Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

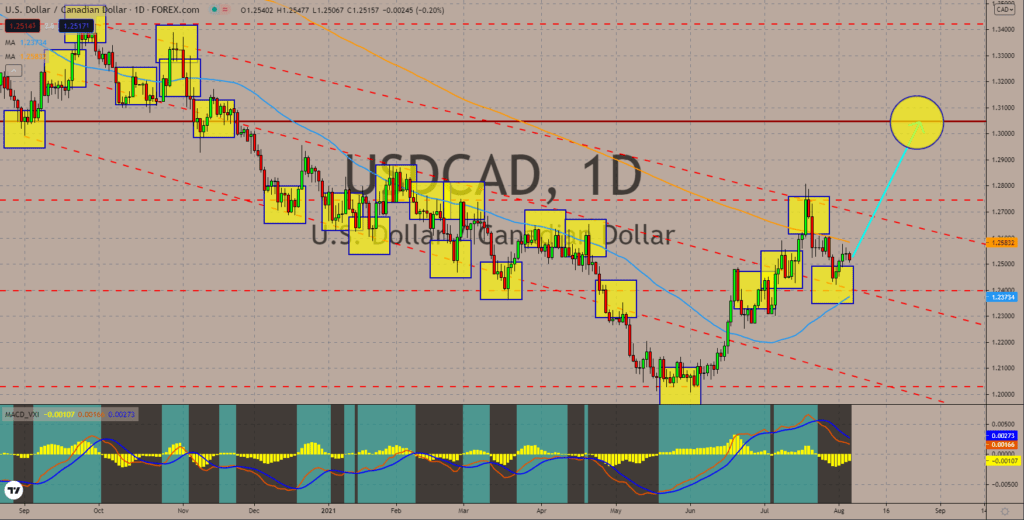

USDCAD

Canada faces geopolitics and economic challenges amidst the pandemic. The manufacturing sector on August 03 posted 56.2 points for July’s PMI report. While the figure is a minor decline from the previous 56.5 points, it represents the lowest data in 4 months. In addition, labor unions in customs and immigration threaten to reduce public services ahead of plans to reopen borders for vaccinated US citizens. The country grapples with the lack of workforce and tourists prompting PM Trudeau to ease US restrictions. Meanwhile, the final week of the extradition hearing for Huawei’s CFO could pressure Canada and US relations. The countries have the treaty to turn over fugitives, but Meng Wanzhou’s case is complex. Any decision by Ottawa could hurt its relations either with America or with China. The indicators reflect concerns over Canada’s economy and politics. The moving averages are showing signs of a “bullish crossover” for the USDCAD pair.

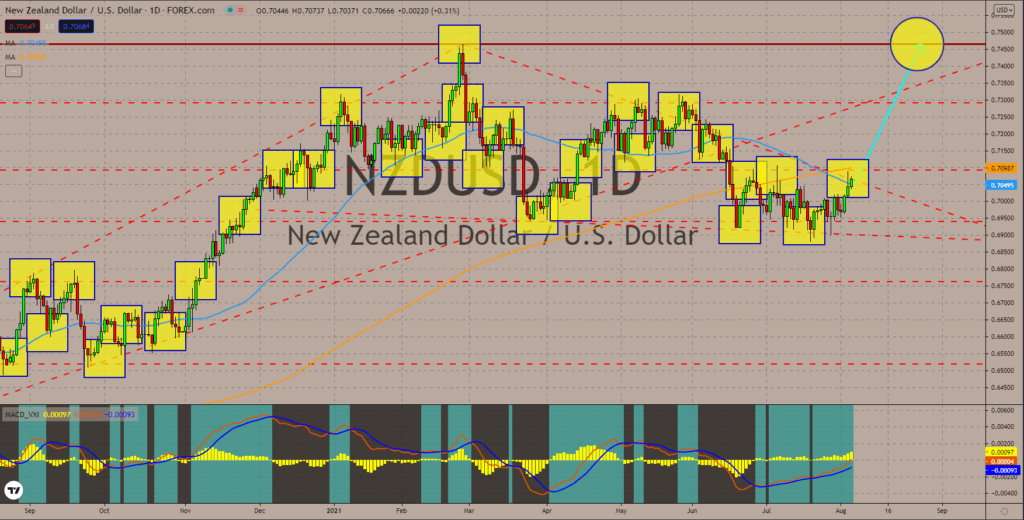

NZDUSD

Just like the Federal Reserve, the Reserve Bank of New Zealand (RBNZ) has a mandate of keeping inflation at a certain percentage and maximizing employment. In the second quarter of the year, New Zealand’s consumer price index (CPI) rose 3.3%, overshooting the central bank’s 1.0% to 3.0% annual target. And on August 03, the country published Q2 unemployment dropping to 4.0%. Before the pandemic, the unemployment rate was also at 4.0%. As a result, analysts are expecting monetary tightening from RNBZ. In July, Australia began to pull its support in the economy with A$1 billion cut in the weekly bond purchasing program. However, the resurgence of the pandemic in the country has forced the RBA to reinstate a A$5 billion budget. The optimism in the New Zealand dollar will defy the bearish bias from the 50]-bar and 200-bar moving averages. Meanwhile, MACD has an opposite reading – a continued bullish momentum in the short term.

