Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

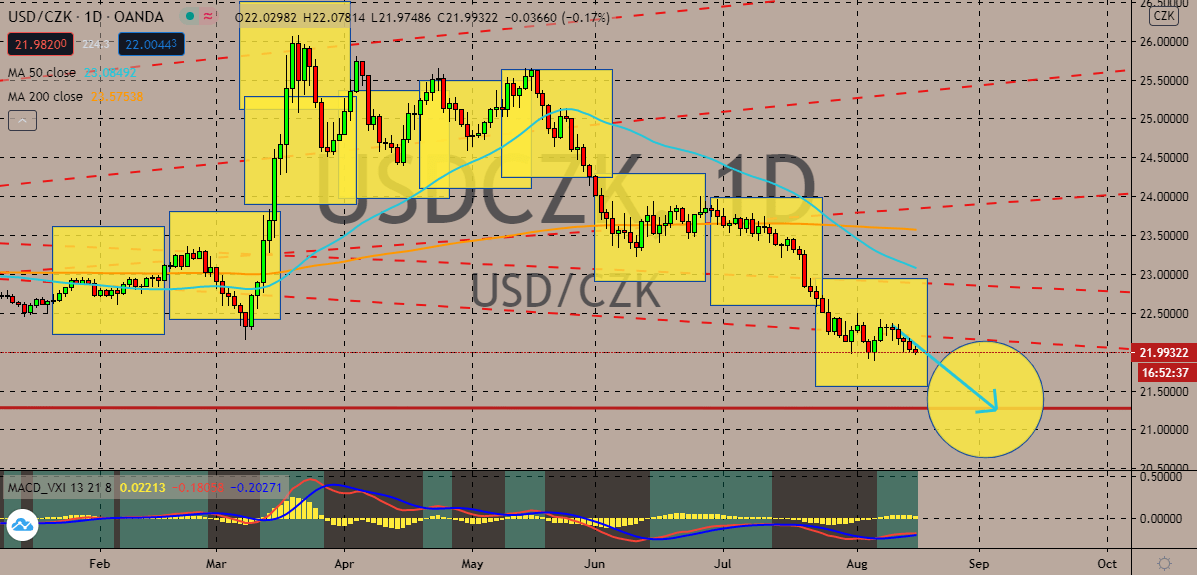

USDCZK

The improvements seen by the Czech economy is helping bearish investors keep the USDCZK pair grounded. Prices aren’t expected to rise anytime soon and are on track to crash towards their support level by the first few days of September. The move should push the 50-day moving average much lower against the 200-day moving average, suggesting a strong market for bears. Earlier this month, the Czech National Bank announced that it would leave its rates unmoved at 0.25% as expected. The move momentarily slowed down the Czech koruna but the significantly better than projected CPI results from the Czech Republic helped it to eventually regain its footing. On the other hand, the lackluster results produced by the US monthly retail sales report for July have caused the greenback to further lose its poise. The US retail sales dramatically went down from 8.4% to 1.2%, coming in much lower than prior expectations of about 1.9%.

