Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

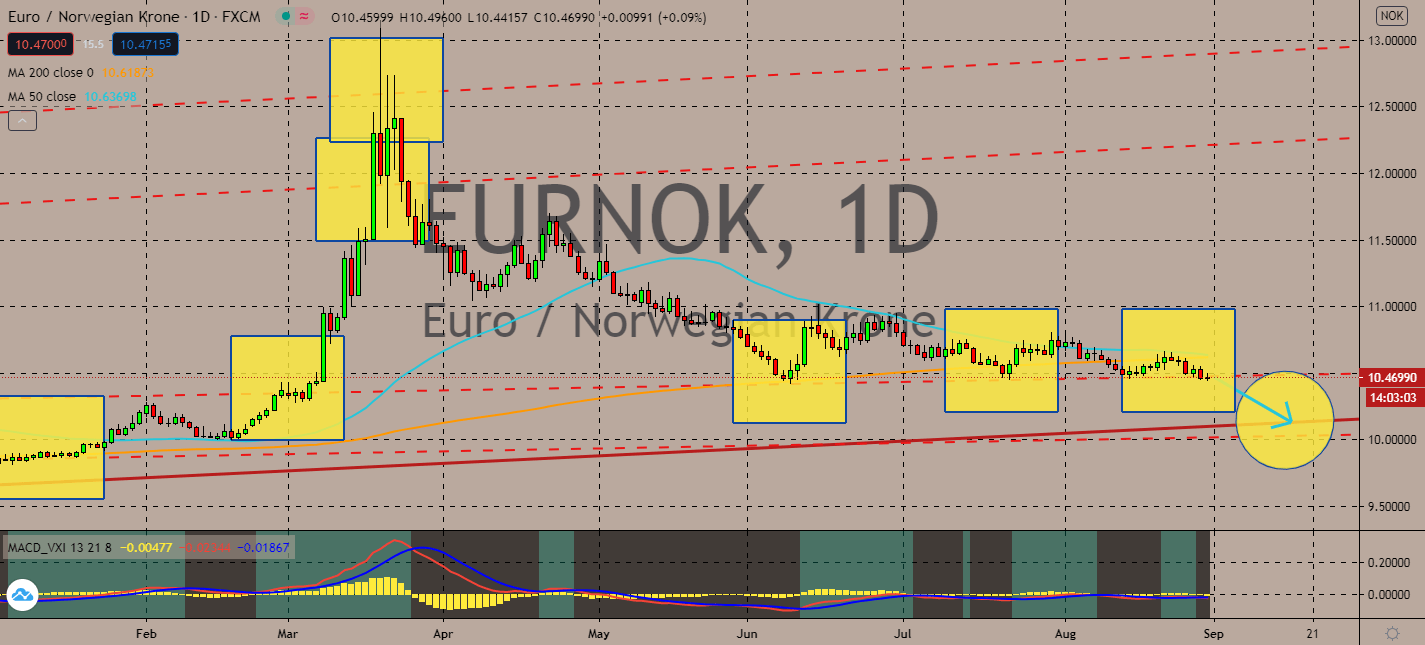

EURNOK

The eurozone is projected to confirm the market’s fears of an economic slump in the second quarter for Italy. Spain and Germany are also about to announce their consumer confidence and inflation for the month of August, which might only barely move, indicating that the market’s confidence in its recovery from the coronavirus is slower than what they initially anticipated. Moreover, after peaking in late May, the 50-day moving average is prompted to witness a gradual fall near-term. It will cross the 200-day moving average, which has been moving sideways, first. This indicates that the bearish market is about to take control of the exchange. Norway’s pending trading partnership with the recovering China will also help the market keep a close eye on its currency and boost it near-term. Both countries are working towards an early completion of its FTA negotiations, which should strengthen both economies in the long-term.

