Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

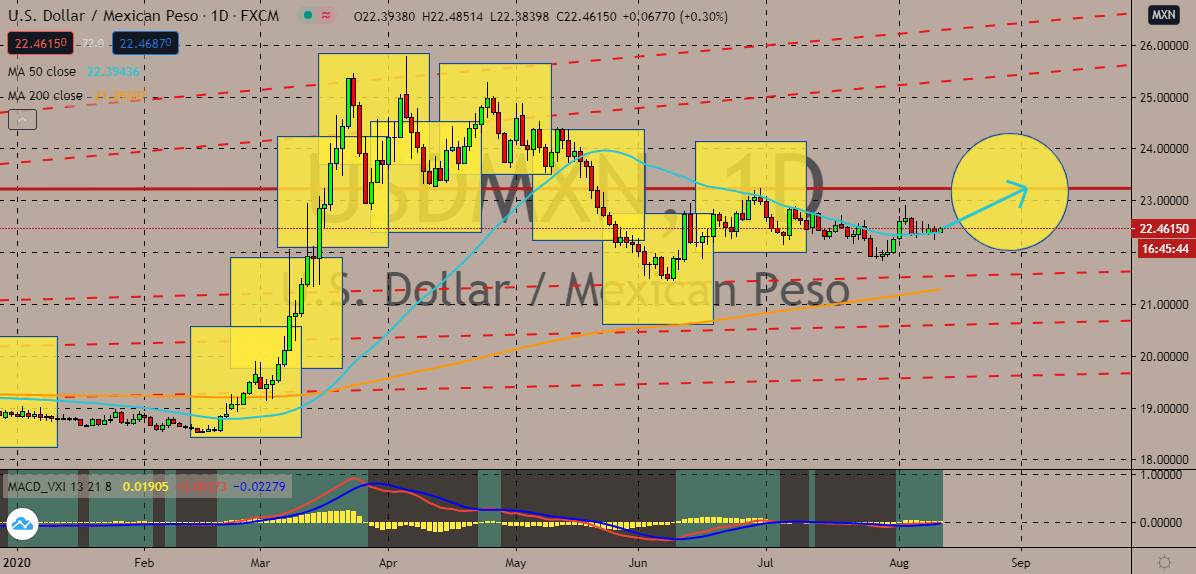

USDMXN

As of today, the trading pair’s prices have been trading neutrally as both sides struggle to gain proper momentum. Eventually, the US dollar to Mexican peso exchange rate should head over to its resistance level as bullish investors gain momentum from the latest news. Prices should be able to hit their highest range since June, maintaining the leverage of the 50-day moving average against the 200-day moving average. The upbeat data recorded by the Mexican economy is fueling the Mexican peso, making it difficult for the US dollar to redeem itself. Just yesterday, it was reported that the June monthly industrial production bounced back stronger than projected. Official reports say that it recovered from -1.8% to around 17.9%, better than the expected 17.0% prior. Aside from that, the country’s yearly and monthly consumer price index for the month of July also pumped out slightly stronger results, helping the Mexican peso’s cause.