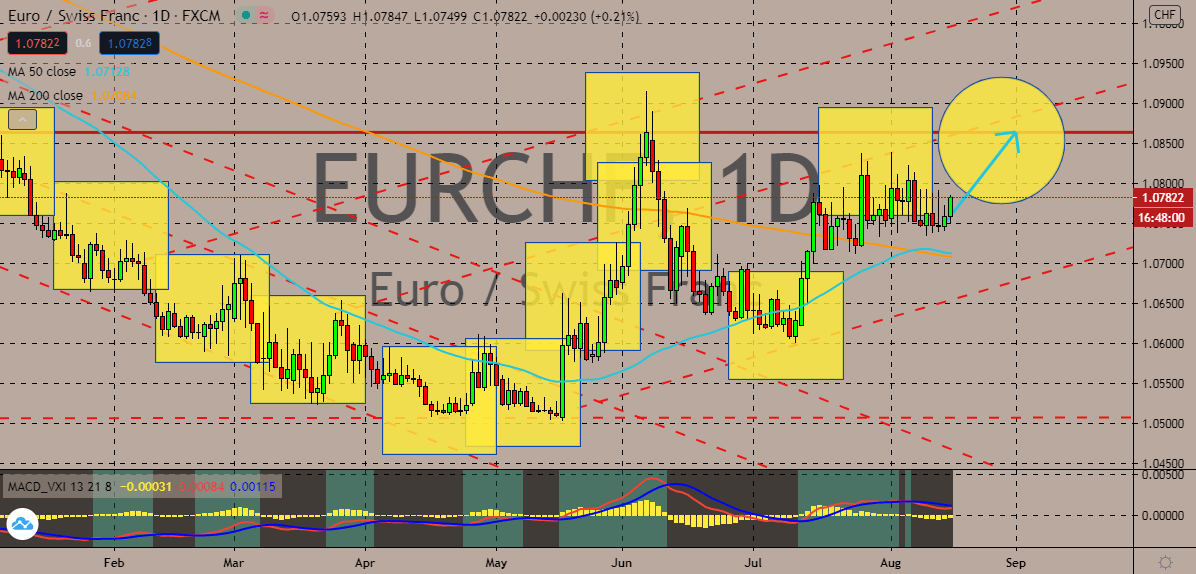

EURCHF

As of writing, the euro to Swiss franc trading pair is seen securing big gains in today’s trading sessions, starting the week off on a highly positive note. It’s clear that the past few weeks have been a rollercoaster ride as both bulls and bears hustle to push their tides into their favor. Prices, however, are expected to turn in favor of bulls and should climb up to their resistance level by the end of the month. The euro is running on the hopes for the eurozone’s economy. Just recently, Germany’s Finance Minister Olaf Scholz proposed prolonging the job-preserving subsidies in the country to about 24 more months. The proposal would cost Berlin around 10 billion euros or less according to Scholz. The move would be greatly beneficial for the eurozone as Germany is its strongest economy. The number of short-time workers in Germany has increased dramatically since the 2008-2009 recession and it has been one of the priorities of the government since.

