Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

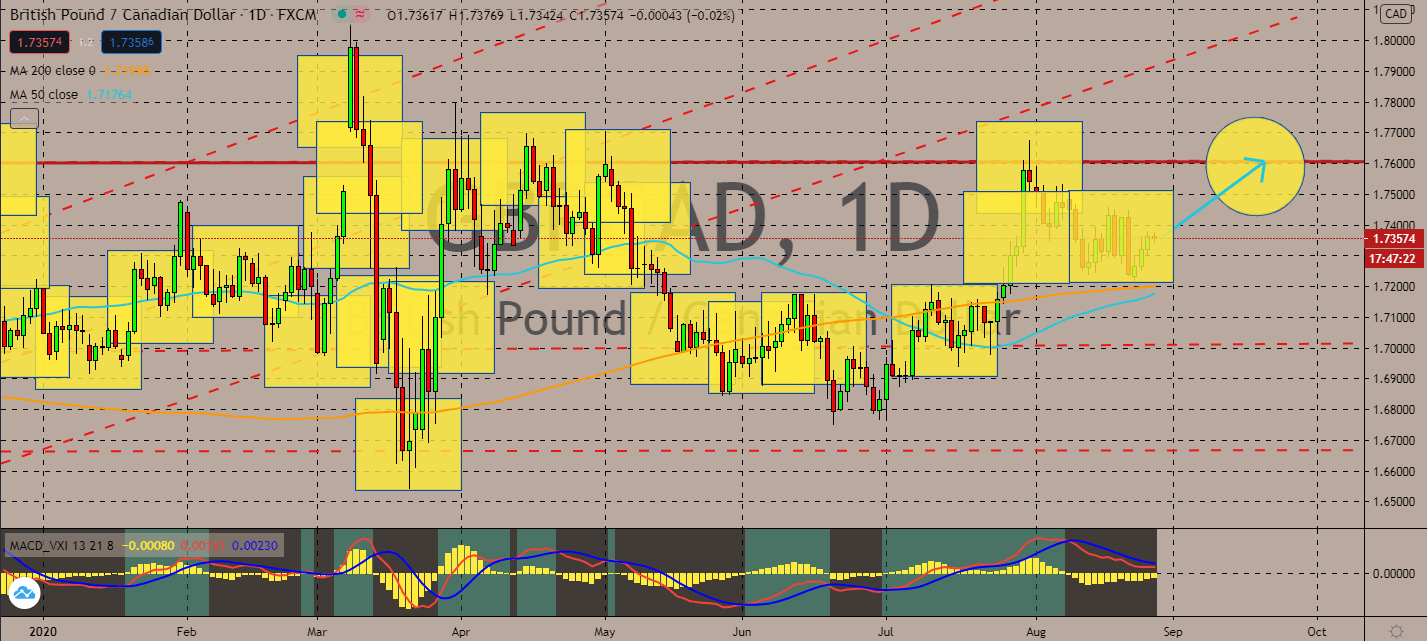

GBPCAD

Demand for houses in the United Kingdom soared since its nationwide lockdowns had ended. Three and four-bedroom houses have become so popular that it takes the average house only 27 days to get bought in comparison to the previous 39-day record during the same period in 2019. This represented a 33% year-on-year increase. This led the pair’s 50-day moving average to creep up into its 200-day moving average counterpart with a possibility to cross and reach beyond it soon. For the loonie, economists are raising concerns about businesses and debt surges in some provinces in Canada. Its Alberta province’s GDP is projected to hit economic debts to new lows this year with an 11% contraction in GDP, which will weigh on nationwide activity from the total collapse of its energy prices. It shows that although Canada was on track to go through a fast regrowth, its economy is beginning to feel the fiscal effects of the coronavirus.