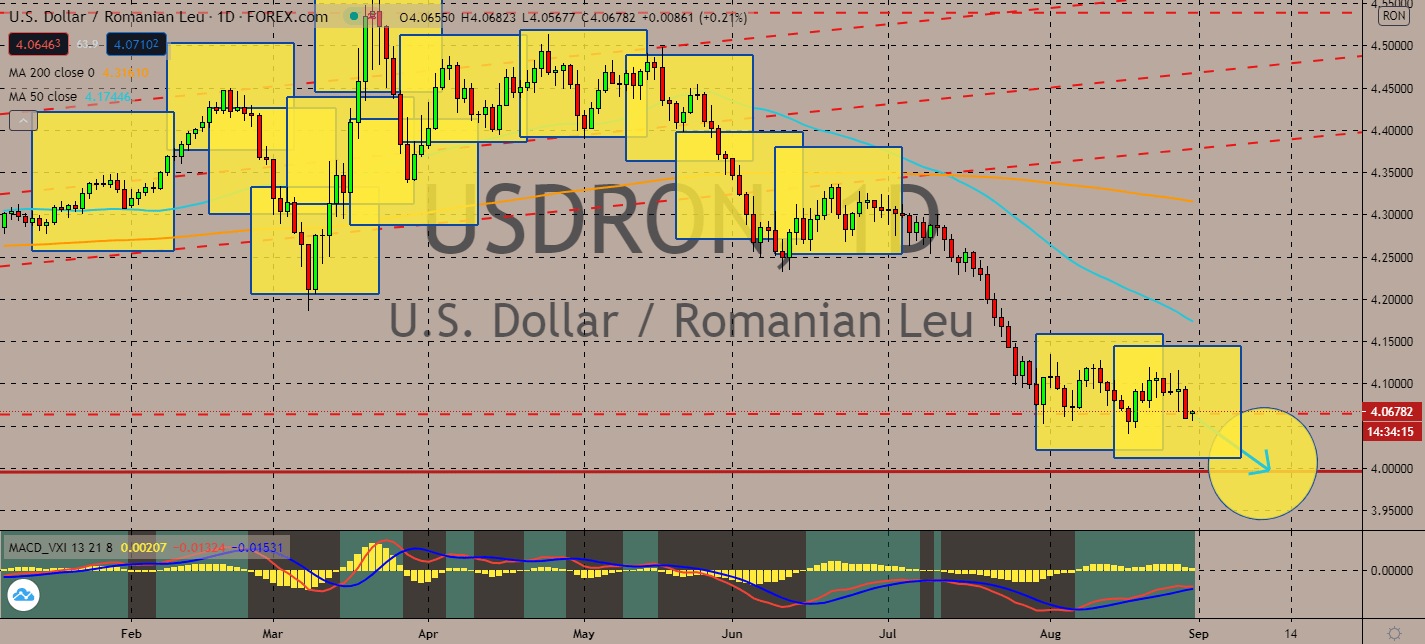

USDRON

Romania doesn’t have any economic data coming up for reports any time soon, but the market is still on risk sentiment. The United States is on its way to meet the 6 million mark in coronavirus cases, which put the Federal Reserve under pressure for another stimulus package to help those who are financially affected by the economic effects of the coronavirus. The country is still recording more daily coronavirus-led deaths than any other country in the world, and even though it’s walking away from its all-time high seen in late July, markets are still weary of the greenback and its value. The rising stock market will act as an alternative to the greenback, similar to the Romanian leu. The pair’s 50-day moving average is prompted to move further downwards, locking the pair into the bearish trend near-term as its 200-day moving average remains tightly sideways. It will continue to trend downward since its near-month consecutive low in July.