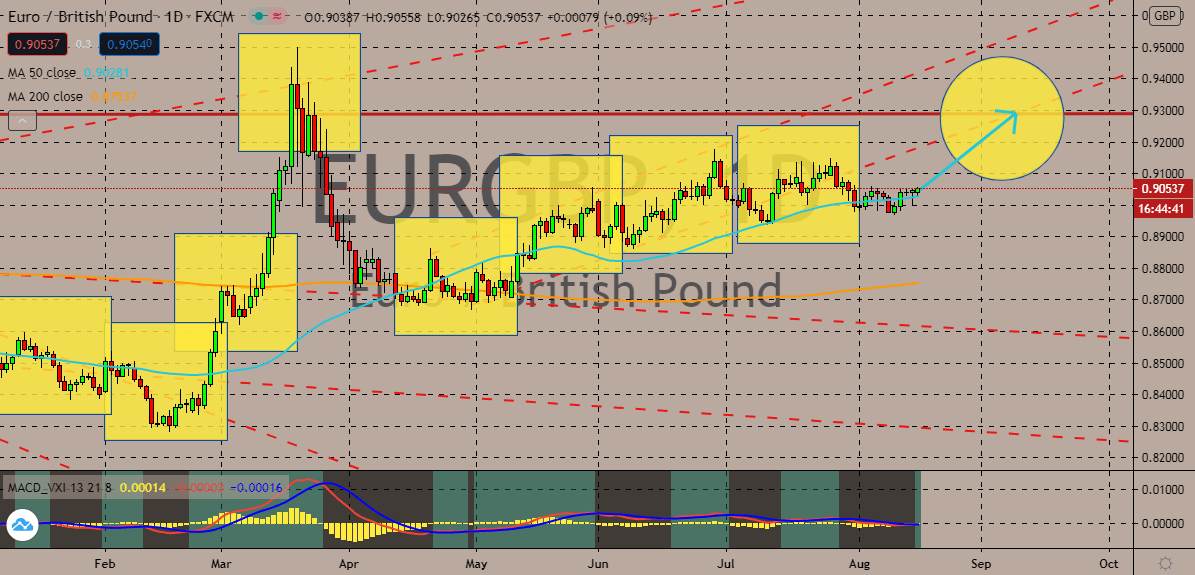

EURGBP

Unfortunately, the positive results recorded by the British economy isn’t helping the cause of the pound sterling. The exchange rate is still gradually advancing in the sessions and is projected to climb up towards their resistance level by the first half of September. The climb should buoy the 50-day moving average higher against the 200-day moving average. Just last week, Britain released its gross domestic product and according to official figures, the results came in slightly better than projected. According to official reports, the United Kingdom’s second quarter gross domestic product dropped from -1.7% to around -21.7% on a year-over-year basis, slightly better than prior forecasts of -22.4%. But as mentioned, it didn’t help the British pound. Another report from the United Kingdom is the June monthly manufacturing production data which came in at about 11.0%, slightly better than the estimated 10.0% outcome.

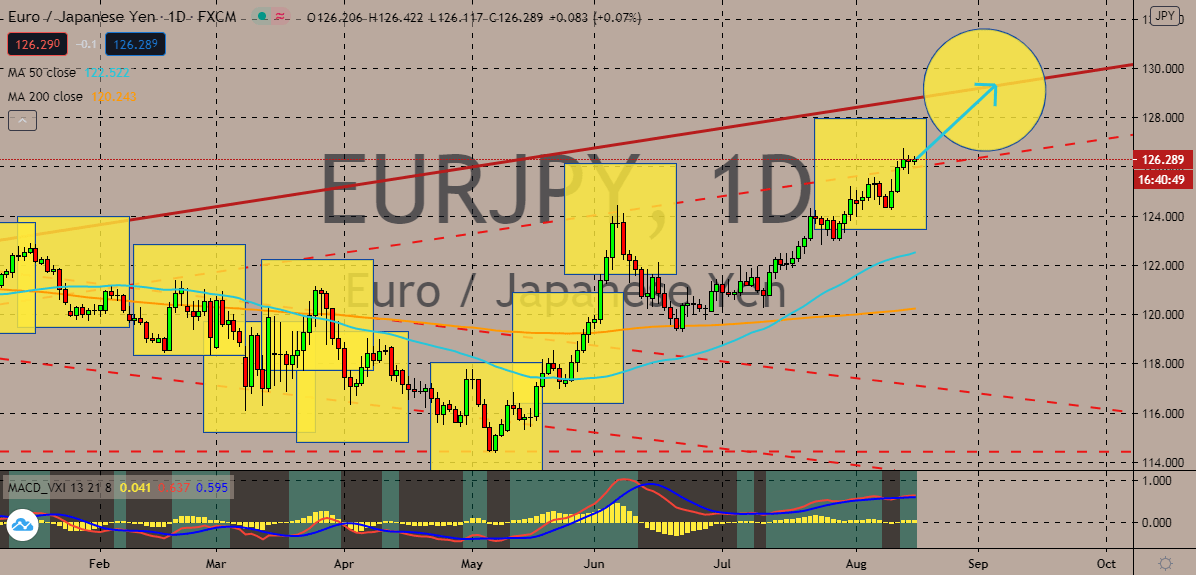

EURJPY

The euro continues to power through against the Japanese yen, and as of today, prices are seen struggling to break past their initial resistance level. Prices are projected to climb higher towards its resistance level as the Japanese yen gets weaker and weaker. The impact of the coronavirus pandemic on the Japanese economy is far more drastic than expected. The faltering Japanese yen should help bullish investors propel the 50-day moving average higher against the 200-day moving average. Also, the recent sharp deterioration in the relationship between the United States and China could further complicate the situation for Japan’s economic growth this 2020. Most economists believe that the geopolitical rift between the two would slow down the recovery of the economy. An expert from JPMorgan said that the economic bloc or de-globalization from the conflict would lower the global productivity growth, affecting Japan with it.

COMMENTS