Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

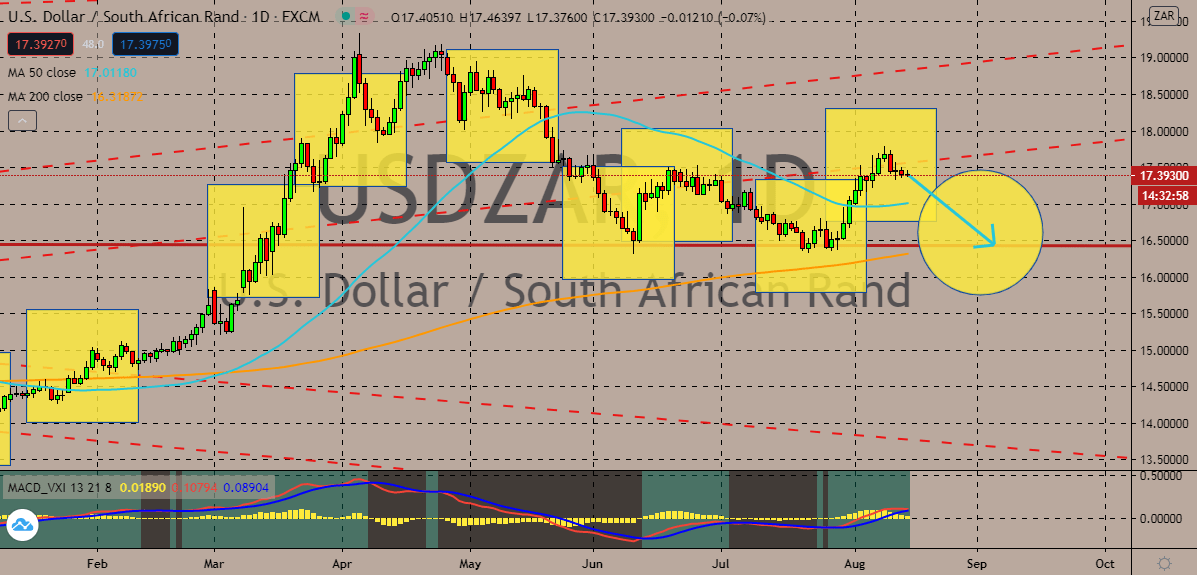

USDZAR

After the pair reached its resistance level, bears have stepped on their gas pedals to prevent the US dollar from running away. As of writing, it’s clear that both sides are still struggling to find their momentum. But the tides are ultimately bound to turn in favor of the South African rand and prices should once again hit their support level in the coming weeks. The decline should help bears pull the 50-day moving average closer towards the 200-day moving average, however, it won’t be enough to force it below the latter MA. Looking at it, global factors have been firmly dictating the direction of the South African rand, and as Russia declares its coronavirus vaccine, investors may get more optimistic about its fate. Recently, Russian President Vladimir Putin announced that a possible and much-needed vaccine for the coronavirus was discovered, strengthening the risk-on sentiment and supporting the cause of Emerging Market currencies in the globe.

