Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

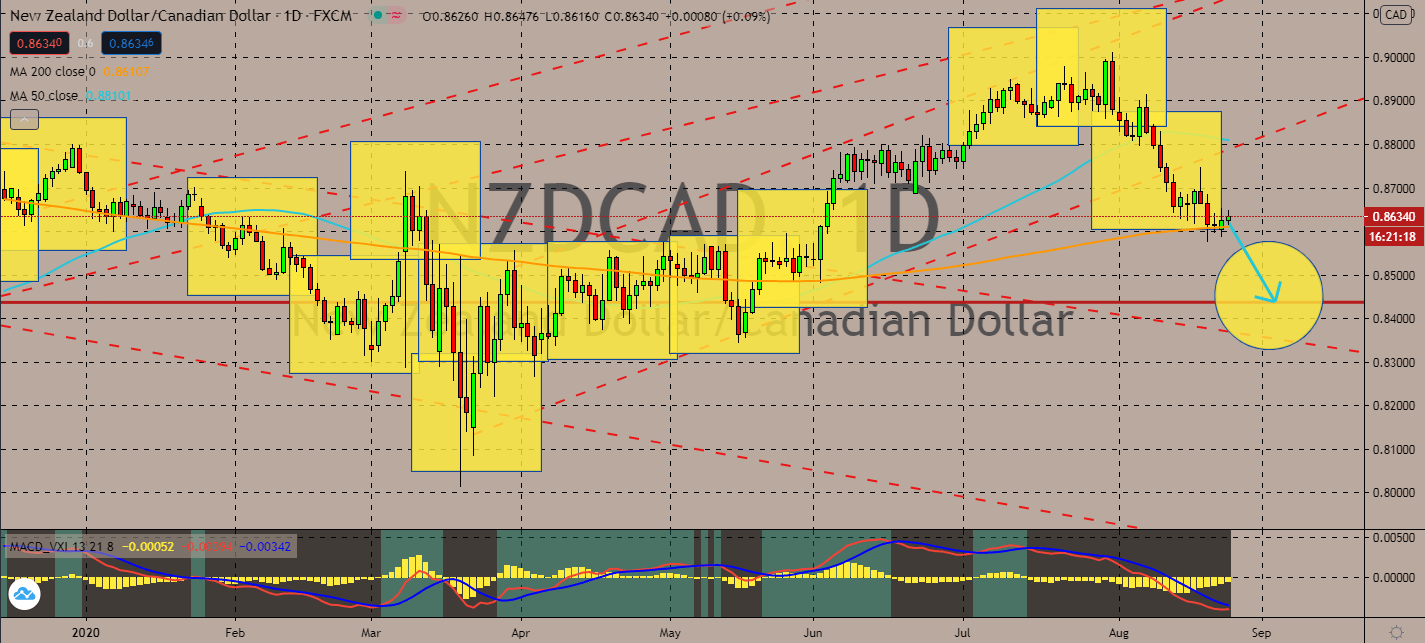

NZDCAD

Canada’s economy is expected to continue its relatively fast economic regrowth over the rest of summer and fall, according to the Conference Board of Canada. The news led the NZDCAD pair’s 50-day moving average to star moving down towards a rising 200-day moving average. Evidently, New Zealand’s “elimination over suppression” lockdown approach is igniting concern in the forex market. Its second-wave national lockdowns are increasing kiwi debt, and more analysts are left to question the effectiveness of this strategy as it carries significant economic costs that can leave its regrowth at a disadvantage. Investors are preparing for the worst-case scenario of continuing lockdown restrictions over the year or two, which could damage the economy much deeper than what was expected earlier this year. In the third quarter, NZ GDP is expected to fall by 1-2% while critics raise their brows on the delayed national election.