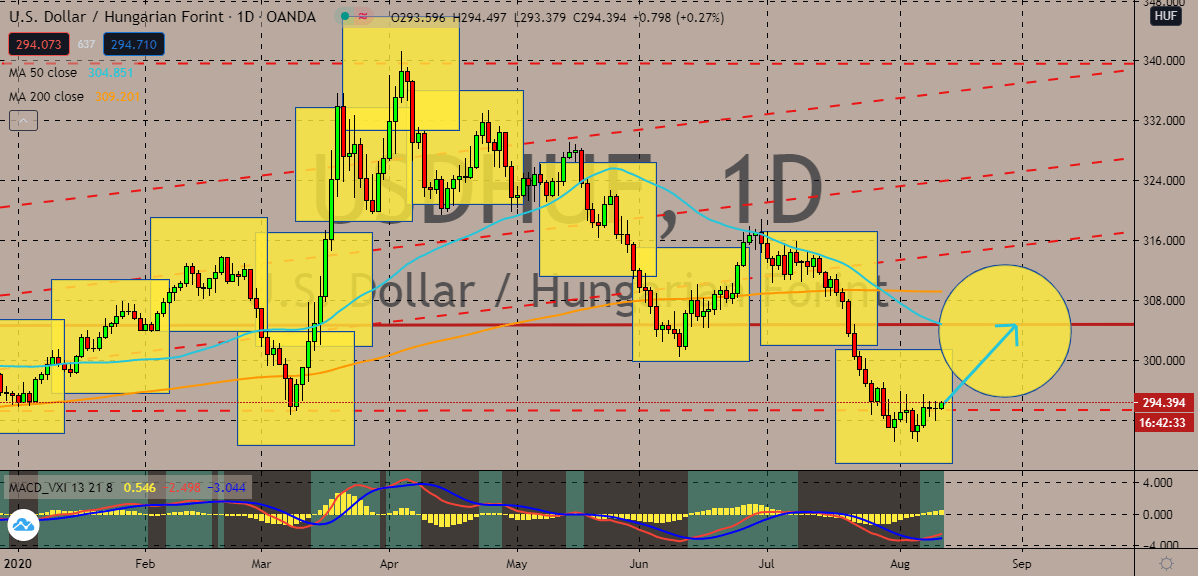

USDHUF

The positive data reported by the Hungarian economy isn’t enough to support the intentions of bearish investors in the market. The US dollar to Hungarian forint is expected to face an uptrend in the coming days as the greenback finally recovers. The price should hit its resistance level by the latter part of the month, but the climb would not be enough helping the 50-day moving average to align with the 200-day moving average. Just yesterday, it was reported that Hungary’s yearly core consumer price index for July went up from 4.0% to around 4.5%. Looking at it, the positive news from the United States isn’t only helping the greenback, it’s also fueling the confidence of investors, buoying the global stock market which in turn also causes European currencies such as the forint to rise. Moreover, investors are hoping that the White House and other American lawmakers to finally agree on a stimulus program that would help the economy recover.

