Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

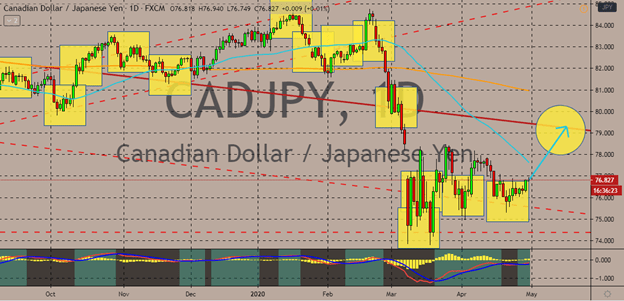

CADJPY

After bears failed to break past the support areas of the pair, bulls are expected to take advantage and force the pair to climb back to its resistance in the coming sessions. Looking at the chart, it’s evident that the pair bounced off twice when it hit it its support just above the 74.00 mark. The pair also recently failed to get through another support at the 75.00 mark, thus leaving room for bullish investors to take control. The Canadian dollar is also starting the get back up to its feet thanks to the improving sentiment on the global crude market. See, the commodity-linked currency has received a boost from the recent improvements in oil prices and the improving global financial conditions which are boosting the outlook of the Canadian economy. However, this doesn’t mean that the loonie will have a smooth climb as the safe-haven appeal of the Japanese yen is also shining thanks to the weak GDP data from the United States, the globe’s biggest economy.

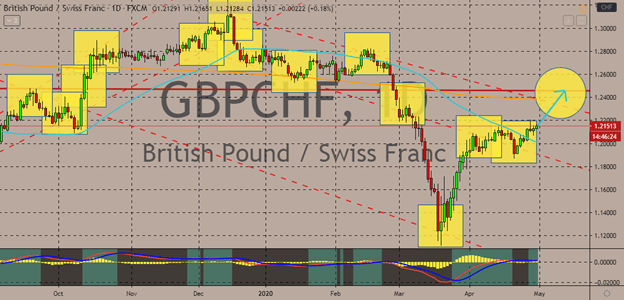

GBPCHF

The Pound sterling to Swiss franc exchange rate is widely projected to gradually climb to its resistance level in the coming days. The pair us fueled by the hopes of the British economy once again reopening. Also, the safe-haven appeal of the Swiss franc is also gradually faltering as investors focus on the news that some major economies, including Switzerland and other countries in the region, are also working on easing lockdown measures. Just this week, Switzerland has started to steadily reopen its economy. The country’s authorities have given the go signal for selected companies and businesses to reopen this week. Among the shops that reopened are hair salons, garden centers, and even DIY stores. The Swiss government has also ordered the country’s military army hands to distribute face masks every day to various shops and businesses in the country. The authorities are closely monitoring the effects of the gradual reopening.

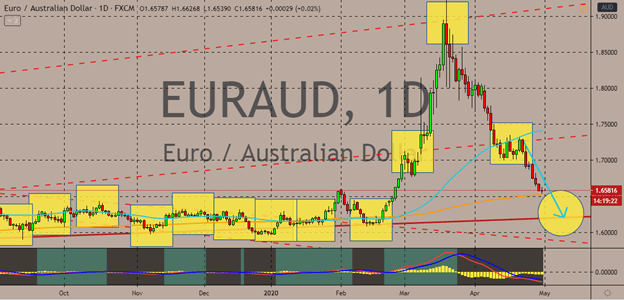

EURAUD

The European region’s beloved common currency is on the defensive against the Australian dollar. Investors of the pair are bracing themselves as the pair is widely projected to crash to its resistance in the coming sessions. The Australian dollar has been on a roll lately as it continuously securing major gains against most major currencies in the forex market. And looking at its matchup against the euro, it appears that it also has it in the bag as it drags the euro to its resistance level. The main source of strength of the Aussie is the stronger than expected performance of the country’s economy. Just recently, the Australian Bureau of Statistics published its domestic inflation report showing that it rose by 0.3% during the first crucial quarter of the fiscal year. The surge in the country’s inflation was mainly driven by the impact of the drought and bushfires which prompted a surge in food and beverage prices in Australia.

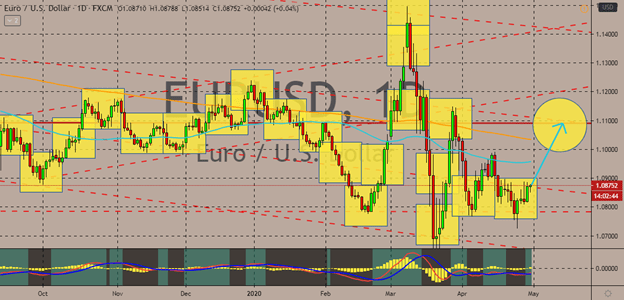

EURUSD

The euro to US dollar exchange rate has steadied this Thursday as investors wait for further guidance from the eurozone’s annual consumer price index report for April. Bullish investors of the EURUSD pair are praying for better than expected results that would propel the pair higher to its resistance area. Moreover, bears are holding on following the devastating results shown yesterday by the United States economy. Although a weaker result would raise its safe-haven appeal, it also poses a threat as it may prompt the authorities to unleash another round of stimulus that could very well damage the strength of the US dollar. Yesterday, the American gross domestic product, unfortunately, crashed from 4.8% to -4.3% in the first quarter of the fiscal year. So, technically speaking, if the European region actually dishes out green figures later on the scheduled reports, it will seal a bullish fate for the EURUSD pair.

COMMENTS