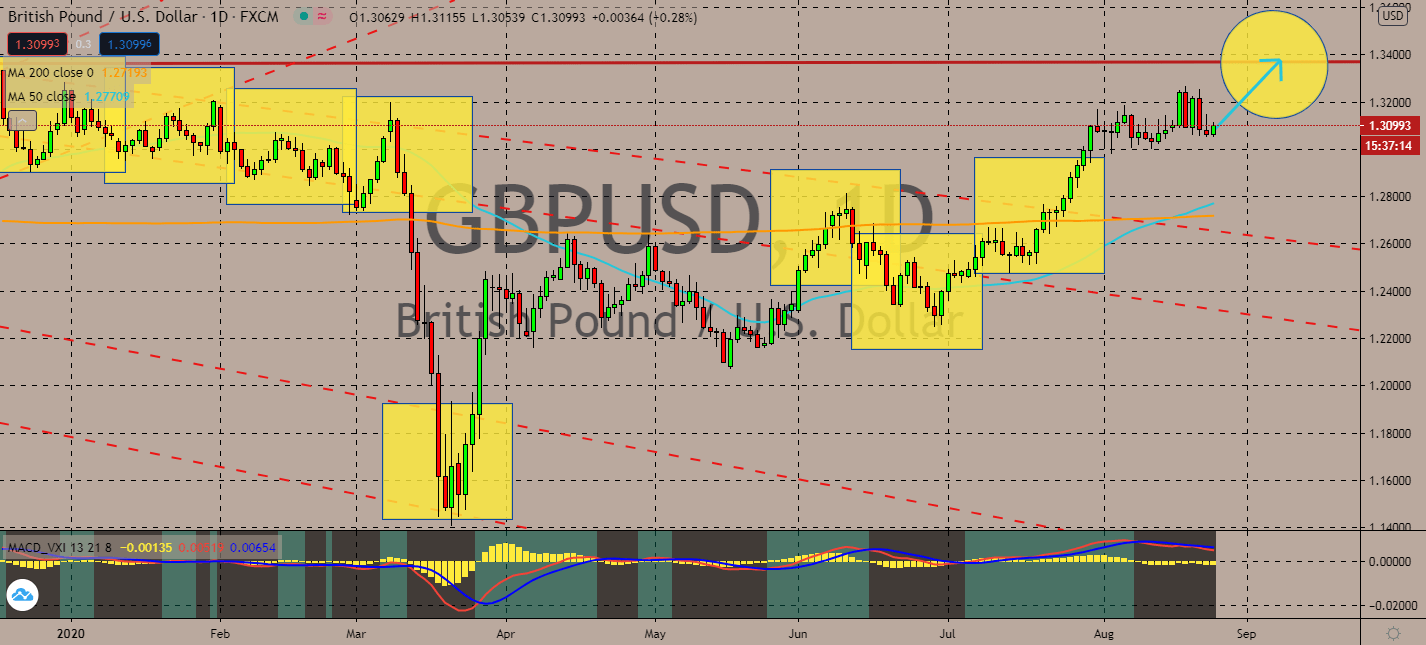

GBPUSD

The pound sterling is in a hesitant bullish market. Risk sentiment is projected to help the UK currency as interest rates remain extremely low in the United States at a lower-than-zero rate of 0.00%-0.25%. Liquidity is still high and yet economists believe that the US dollar is still overvalued largely by its international burning power. The pair’s 50-day moving average recently crossed its 200-day moving average to an upwards slope, showing that even though the UK is still in conflict with its trade partners, GBP is still bound to move upwards. The greenback is now projected to decline no thanks to its worsening export and import prices during the second quarter of 2020. Brexit talks are still out in the open as the City gradually opens up again, and selling pressure is on the greenback as the Bank of England begins its talks about a possible negative benchmark interest rate in coming months if its regrowth doesn’t continue.

