Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

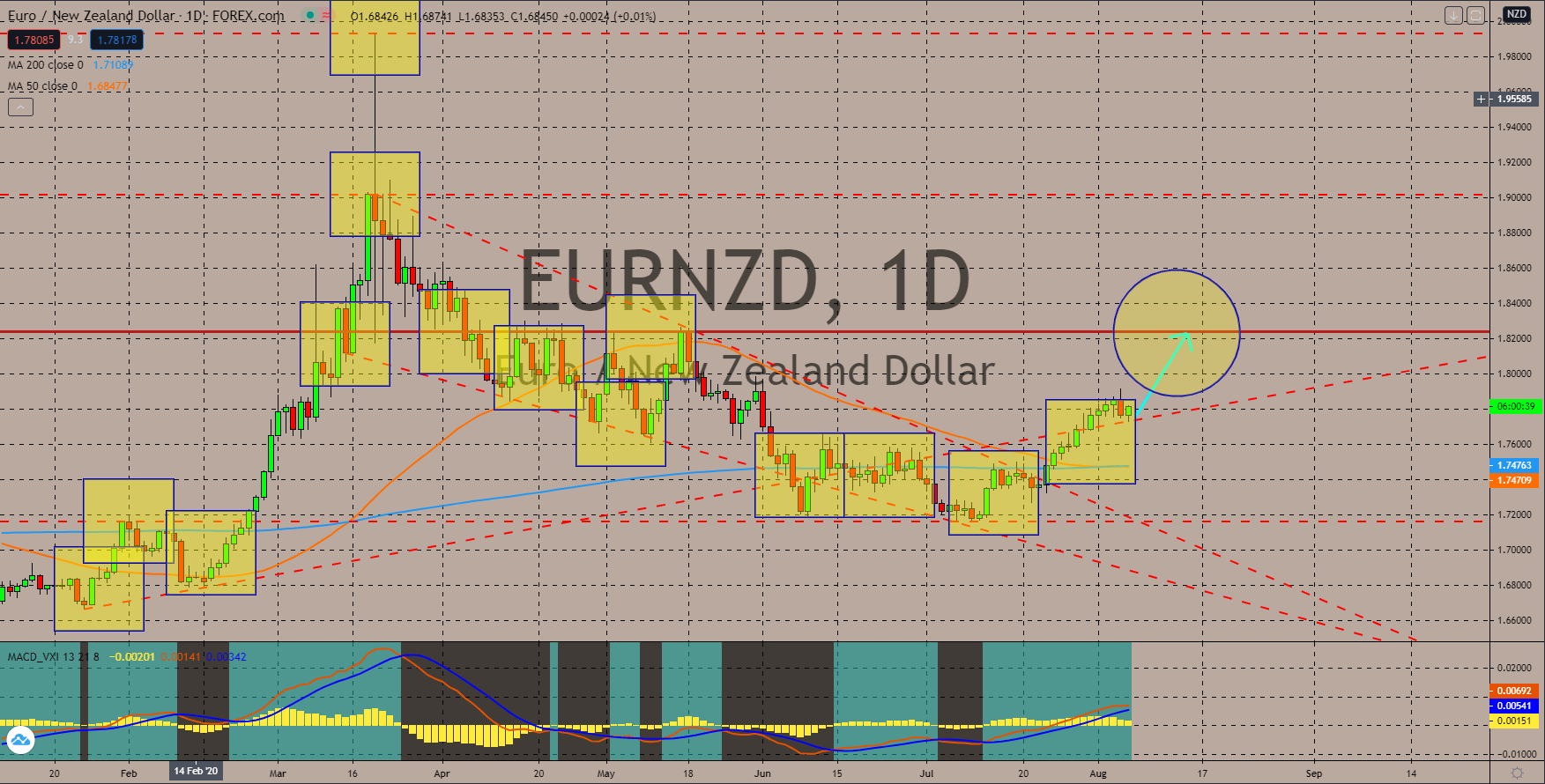

EURNZD

Germany and France’s surging import and export reports will drive the pair in the coming sessions. Germany’s import increased by 14.9% for the month of July. Meanwhile its export almost doubled from the prior months report of 3.6% to 7.0%. On the other hand, France’s total import and export represents these report’s third consecutive increase. Figures were recorded at $40.4 billion and $32.4 billion, respectively. Analysts believe that the increase in these reports will continue in the coming months as the European region began to reopen its borders. Meanwhile, despite successfully eliminating the coronavirus cases in the country, New Zealand’s import and export data will remain sluggish. This was following the decision by NZ Prime Minister Jacinda Ardern to continue its heightened control on its borders to prevent non-NZ citizens from entering the country. This, in turn, will hurt the import and export businesses.