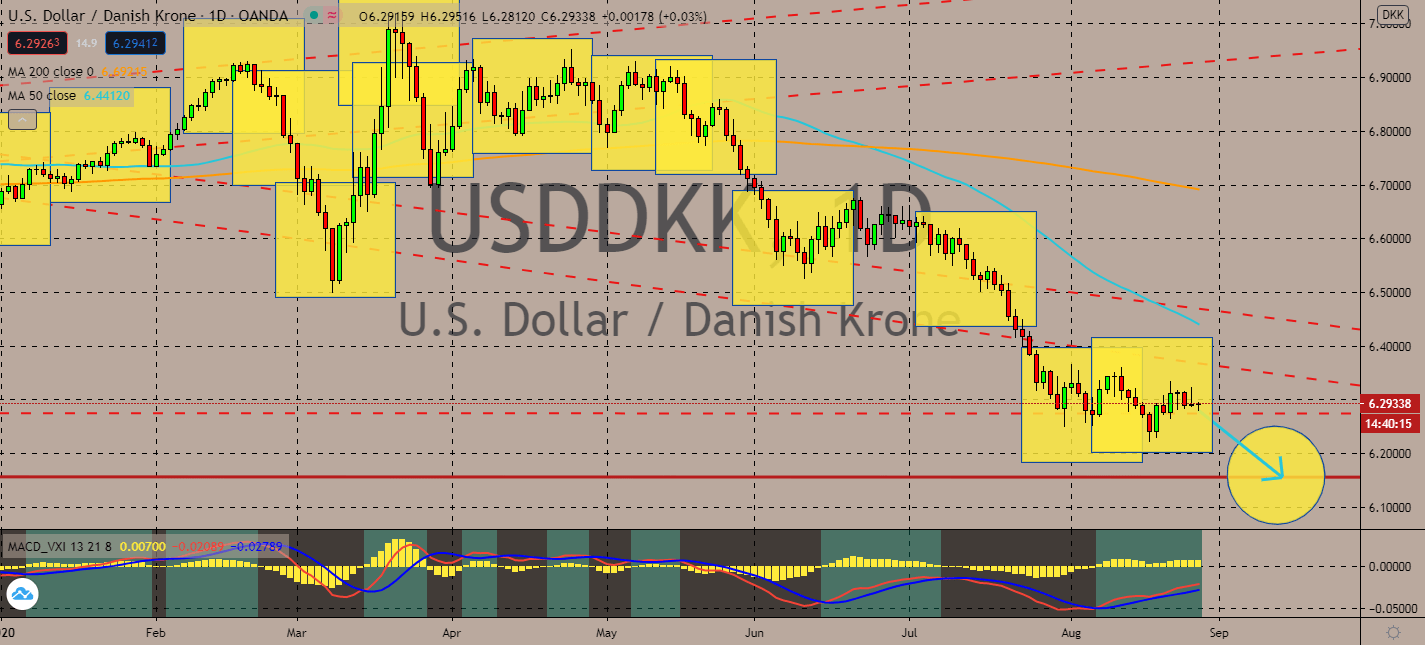

USDDKK

The reproduction number for Covid-19 infections in Denmark, which describes how many people an infected person infects, now stands below 1. The figure is expected to benefit the Danish krone considering that the United States is about to report what markets think is one of its biggest quarterly declines in GDP to date. In fact, after what could be a 32% decline in economic activity is expected to drag it into a double-dip recession by the end of the year. This is expected to push investors into risk-oriented markets like the Danish krone. The announcement came after key economists warned that the US economy might not even experience a regrowth this year at all. The pair’s 50-day moving average has been moving further below its 200-day moving average since late June, and its path will bring confidence in bearish traders as more analysts anticipate a W recovery instead of a V-shaped recovery they had initially planned.