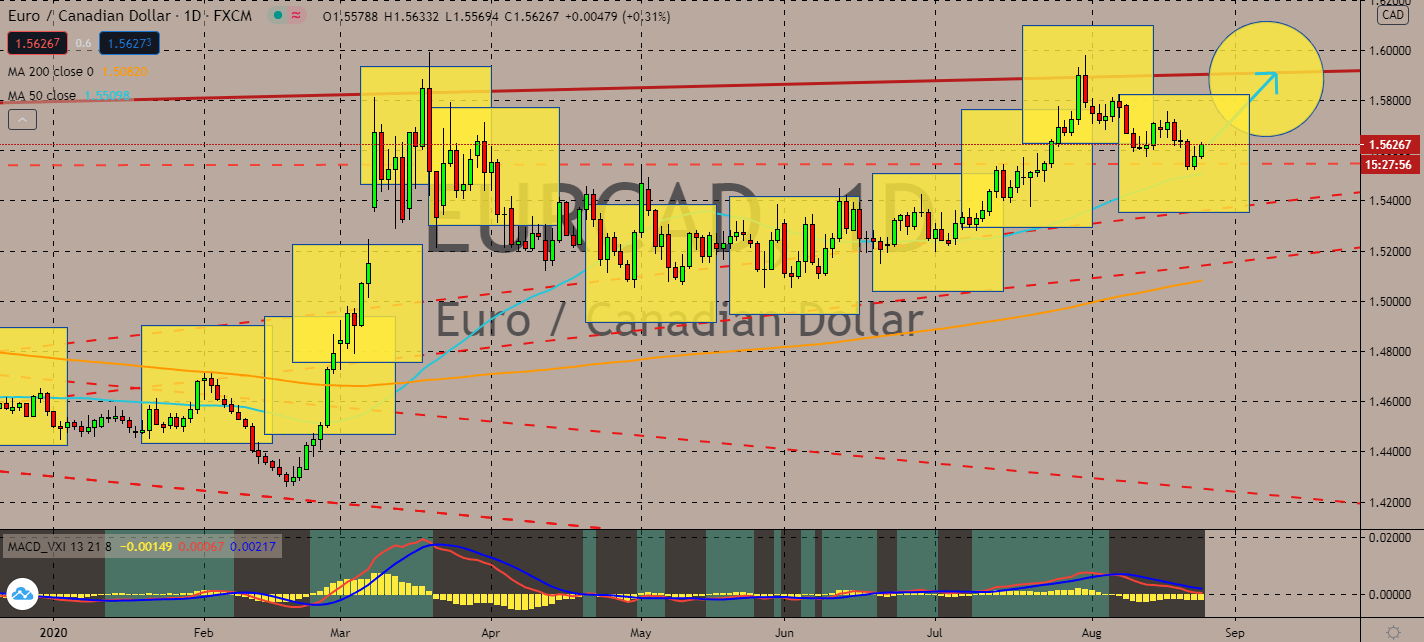

EURCAD

Investors are still worried about the lack of immigration counts in Canada’s real estate market. Although Canadian borders are open for international students and working visas, Toronto is still looking at a 41% decline, Vancouver is still at a 19.2% decrease, and Montreal has seen a 63% decline in new permanent residents. All are compared to the same period in 2019. The concerning figures are bound to push the loonie dollar down against the euro currency. This is further proven by the climbing 50-day moving average contrary to the treading 200-day moving average. The European Union also just announced a proposal to provide €81.4 billion in financial support for 15 member states, which are prompted to help each country preserve their employment and therefore stimulate their economies. Once the proposal gets approved, investors are bound to root for the already recovering European economies in upcoming sessions.

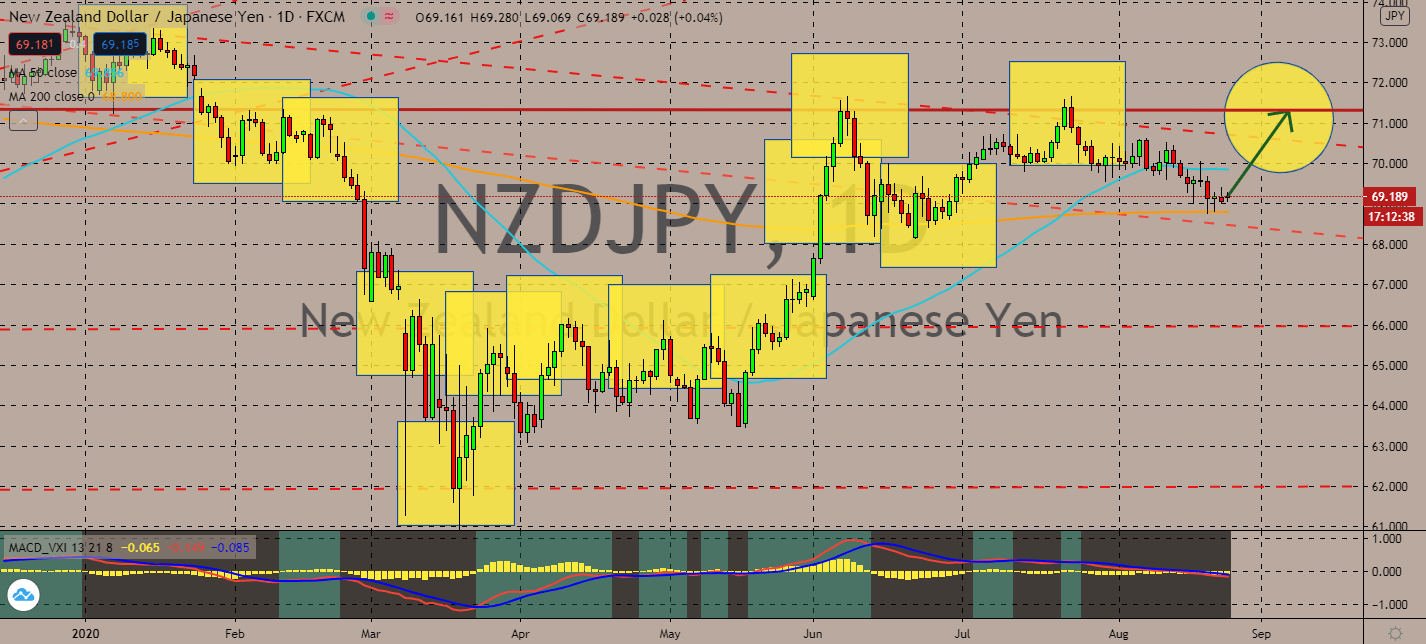

NZDJPY

It looks like the exchange is preparing for a catapult. Japan’s economic decline seen in the previous quarter is projected to push its yen down against its kiwi dollar counterpart near-term as it prepares to wrap up its trade deal with the United Kingdom. The completion of the deal is part of the UK’s effort to wrap up trade deals outside the European Union. Fortunately for New Zealand, the kiwi-yen’s 50-day moving average is still walking sideways above its 200-day moving average, proving that the bulls are still holding onto the pair thanks to risk-oriented traders dominate the forex market. For now, the Reserve Bank of New Zealand’s balance sheet is still growing as it supports the economy and financial system from the effect of the coronavirus. NZ’s second wave lockdowns are prepping for a volatile ride in most forex markets, including the Japanese yen, near-term as the threat of another interest rate decline takes over within three months.

COMMENTS