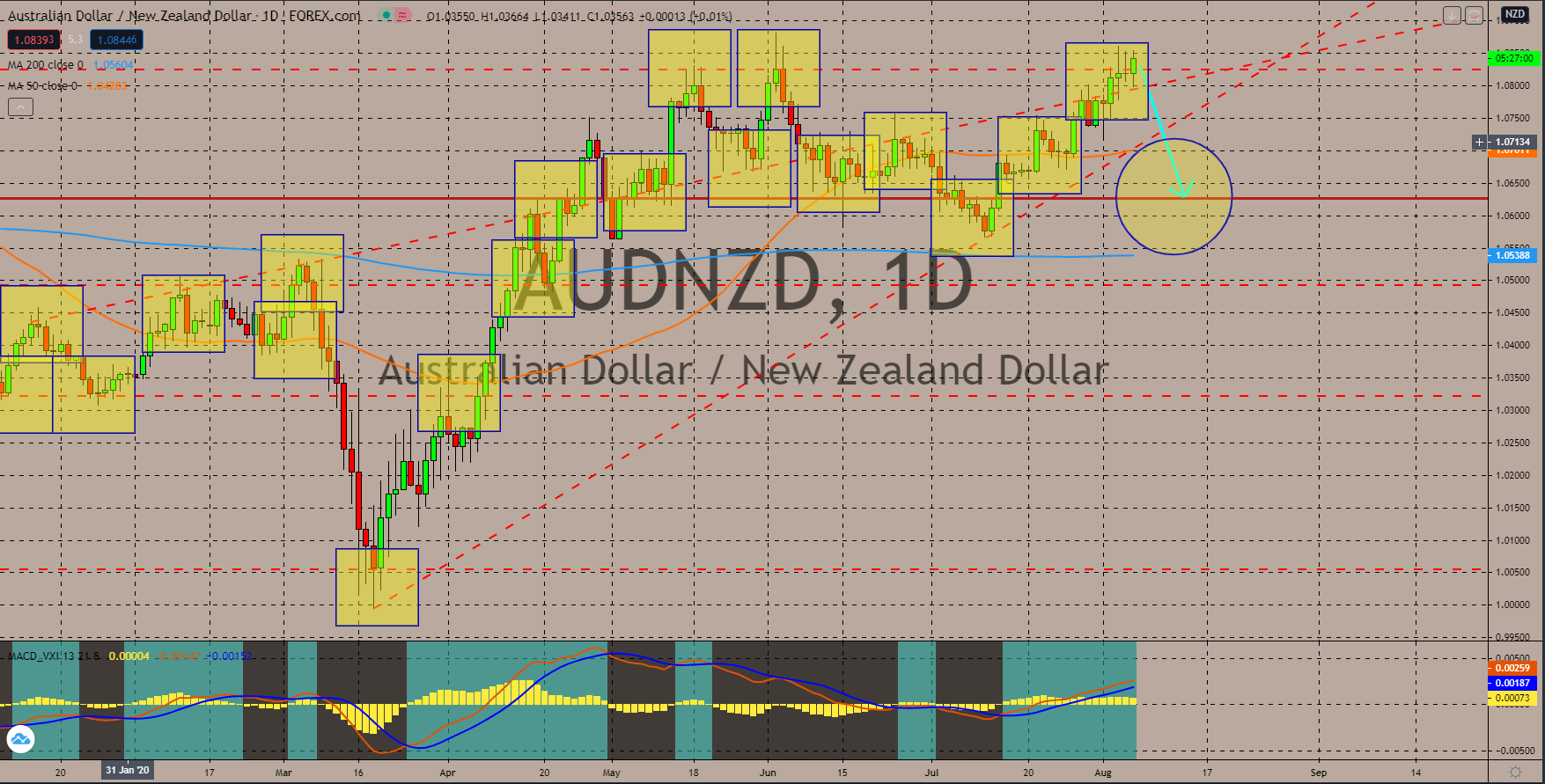

AUDNZD

The second wave of coronavirus cases is threatening to derail Australia’s U-shaped recovery. In July, analysts predicted a U-shaped recovery for Australia while its neighbor New Zealand got a V-shared recovery prediction. Yesterday, the announcement of Australia’s second largest city entering a second lockdown for the year shocked investors. The lockdown in Melbourne was due to the 471 new cases of COVID-19 on Wednesday. Meanwhile, the whole state of Victoria, which Melbourne was located, is predicted to suffer a 10% unemployment rate and could cost the national economy up to $12 billion by the end of the year. However, some analysts suggest that the impact of the new lockdown restriction could be deeper as the country wasn’t still able to recover from its recent slump. Meanwhile in New Zealand, the country was still cautious with the possible resurgence of the virus. Despite this, analysts reaffirm their V-shaped recovery expectations.

