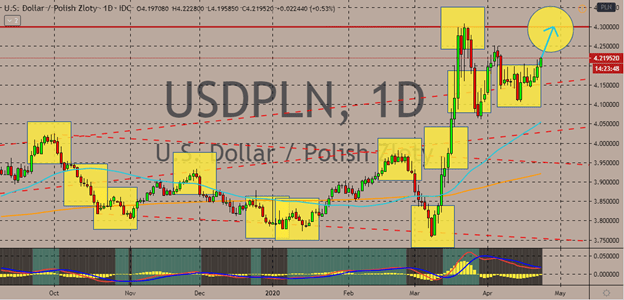

USDPLN

Despite the broad weakness of the US dollar today, the Polish zloty still found itself on the defensive. The magnitude of the impact of the coronavirus to the Polish economy has placed the Polish zloty in a tough predicament. It has cemented the bullish fate of the USDPLN. Since the pair bounced off its support, it’s been expected that the momentum will help bulls reach the resistance area in the coming sessions.

Experts say that the Polish economy has lost roughly PLN 80 billion thanks to the unforgiving pandemic. The sheer impact of the virus in just a month has drained the confidence of investors. Aside from that, another factor that’s working in favor of bullish investors is the glowing safe-haven appeal of the US dollar amidst the coronavirus crisis. The question of whether the pair has enough to strength to break past its resistance level still stands as the US economy might pump out another stimulus package to help the economy.

COMMENTS