Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

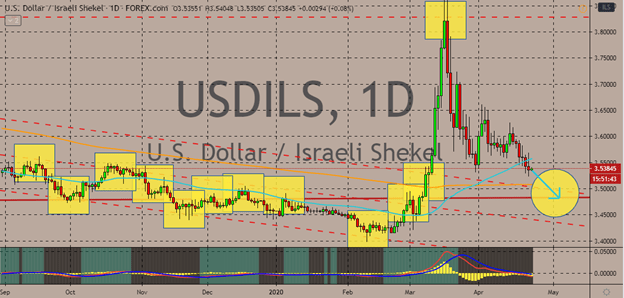

USDILS

The stronger than expected consumer price index results that were issued last week cemented the bearish fate of the USDILS pair. It’s believed that the pair will soon extend lower to its support levels as the Israeli shekel continues to overpower the US dollar. Looking at the pair, it appears that it’s still bullish considering that the 50-day moving average is steadily trading above the 200-day moving average. However, bearish investors are looking to force the 50-day to pivot and dive in the coming sessions. Moreover, the Israeli Central Bureau of Statistics released the country’s monthly consumer price index (CPI) earlier last week, showing progress from -0.1% to about 0.4%, improving beyond the projected 0.3% prior. The good news gave the Israeli shekel to rally against the thriving US dollar. Although as of today, the exchange rate is seen slightly recovering, but bears are still determined to force the pair lower to its resistance.

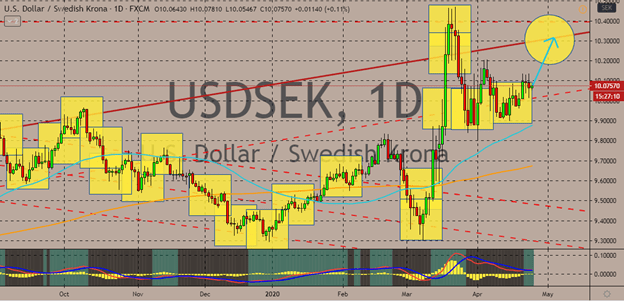

USDSEK

The Swedish krona remains on the defensive against the US dollar after bears failed to break past the support level which caused the pair to bounce back. The better unemployment rate results from Sweden was immediately countered by the drop in the country’s consumer confidence and manufacturing confidence. The two aforementioned reports drained the strength of the Swedish krona, placing it on a though predicament against the US dollar. Also, the rising number of coronavirus cases in Sweden has also weakened it against the US dollar. Currently, Sweden has the highest number of coronavirus deaths among its Scandinavian peers, which isn’t a good sign for the country. As for the greenback, some experts doubt whether the currency has more fuel in its tank to rally even higher against the Swedish krona. The suggestions draw questions as to whether the pair could break past its resistance or just bounce off once again.

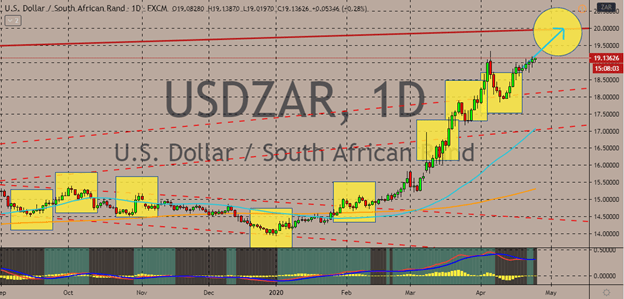

USDZAR

The South African rand is standing against the US dollar, preventing it from running away with hefty gains this Friday. It appears that bullish investors are failing to snatch bigger gains in the previous sessions against the rand. Looking at the chart, it appears that bulls are widely in control based on the significant distance between the 50-day moving average and the 200-day moving average. However, it’s worth noting that the rand is also failing to recover against the US dollar despite the broad weakness faced by the beloved buck following the latest wave of stimulus package. The greenback is seen weakening in the forex market but remains on top of the South African rand. However, bearish investors are hoping that the South African rand could recover considering that the country is now preparing to lift restriction which will finally reopen the economic activities of the South African economy amidst the pandemic.

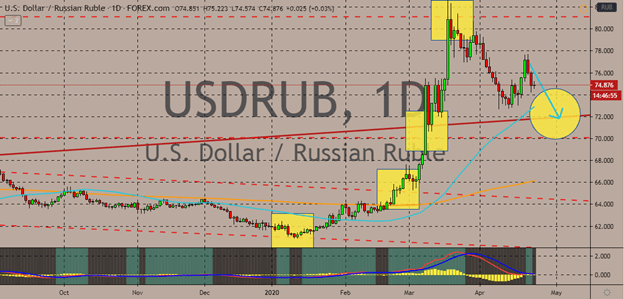

USDRUB

The Russian ruble is forcing the US dollar to its support levels as it gathers strength from the stabilizing commodity market. The status of the crude market very much determines the fate of the pair as, of course, the safe-haven appeal of the US dollar relies on it and the strength of the Russian ruble is related to the prices. The pair is expected to touch down to its support levels by the end of the month or by the first few days of April. Bearish investors are hoping that the oil market continues to stand stronger which will be beneficial for the Russian ruble. Meanwhile, it’s doubted whether the pair will break through its key support level considering that the Central Bank of Russia has reportedly been considering lowering its official rates. Reports say that the central bank isn’t afraid to cut its interest rates to support the economy and has chosen an expansionary policy in the past wherein it will gradually reduce rates to counter inflation slump.

COMMENTS