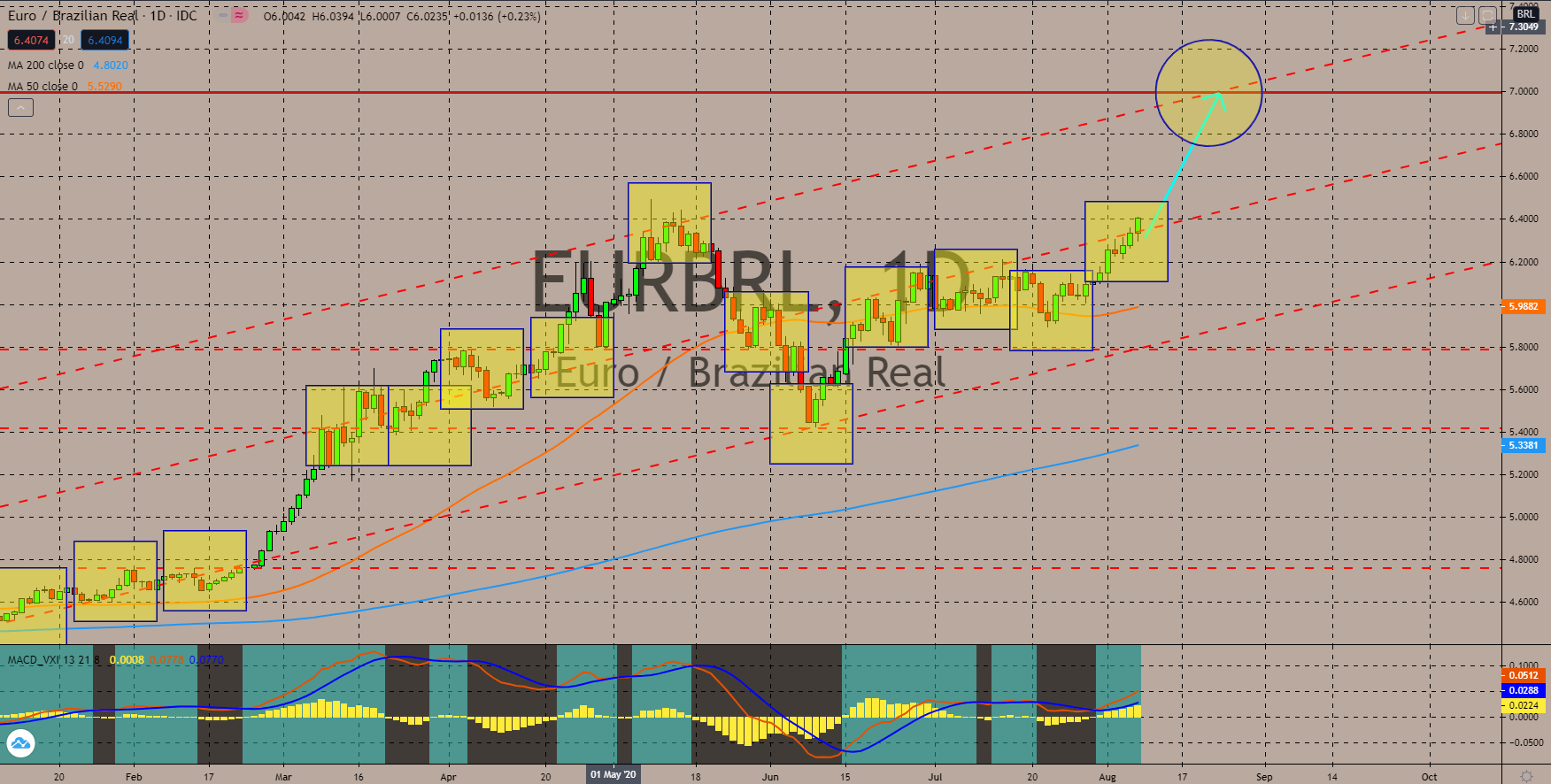

EURBRL

The high unemployment rate in South America’s largest economy along with its interest rate cut will drag the Brazilian real in coming sessions. Yesterday’s report for the unemployment rate showed the highest recorded figure since June 2017.The number came in at 13.3%, which is slightly higher compared to the prior month’s 12.9% figure. Aside from this, the country’s central bank gave in from pressure to reduce its rates to save its economy. Since March this year, the Central Bank of Brazil slashed 225 basis points on its benchmark interest rate. The current rate was now sitting at 2.00% from 2.25% in June. Meanwhile, the EU’s economic powerhouses, Germany and France, reported strong figures for their industrial production report for the month of June. Figures were recorded at 8.9% and 12.7%, respectively. The recovery in the European region, particularly in the European Union, is helping the euro currency to recover its losses.