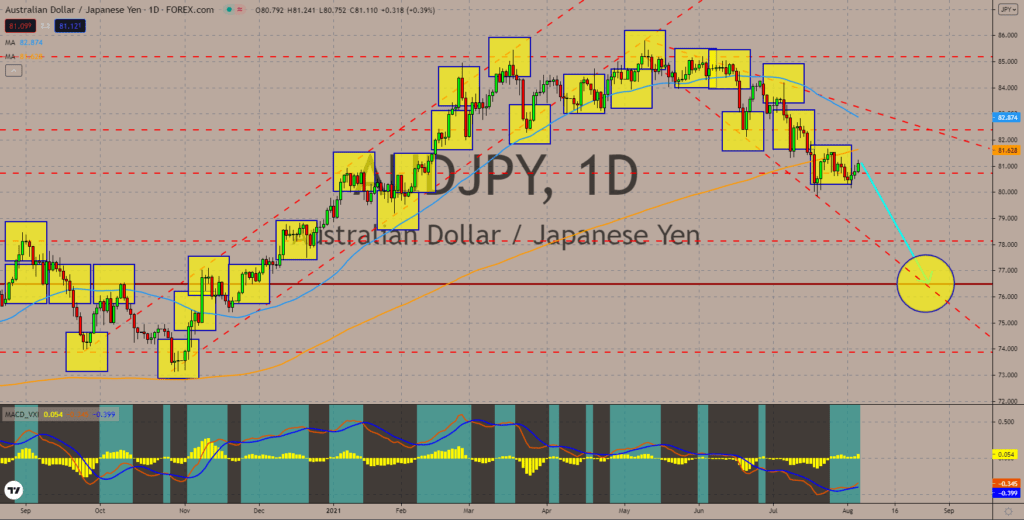

AUDJPY

The third wave of the pandemic hit Australia’s economic activity. In July, the Manufacturing PMI plunged by 1.7 points to 56.9 points representing a 3-month low. The services sector took the most hit with 44.2 points. This was the first time the PMI contracted since May 2020. Meanwhile, the Australian Industry Group (AIG) showed a decline in the construction business to 48.7 points. A figure below 50-points suggests a downturn for the report. Earlier in the week, the Reserve Bank of Australia maintained an accommodative stance for its short to medium-term monetary policy. The interest rate remained at a record low of 0.10% while bond purchases were back at A$5 billion per week until October this year. This was a reversal in July’s A$1 billion cut before coronavirus cases took off. The weekly bond allowance will go back to A$4 billion in November 2021. The 50-bar and 200-bar moving averages show a possible formation of a “bearish crossover” in August.

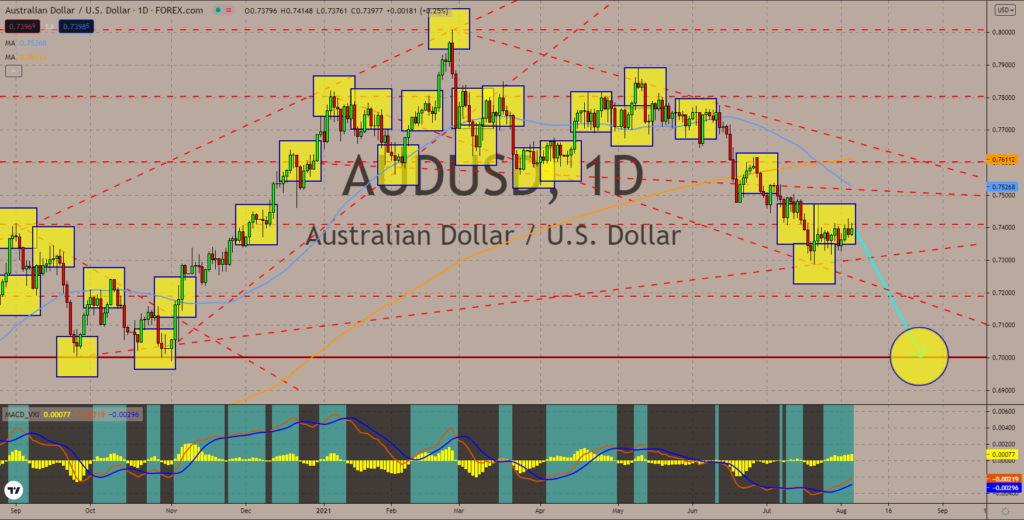

AUDUSD

Investors’ sentiments were mixed ahead of the US Non-Farm Payrolls on Friday, August 06. The Purchasing Managers Index for the manufacturing sector hit a historical high In July. An increase of 0.3 points pushed the final result to 63.4 points. The figure surpassed the prior month’s record of 62.1 points. However, the Services PMI fell 4.7 points to 59.9 points. For the labor market, the ADP published a Non-Farm Employment Change of 330,000 jobs. This is a huge miss from the anticipated 695,000 additions. Meanwhile, the initial jobless claims on Thursday, August 05, are in line with the 385,000 consensus estimates. As for the trade data, the deficit widened in July to -75.75 billion. This is a new record for the report after hitting a historical high in March 2021 with -74.40 billion. The expected decline in prices was confirmed by the moving averages in late July. Analysts expect a short-term recovery towards 0.75000 before a continued decline in AUDUSD.

COMMENTS