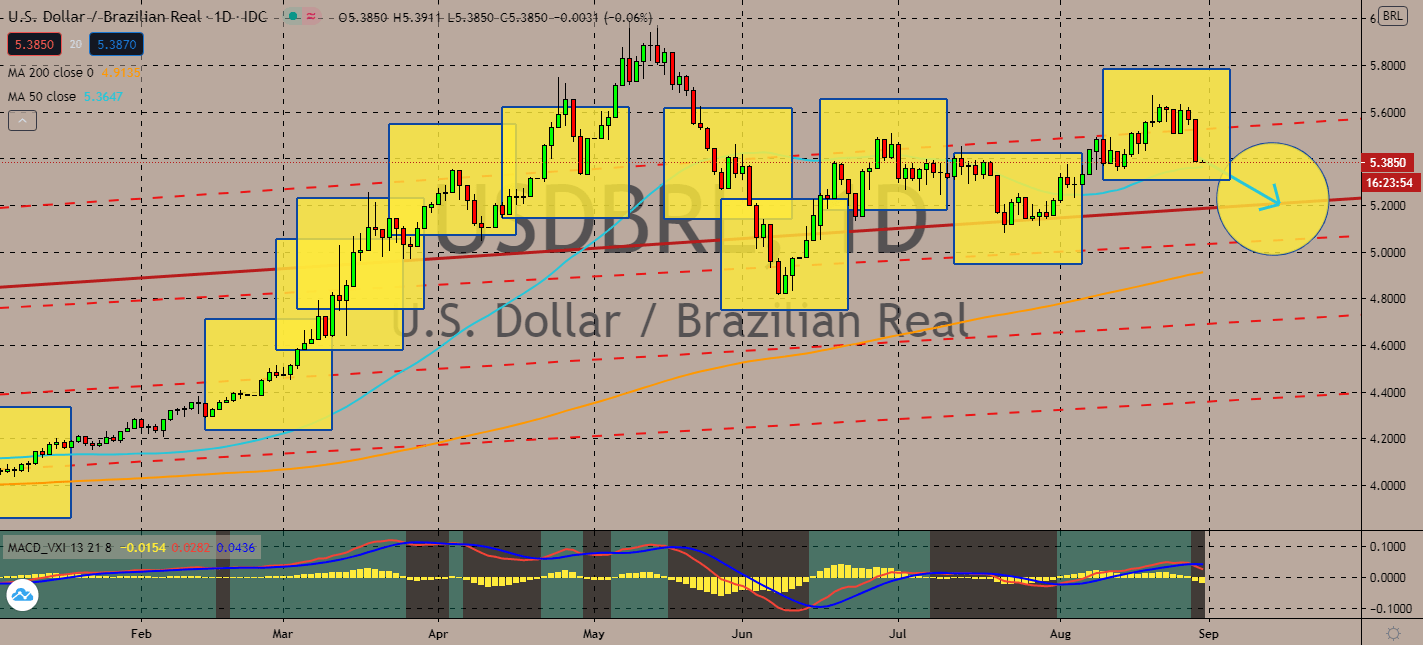

USDBRL

The market is bound to push the greenback further downward as they focus on the effectiveness of each local fiscal stimulus packages toward coping with the effects of the coronavirus. The Federal Reserve, although it had been one of the catalysts of a widespread central bank movements in the world, is under pressure to consider another stimulus package as the coronavirus continues to endanger its economy. Although the pair’s 50-day moving average is still above its 200-day moving average, the bear market might be able to redeem its trend soon. This is largely because although Brazil’s coronavirus death toll reached an all-time high, its economy is back in recovery. Brazil’s Minister of Economy Paulo Guedes promised that its government is finalizing stimulus to help businesses survive in the pandemic, keeping markets engaged in the slowing real currency when compared to the market-wide plummeting greenback.

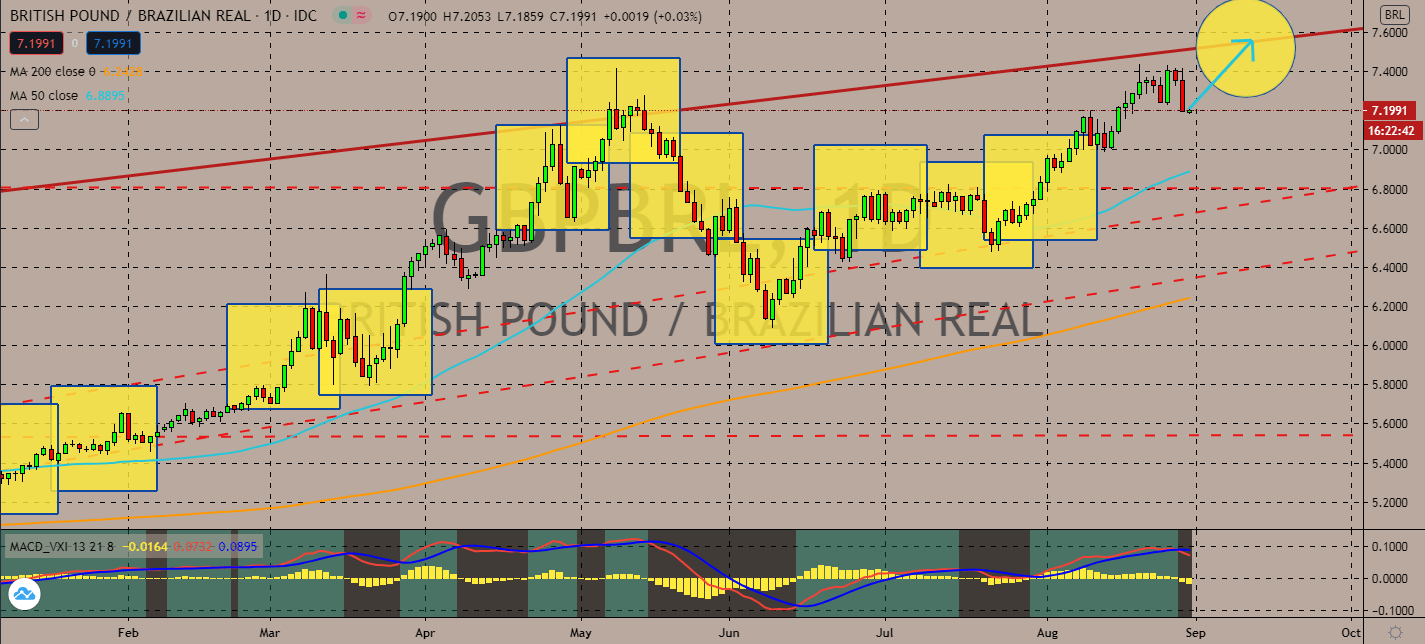

GBPBRL

The Bank of England promised that its emergency policy will stay until the UK economy has managed to recover from the economic effects of the coronavirus. Key economists said that the Bank’s quick and aggressive response was an effective measure that countered the market panic and nationwide lockdown. Moreover, the central bank had promised that it wouldn’t raise interest rates or initiate another quantitative easing program within the year. The confirmation that it still has bullets to fire to help boost its inflation rates back to the 2% target will help the pound sterling boost its 50-day moving average further up its 200-day moving average counterpart. Economists expect that the gradual lockdown easing from May will also help reach an economic growth of about 15% within the third quarter. Meanwhile, Brazil had just surpassed 120,000 Covid-19 deaths. The worry is prompted to turn the market away from the real.

COMMENTS