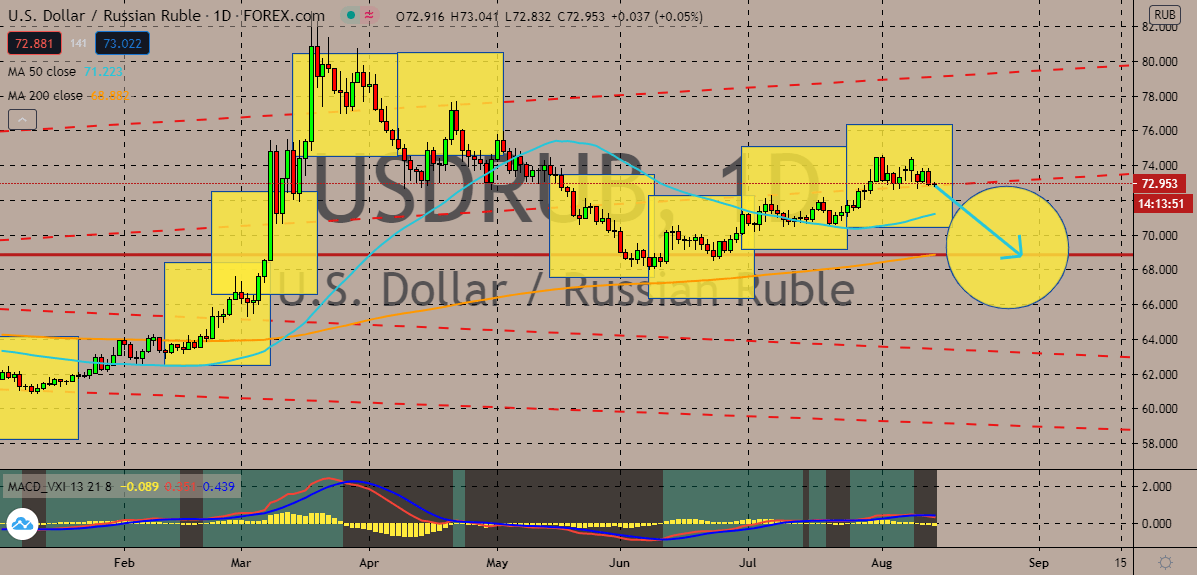

USDRUB

The odds are looking good for USDRUB bears – the lack of investors’ confidence for the greenback, the recent announcement of Moscow about its coronavirus vaccine, the connection of the ruble to oil, and the strong sentiment for Russia’s economy is helping bears regain the momentum. As of writing, the trading pair is seen neutral but eventually, it’s expected to go down to its support level. The ruble’s strength is expected to help bears force the 50-day moving average closer to the 200-day moving average, limiting the bullishness of the pair. But there are still headwinds ahead for the pair as Russia’s vaccine is met by suspicion and criticism. Looking at it, the claimed vaccine is still going to have its final phase of trials and the Philippines, under current Rodrigo Duterte, has volunteered to take a simultaneous test. The drug will now be tested on Filipinos and Russians before it could be mass-produced for commercialization.