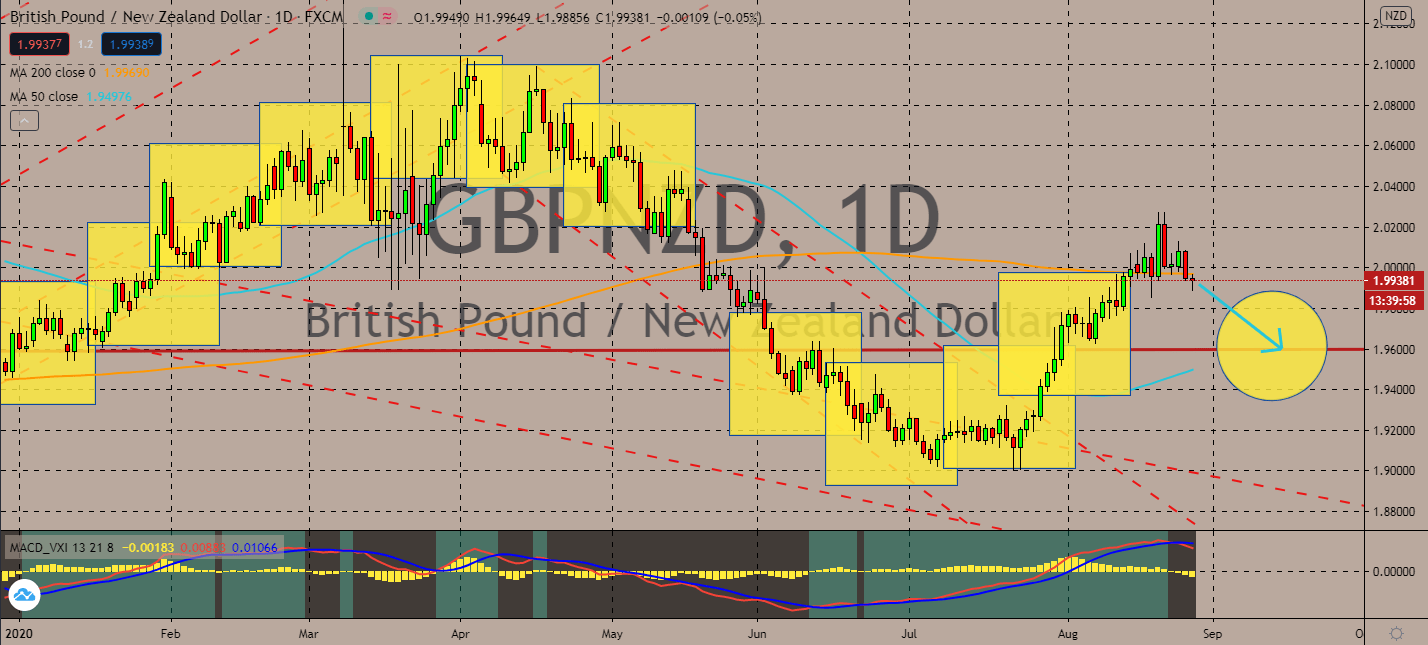

GBPNZD

The Organization for Economic Cooperation and Development said the UK economy will suffer the worst economic decline among major economies in the quarter ending June. Lockdown measures had pushed the country into a recession with a 20.4% contraction. To compare, the City experienced an economic drop of 2.3% at the height of the 2009 financial crisis. Although the GBPNZD pair’s 50-day moving average is climbing towards 200-day moving average levels, the trading pair will still be declining near-term because of this. Meanwhile, China’s economic recovery is projected to uplift the New Zealand dollar, showing the market’s interest in ASEAN countries as safe havens. That said, NZ Health Minister Chris Hipkins also confirmed that kiwis don’t need zero cases to lift lockdown restrictions, which prompts hope for new economic activity near-term as its daily count of new coronavirus cases remain one-digit.

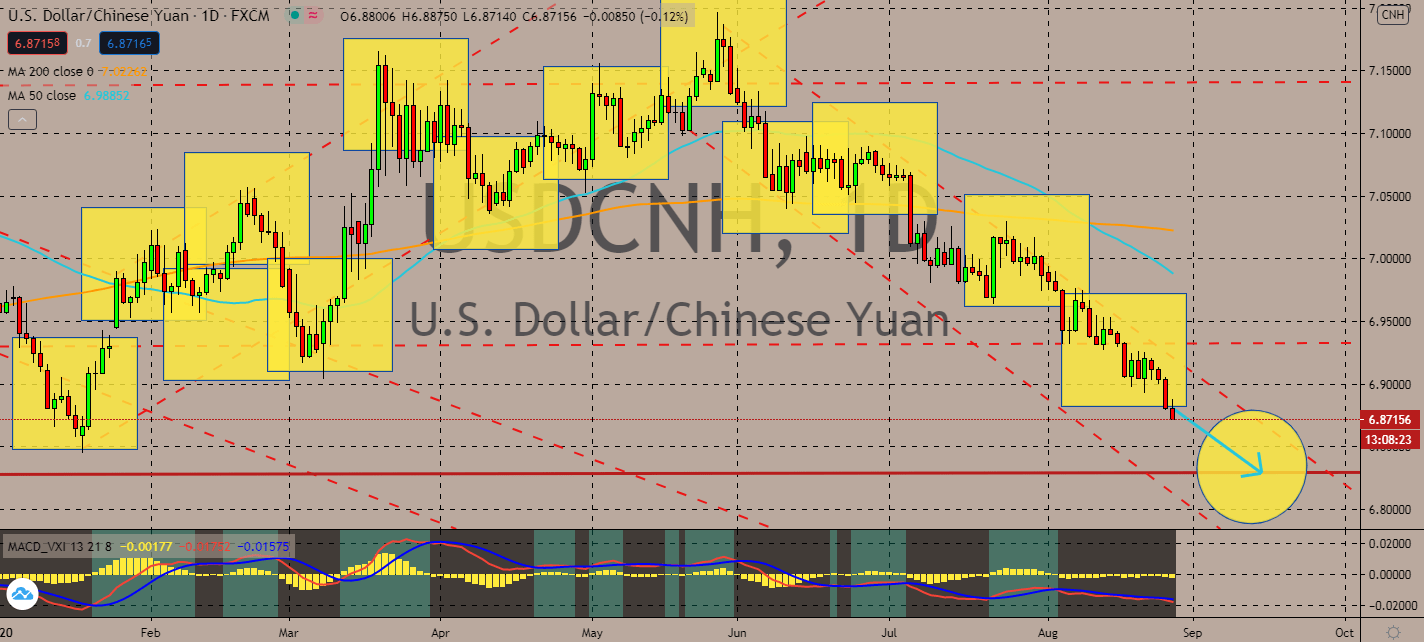

USDCNH

BHP Group CEO Mike Henry is looking forward to China’s V shaped recovery from the economic effects of the coronavirus. Henry said that its government had implemented stimulus packages that effectively improved momentum. Industrial giants in China also rebounded for the third consecutive month in July, which improved by 19 percent even after the 11.5 percent increase seen in June. Although profits had fallen by 8.1 percent during the first half of this year, its second half is projected to witness better growth. Moreover, local financial institutions call that its improvement is largely driven by real estate and infrastructure. Meanwhile, experts warned that its gross domestic product won’t be able to recover to pre-coronavirus levels until 2022. The exchange’s 50-day moving average is set to continue its trek below the 200-day moving average since it first crossed its path in early August.

COMMENTS