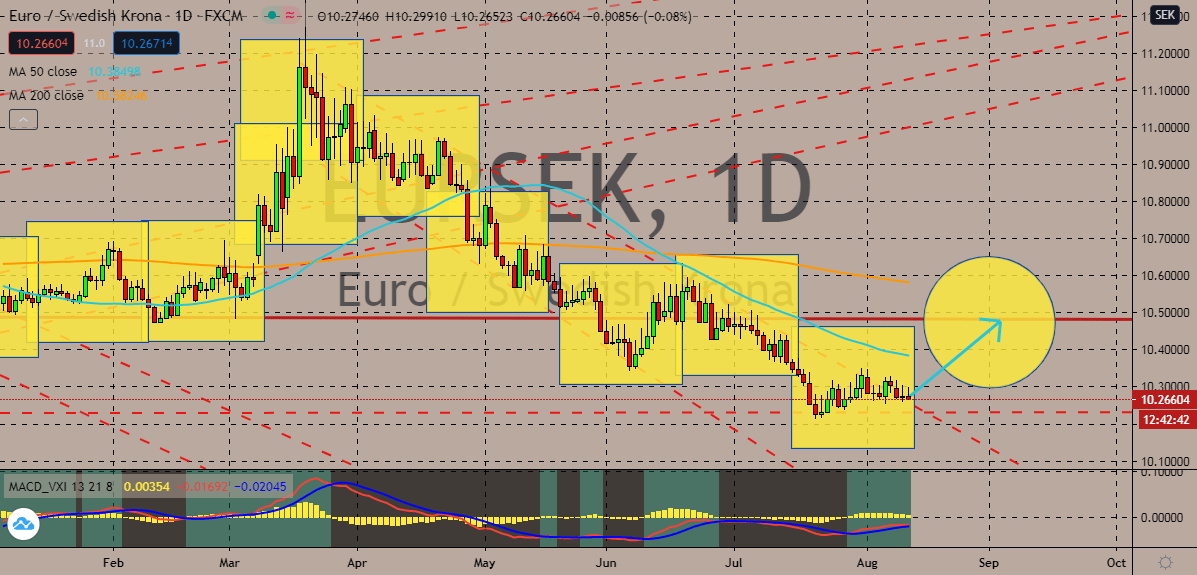

EURSEK

The better than expected results produced by the Swedish economy has helped bearish investors of the pair keep prices grounded. Unfortunately for bears, their reign will be challenged by the euro. Yes, the recently released economic results have helped the Swedish krona remain strong, but it only provides short support for bears. The exchange rate’s prices are still expected to climb up towards their resistance by the first few days of September. However, the move would not be enough to fully lift the 50-day moving average against the 200-day moving average, meaning that prices are still in bearish conditions by then. Earlier today, it was reported that both of Sweden’s monthly and annual consumer price index for July came in better than projected. Official reports say that the monthly July CPI went down from 0.6% to 0.2%, slightly stronger than earlier expectations of about 0.1%. But as said, those results aren’t expected to help it hold prices longer.

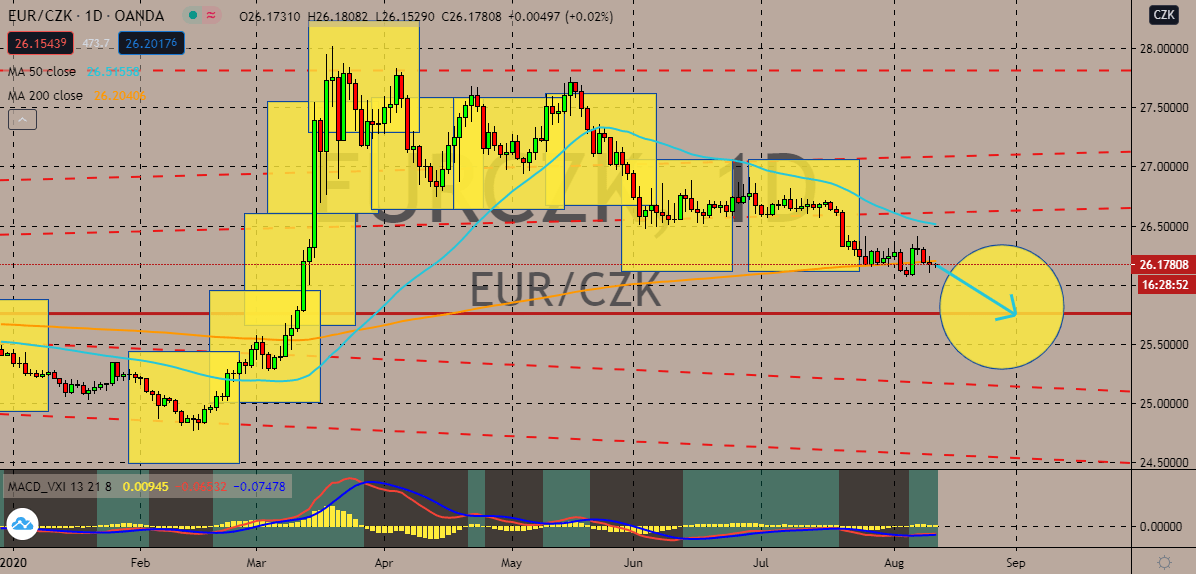

EURCZK

The Czech koruna keeps the euro grounded after investors gained confidence from the stronger the expected results produced by the country’s economy. Prices are projected to go down even lower towards their support level by the end of the month and that should help bears even the field by pulling the 50-day moving average closer to the 200-day moving average. Just recently, it was reported that the Czech Republic’s quarterly gross domestic product dropped from -3.4% to around -8.4% in the second quarter of the year. The results came in significantly better than earlier estimates of about -12.9%, easing the pressure off of investors. However, looking at the pair’s strength today, it’s evident that the euro is putting up a fight. The positive investor sentiment in Germany, the bloc’s biggest economy, is helping the single currency defend itself. Sadly, the figures are not enough to help it rally against the Czech koruna.

COMMENTS