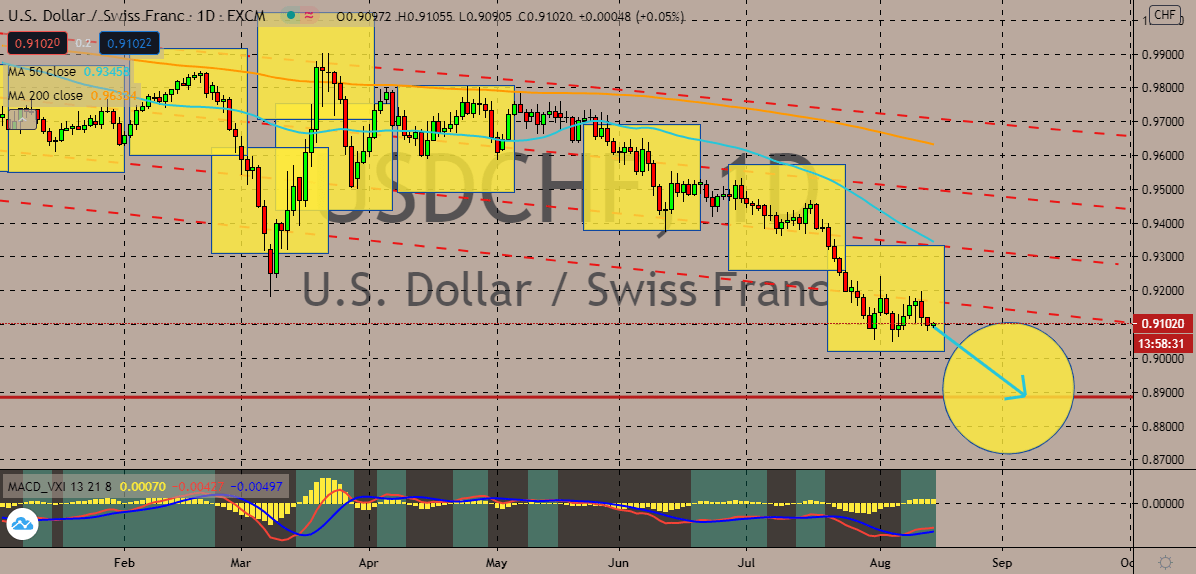

USDCHF

The better than expected results recorded by the Swiss economy is helping the Swiss franc keep the US dollar grounded this Friday. Since the pandemic struck the United States, bearish investors have been successfully forcing prices lower and their momentum isn’t expected to die down anytime soon. Prices are forecasted to reach their support level by the first few days of September, forcing the 50-day moving average even lower against the 200-day moving average. Earlier this week, Switzerland announced that its July unemployment rate remained unmoved, defying what economists and other experts believe. The strong unemployment figures also help solidify the argument that the Swiss economy is steadily holding itself and recovering from the coronavirus pandemic. Meanwhile, the stalemate between US lawmakers is further draining the US dollar, and as it prolongs, the weaker the dollar may get against the Swiss franc and other currencies.

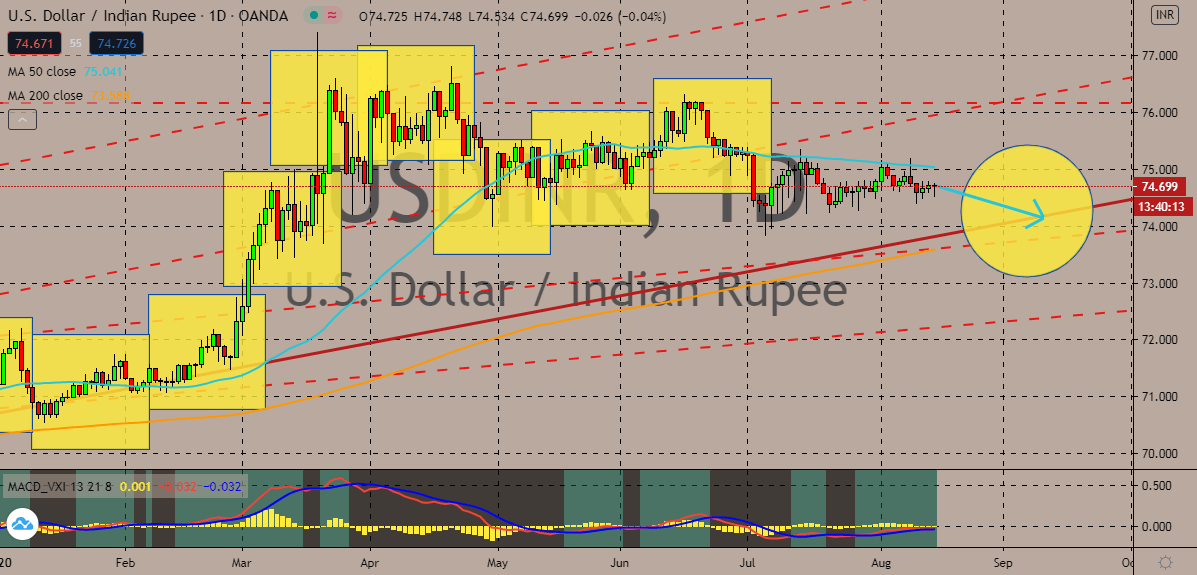

USDINR

The Indian rupee manages to force the USDINR trading pair to steady this Friday. Prices are projected to gradually go down towards their support level as the positive sentiment for India’s equity market continues to strengthen bearish investors. Aside from that, the sustained foreign fund inflows are backing up the Indian rupee’s cause. The pair’s decline isn’t expected to have a major impact on the 50-day moving average and 200-day moving average’s placements. Although it will force the 50-day MA closer to the 200-day MA, it’s still not enough to force the market to turn bearish. Moreover, the Reserve Bank of India is expected to announce an OMO or a special OMO (Operational Twist) that will address the anxiousness of investors in the domestic bond market. But it’s worth noting that those fundamentals are met by skeptics with questions as it could not be enough to help the Indian rupee break past its support level.

COMMENTS