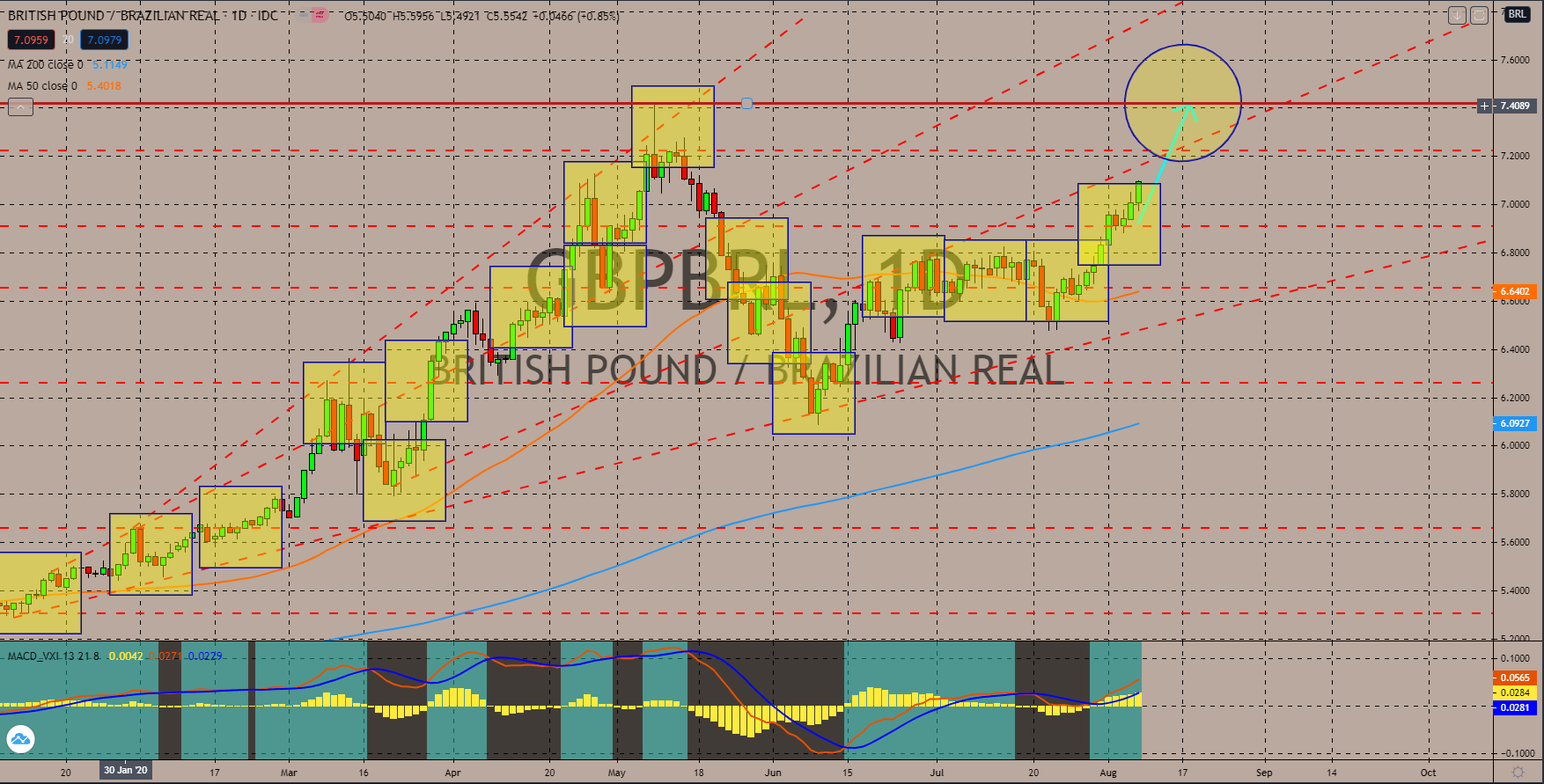

GBPBRL

The recent reports from the United Kingdom suggests that the country is now beginning to recover from the pandemic. Thursday holds several key reports from Britain, including its total quantitative easing (QE) figures for the month of July and the Bank of England’s interest rate decision. Figure for July QE went down to $725 billion from $745 billion in the prior month. Moreover, the country retained its 0.10% benchmark interest rate. This means that the recent intervention from the government and the central bank is already helping the local economy to cope with the pandemic. Aside from the United Kingdom, Europe’s two (2) largest economies also reported positive figures for this week’s reports. Meanwhile, Composite and Services Purchasing Managers Index (PMI) reports for Brazil also showed positive figures. However, the recovery in the country might be derailed as the number of coronavirus cases in the country continues to soar.

COMMENTS